What Fork? Asian Traders Are Buying Bitcoin Cash

With bitcoin cash (BCH) now looking certain to split into two competing cryptocurrencies, some traders in Asia are betting that the sum of the parts will be worth more than the whole.

Specifically, these investors have been buying BCH in anticipation that Thursday’s contentious network software upgrade, or hard fork, will leave them owning two coins with a combined value greater than the current price.

James Quinn, head of markets at Kenetic Capital, said even some institutions have gotten in on the act, as “the number of requests and interests in the area increased remarkably in the general market development.”

While forks are a relatively new and complicated phenomenon unique to cryptocurrencies, they can be intuitive to traditional investors used to analyzing equities, Quinn told CoinDesk, explaining:

“I think this type of trade is accessible and can be understood by institutions even if they don’t have a lot of crypto experience, because in some way it’s similar to a special dividend or stock split.”

As a result, the Hong Kong-based Kenetic, a cryptocurrency and blockchain investment firm that executes trades with its own capital and on behalf of institutions and high-net-worth individuals, has seen a significant uptick in BCH trades.

“We are doing multiples of what we’d normally be looking at,” Quinn said.

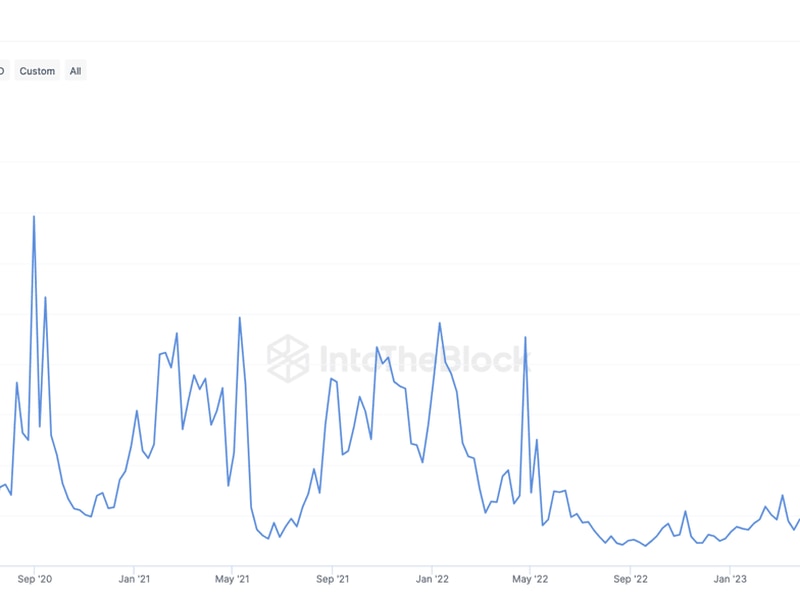

Kenetic is not alone. According to data from CoinMarketCap, the daily trading volume of BCH overall has seen a significant growth since early November, climbing to as high as $1.4 billion on Nov. 4 – more than 6 times than just $228 million on Nov. 1.

The increased buying pushed the price of BCH to as high as $638 on Nov. 7, though since then it has declined to around $500 as of press time. But the price still has a 10 percent premium over an average of about $450 throughout October.

‘Free candies’

Stepping back, bitcoin cash has been doing a hard fork roughly every six months since it split off from the original bitcoin network in August 2017. While previous upgrades were largely uneventful, the one coming up November 15 threatens to tear the community apart.

One camp has rallied behind the more-established version of the bitcoin cash software, known as bitcoin ABC, and keeping the network’s current block size at 32 megabytes. The other, led by Craig Wright – one of the most polarizing figures in crypto, famous for claiming he is bitcoin creator Satoshi Nakamoto – is pushing for an alternative called bitcoin SV (“Satoshi’s vision”) and an increase in the block size to 128 MB.

Last week, crypto exchanges with the largest trading volume for BCH including Binance, Huobi, OKEx and Bitfinex, all announced they will support the fork, bringing potential liquidity in the secondary market for the forked-off assets, should the split occur.

OKEx told CoinDesk that the exchange has also seen a similar trend, with an almost 10-time growth in BCH trading volume from institutional investors on the platform since last week.

“We can see that traders are excited for the fork. Of course, everyone will try to capitalize on the creation of new coins. But at the same time, the huge increase in trading volume also indicates their confidence in the market, especially for institutional traders.” said Andy Cheung, head of operations at OKEx.

While Huobi and Binance declined to share specific data, a Huobi representative said: “If it’s about getting free candies, the expectations for institutions and retail traders are pretty aligned. So their overall trading trend is also similar.”

Quinn said Kenetic had sent out commentaries early November to clients explaining why this fork could be interesting but the actual volume didn’t see an uptick until last week.

“Other desks have done the same. We aren’t the only desk that is talking about it,” he said. “It didn’t seem like a lot of people were talking about it before November. … So it’s interesting to see how it has been there but the price actually didn’t really start until early November.”

A ‘risk-on’ trade

To be sure, not every buyer is necessarily set on holding bitcoin cash until after the fork. Quinn said there may be investors that just take advantage of the uptick in volume and volatility but are not waiting on the fork specifically.

“Whether institutions care [about arguments of the fork] depends on how they make decisions,” he said. “Some will use a more fundamental approach and may look for insight in how the fork may work out. Others won’t care about the background really because they have a more quantitative approach.”

And this wouldn’t be the first time traders made a bet on a hard fork. There was a similar buying trend in 2017 ahead of the one that led to bitcoin cash seceding from bitcoin.

But the context has changed. Back then, crypto prices were going gangbusters, and it was plausible to assume that a newly created token would surge in value once it hit the market.

This time around, it’s far from guaranteed that any “free money” BCH holders receive will be worth much for long.

“The market was generally a lot active and hot, and generally bullish in 2017,” Quinn said. “Whereas in 2018, [the overall sentiment] was more like, ‘okay, none of this is working this year. Let’s take some risk off.’”

As such, the BCH buying is “a risk-on type of trade,” he said.

Yet the fact that investors are willing to take such risks is itself encouraging, Quinn said, concluding:

“The price action, volumes and flows we’ve seen ahead of this fork have demonstrated interest in committing capital. We see this as constructive in terms of sentiment. ”

Fork and cash image via Shutterstock; BCH chart via CoinMarketCap