What Does Nigeria’s Blockchain-Friendly Regulatory Change Mean For Bitcoin Adoption?

This is an opinion editorial by Heritage Falodun, a Bitcoin consultant and computer scientist based in Nigeria.

On May 3, 2023, during a federal executive council meeting presided over by President Muhammadu Buhari at the council chamber in Abuja, the Nigerian government approved the official use of blockchain technology in the country.

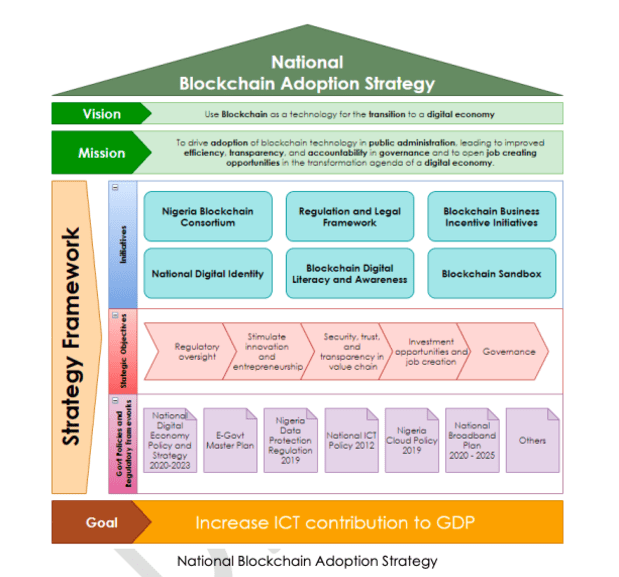

Nigeria’s minister of communications and digital economy, professor Ali Isa Pantami, disclosed the official approval of “The National Blockchain Policy For Nigeria,” stating that the “the new policy was a product of consultations with 56 institutions and personalities whose end goal is to institutionalize blockchain technology in Nigeria’s economy and security sectors.”

Nigeria’s History With Bitcoin Regulation

Taking a deep dive into understanding the disposition of the Nigerian government toward blockchain-dependent innovations over the years will paint a clear picture of how crucial and important this recent policy and federal approval is for the Bitcoin space in Nigeria and Africa at large.

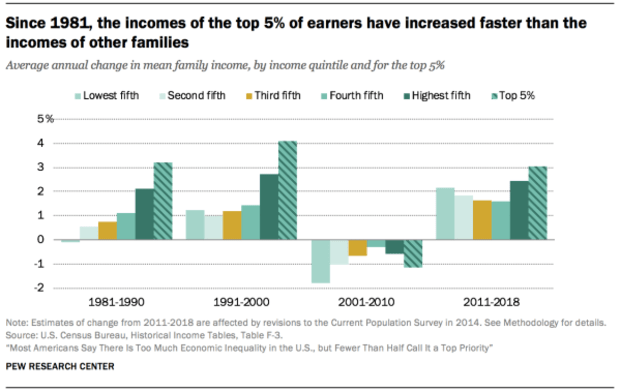

On January 12, 2017, the Central Bank of Nigeria (CBN) issued a circular which cautioned financial institutions and the general public about the risks associated with blockchain-dependent technologies, such as Bitcoin. Building on that previous warning and directive, on February 5, 2021, the Central Bank of Nigeria officially prohibited banks from facilitating any Bitcoin- and crypto-related transactions by reissuing the circular — a ban that remains unreversed as at the time of writing.

This restrictive policy come at a time when adoption of Bitcoin and shitcoin-related activities was on the rise in Nigeria, and it was a restriction that further fueled the use of Bitcoin and stablecoins as users who are wallowing in the pains of financial restriction increasingly discovered the power of decentralized Bitcoin innovations, like peer-to-peer (P2P) marketplaces.

Amid all of these impromptu regulatory measures, CBN was apparently busy creating what it considered an alternative to shitcoins: a government-controlled digital currency called the e-naira, which was officially launched on the October 25, 2021, unequivocally built on a centralized system, not a decentralized blockchain like Bitcoin’s. Meanwhile, Nigeria’s Security And Exchange Commission (SEC) was occupied with creating policy frameworks for token-issuance platforms and exchanges.

All these regulatory changes were not unconnected to the government’s awareness of just how thriving the blockchain industry is in Africa’s most populous country.

What Does This Mean For Bitcoin In Nigeria?

At this point, one will naturally ask what another regulatory update in the national blockchain policy means for Bitcoin.

A quick but detailed response would be: This is definitely a welcomed development for Bitcoin advocates in the country and one of the possibly many steps that we might witness in the right direction.

From my interpretation, this policy is focused more on giving a direct government overview to relevant regulatory bodies such as the National Information Technology Development Agency (NITDA), CBN, SEC, the Nigerian Communications Commission (NCC) and the National Universities Commission (NUC), among many others who are now expected to develop more detailed regulatory frameworks from using blockchain-based innovations like Bitcoin. The government is moving from being totally repelled by or antagonistic about Bitcoin-, blockchain- and crypto-related activities to now accepting them by default and creating a regulatory environment for them to move forward.

And while altcoins and other development and products dependent on blockchains excluding Bitcoin still stand a chance to remain regulated and subjected to the directives of these incoming regulations, Bitcoin uniquely repels such regulations.

As a stakeholder in the African Bitcoin space, I must confess that consistent clarity from governments will not only help in driving adoption but will also create an enabling environment for Nigerians to incorporate decentralized blockchain technology, like Bitcoin, into scaling their businesses and ways of life, while opening numerous legal opportunities for everyone.

As the industry keeps shaping up, keep tabs on the space, as Nigeria President-Elect Bola Tinubu has promised to enable the prudent use of blockchain technology and cryptocurrencies in the nation’s banking and financial sector. My fingers remain crossed until we experience full implementation of Bitcoin-friendly regulations in Nigeria.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.