What Do Bitcoin, Antifragility And Fantasy Football Have In Common?

Fantasy football players and Bitcoiners use the same strategic thinking principles when building for an uncertain future.

“Nassim Nicholas Taleb is a Lebanese-American essayist, scholar, mathematical statistician, and former option trader and risk analyst, whose work concerns problems of randomness, probability, and uncertainty.” — Nassim Nicholas Taleb

Introduction

Life is a constant stream of decisions, the outcomes of which shape our futures. In this constant churn of decisions, we seek to improve our odds against the inevitability of randomness, whenever possible. We want to make well-informed decisions to best position ourselves to benefit from these external uncertainties. All people use this probabilistic approach in their daily lives, whether it is realized or not, i.e., “If I want the best outcome, should I do X or Y? Which one has the higher probability of a favorable outcome? That’s the one I choose.”

In order to make a decision, you need to focus on the consequences (which you can know) rather than the probability (which you can’t know) — Nassim Nicholas Taleb

As it turns out, Bitcoin believers and fantasy football players are kindred spirits when it comes to making decisions that benefit from chaos. Bitcoiners and a certain sect of fantasy football drafters are both betting on probabilistic outcomes using the same foundational principle. A principle that was conceived and popularized by scholar, mathematical statistician, and former risk analyst, Nassim Nicholas Taleb. That principle is called “antifragility.”

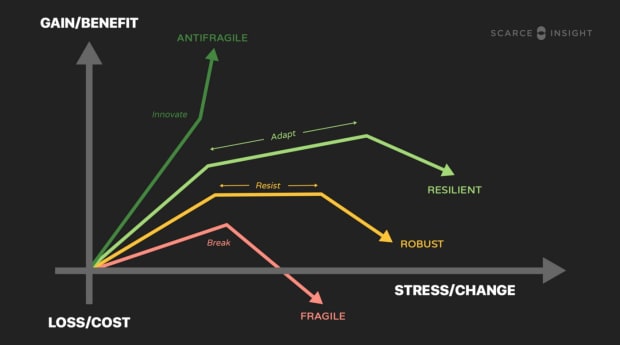

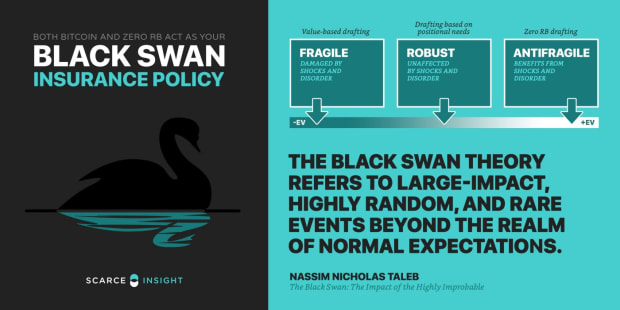

Qualities of the antifragile are outlined by Taleb as follows:

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors. Yet in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.”

As exposure to stressors accumulate over time, the “fragile” break, but the “antifragile” grow stronger.

In recent years, many fantasy footballers gravitated towards a new drafting strategy, popularized by Shawn Siegele in 2013. That strategy is called “Zero-RB” drafting. Simply put, not drafting any running back position players until the later rounds in their drafts.

How Does The “Zero RB” Draft Strategy Work?

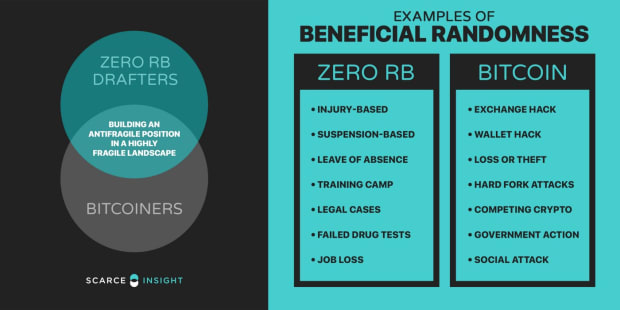

The aim for the Zero RB draft strategy is to utilize your early round, higher draft capital on players with less downside risk. Since the running back position experiences significantly more injuries than other player positions, Zero RB drafters look to avoid spending high draft capital on players that carry added risk. Instead, they load up on positions with more favorable risk profiles in early rounds, like the wide receiver. This allows them to use the middle and late rounds of drafts to take a bunch of antifragile bets, by accumulating low-cost, high-upside running backs.

Not only does avoiding drafting running backs in early rounds minimize risk exposure, but taking a bunch of late-round dart throws at Running Backs pays off at a higher risk/return rate than any other position. Why? Because running backs disproportionately benefit from the highly fragile landscape that the NFL offers. Like any antifragile bet, mid-late round running backs benefit from chaos, disorder, and/or random events like multi-week or season ending injuries. These events can cripple a fantasy team, and break what once seemed like a well-balanced roster construction.

“Running backs are at the highest risk of injury, and their injuries average significantly longer in length than any other position.” — Michael Gertz, ProFootballLogic.com

Some direct examples of the NFL’s highly fragile landscape:

- Player sustains injury in training camp.

- Player sustains multi-week or season-ending injury.

- Player fails a drug test; suspended multiple weeks.

- Rookie player outshines expectations; unseats incumbent player.

- Player has a psychotic breakdown and gets released by multiple teams.

- Player involved in sexual assault allegations, put on Commisioner’s exempt list rendering him unable to play.

Those that gain from these fragile circumstances are not typically the teams that drafted running backs in the early rounds. Instead, many of these fragile events increase the probability that a Zero RB roster construction is the winning strategy. These multi-week or season-ending injuries cause the running backs accumulated in the mid-late draft rounds to increase in value, as it becomes more likely that they crack the starting lineup for their team.

These players are the low-risk, high-upside bets that you want to have made in the wake of “Black Swan” events. They are the backups, the rookies, and the players with freak athletic profiles who’s opportunities to accrue fantasy points for your team are about to increase significantly in the face of chaos.

TL;DR: The Zero-RB strategy is simple. Flip fragility on it’s head, and find a way to benefit from it. Build an antifragile roster in a fragile NFL landscape.

What Does This Have To Do With Bitcoin?

The strategic balancing of economic incentives has allowed Bitcoin to achieve something that has never before been achievable by humankind; absolute scarcity. A provably finite supply which is easily verifiable, and openly displayed to anyone across the world.

Bitcoin may be the most significant alignment of computer science, economics, and game theory ever discovered. Since 2009, its network has continued to grow consistently and globally. Bitcoin’s core value proposition is not that you can pay people instantly and cheaply. It’s not coming for the likes of PayPal or Visa. It’s coming for store of value assets like gold, real estate, or fine art, and eventually the U.S. dollar. Bitcoin is being accumulated by investors because they are recognizing that not only does it have similar monetary properties to gold, but that bitcoin significantly outperforms them across most of those measures. It also offers a few additional properties that we’ve never seen before in a monetary asset. Being purely digital information, bitcoin is incredibly portable, highly divisible, and openly programmable.

“Macro investor Paul Tudor Jones is buying Bitcoin as a hedge against the inflation he sees coming from central bank money printing, telling clients it reminds him of the role gold played in the 1970s.” — Bloomberg

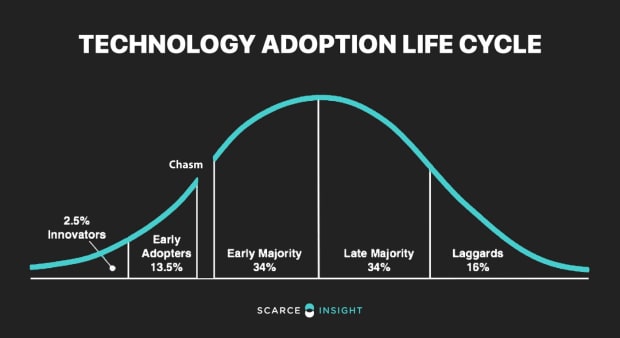

As of today, the opportunity cost is low because we are still early in Bitcoin’s technology adoption cycle. While being early also does mean it carries more risk, the potential upside if bitcoin succeeds in becoming an internet-native global money significantly outweighs that downside. It’s a strategy that Nassim Taleb would say has highly favorable “asymmetry.” Taleb explains this opportunity as follows:

“Antifragility implies more to gain than to lose, equals more upside than downside, equals (favorable) asymmetry.” — Nassim Nicholas Taleb

In contrast to Zero RB draft strategy, where players seek to accumulate running backs in the later stages of a draft, Bitcoiners seek to accumulate bitcoin in the early stages of its technology adoption life cycle.

In similarity to Zero RB draft strategy, where players seek to construct an antifragile roster, Bitcoiners seek to accumulate bitcoin, strengthening their position in the face of a precarious and highly uncertain surrounding environment.

When you’re allocating some of your money into bitcoin, no matter how big or small your holdings, you’re placing an antifragile bet. It is a bet that bitcoin has the properties, qualities and ability to outperform other store of value assets, and forms of money. Bitcoin also carries the much lower probability outcome of replacing the U.S. dollar as the global monetary base in the longer time horizon. The potential returns in these scenarios highly outweigh the current opportunity cost, creating an investment opportunity with asymmetric upside potential.

Why Does Bitcoin Benefit From Fragile Events?

Bitcoin is programmable. This allows it to adapt, maneuver around and overcome the roadblocks that it faces. Bitcoin is an antifragile choice that exists inside a fragile complex system, just like the injury-wrought fantasy football landscape. It is antifragile because it runs on a decentralized, globally-distributed network of computers and is built with open-source code that is fully verifiable to any and all observers. This assures that two key rules stay in place:

- RULE #1: There will never be more than 21 million bitcoin. The entire supply must be openly auditable by anyone.

- RULE #2: No one can change Rule #1 without an overwhelming consensus from 51% of the network’s users.

Bitcoin does not merely just resist change with these rules. Each failed attempt also means that Bitcoin adapts, improves, and belief in its permanence grows stronger as a result.

For a deeper dive into the specific traits that make Bitcoin so antifragile, I highly recommend reading Parker Lewis’ series “Gradually, Then Suddenly”.

Here is a quick snapshot:

“Its decentralized and permissionless state eliminates single points of failure and drives innovation, ultimately ensuring both its survival and a constant strengthening of its immune system as a function of time, trial and error. Bitcoin is beyond resilient. The resilient resists shocks and stays the same; the Bitcoin network gets better. While it is easy to fall into a trap, believing Bitcoin to be untested, unproven and not permanent, it is precisely the opposite. Bitcoin has been constantly tested for going on 12 years, each time proving to be up to the challenge and emerging from each test in a stronger state.” — Parker Lewis

On A Long Enough Timescale…

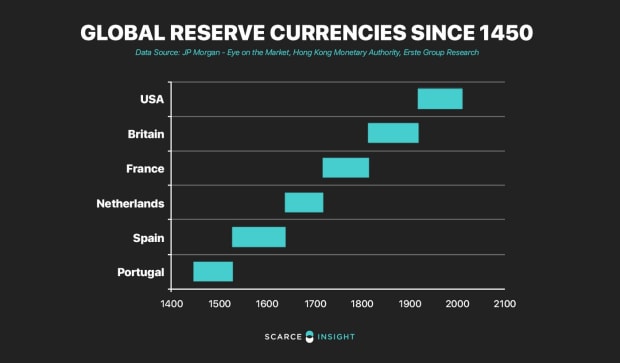

The timescale for the antifragile bets of fantasy football players to play out is about 17 weeks, the length of the NFL regular season. However, for Bitcoin the timescale is unknowable and indefinitely extending. One potential timescale to consider for context might be the historical timeline of world reserve currencies, visualized below:

The reserve currency transition is a cycle that has typically lasted in history somewhere between 80 to 110 years. The U.S. dollar has been the official global reserve currency for 73 years now.

As it stands today for Bitcoin, we’re currently in the late rounds of the draft. As more time goes by, assuming Bitcoin continues to strengthen and gain adoption, the opportunity cost becomes higher. Today, it might cost you a twelveth or thirteenth round pick for some bitcoin. In a few years, you might be paying up with your first rounder.

TL;DR: The Bitcoiner’s strategy is simple. Flip fragility on it’s head, and find a way to benefit from it. Build an antifragile portfolio in a fragile financial landscape.

Conclusion

Zero RB drafters and Bitcoiners are both using the same decision-making principle (antifragility) to aid them in decision making amongst inevitable randomness. They put faith in provable math instead of human error. Each uses computer science as a tool for enhancing their decision making, in the hopes of increasing their odds of an advantageous future outcome.

As Tyler Winklevoss has said of himself and other Bitcoiner believers:

“We have elected to put our money and faith in a mathematical framework that is free of politics and human error.” — Tyler Winklevoss