What China’s Alarming Financial Crisis And A Strengthening US Dollar Means For Bitcoin

China’s banks face insolvency risks with widespread mortgage boycotts. The U.S. dollar is strengthening and bringing bitcoin down in the process.

“Fed Watch” is a macro podcast with a true and rebellious bitcoin nature. In each episode we question mainstream and Bitcoin narratives by examining current events from across the globe, with an emphasis on central banks and currencies.

Listen To The Episode Here:

- Apple

- Spotify

- Libsyn

- Overcast

In this episode, Christian Keroles and I catch up on the week, go through an update on the evolving Chinese financial crisis, talk about why fiat money today should rightly be called credit-based money and the side effects of that fact. Last, we dive into the bitcoin chart.

You can access this episode’s slide deck of charts here or below.

China

First up is the situation in the Chinese economy. They are facing some major issues in their real estate market, economy and banking system. Currently, 28 of the top 100 real estate developers have defaulted on or restructured their debts. There is a growing “mortgage boycott,” where purchasers of unbuilt housing units in projects that are now delayed due to the pandemic, developers’ financial situation and the country’s zero-COVID policy, have refused to pay their mortgages. The boycott started with 20 projects and has since grown to 235 projects.

The rhetoric around this mortgage crisis is eerily similar to that in the U.S. in 2007. Excuses such as, “It is a small number of mortgages” and “Effects are contained” are being offered.

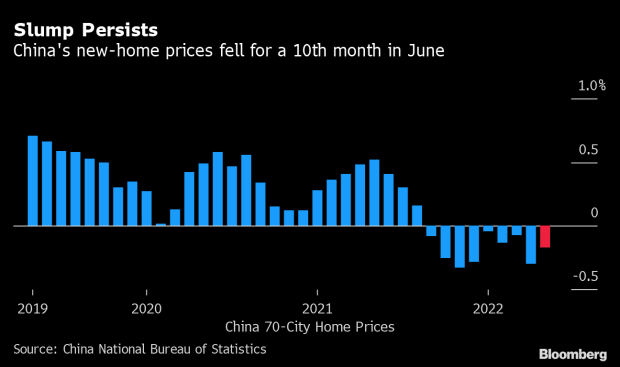

As a result of the developer and mortgage problems, small- and medium-sized banks are running into solvency issues. Chinese banks have $9 trillion in exposure to real estate. If there was a problem with perpetually falling home prices, it could very quickly cause a solvency issue for banks. Indeed, that is exactly what we are seeing.

New unit home prices in China have fallen for the 10th straight month in June 2022.

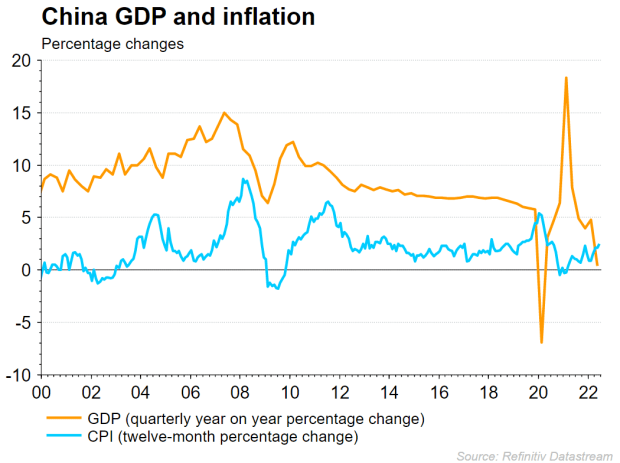

Gross domestic product crashed in Q2 2022 to 0.4%.

The GDP chart nicely supports my personal macro predictions that the major economies are going to return to the post-Global Financial Crisis (GFC) “normal.” Since the GFC, growth in China has been slowly trending downward. Then there was the violent economic disruption and whiplash effect in the economy, followed by a return to slowing growth.

At the end of the China segment of the podcast, I read through a fascinating article from Nikkei Asia on the situation around recent bank runs in the Henan province. The article highlighted the abusive response to the bank run and the growing dangers of a full-blown financial crisis in China.

Bitcoin Charts

Next, we go through a couple of bitcoin charts. The first two charts highlight the similarities and differences in the chart during periods that resembled today’s price action. I pointed out that the current flat consolidation differs because it has higher highs and higher lows, where the previous breakout attempts did not.

There are also some very interesting observations from Twitter on cash positions in hedge funds and the bitcoin market.

Kuppy is pointing out that the percentage of hedge fund portfolios that are holding cash is higher than any period since the dot-com bubble back in 2000. When these peaks happen and hedge funds rotate back into stocks, the market bottoms and has a nice rally.

We can also see this effect in the bitcoin market.

This chart is a little busy, but the top panel is the “stablecoin dominance,” as I’ve called it, the ratio between the stablecoin market cap and bitcoin’s market cap. It is a proxy for a “cash position” in the bitcoin market. The bottom panel is the bitcoin price. At relative tops in the stablecoin ratio, bitcoin bottoms in price because those stablecoins can rotate into buying bitcoin and vice versa.

The U.S. Dollar

There has been a lot of talk about the strengthening dollar. We are the only bitcoin podcast that unequivocally called for a strong dollar over the last two years, and boy have we been right on that.

I do not expect the dollar to sell off dramatically after its parabolic rise, but to establish a new higher range, perhaps between 100-115 on the U.S. Dollar Index (DXY).

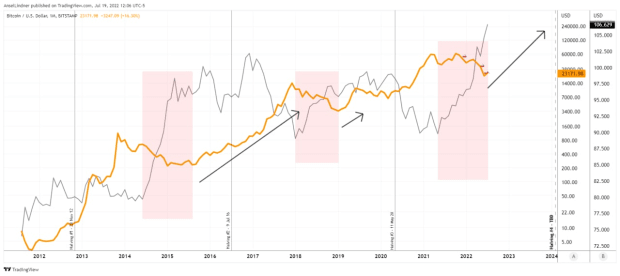

I stress that bitcoin does not need a weakening dollar to explode higher. In fact, if you look at the history of bitcoin charted with the DXY, you can see the dollar establishes a new higher range where bitcoin does sell off. After periods of a rising dollar, bitcoin tends to take off. I didn’t have a chart prepared to show this during the live stream, but it’s included below.

The pink zones indicate periods of rising dollar and falling bitcoin. The black arrows indicate rising bitcoin amid a steady dollar at a higher range. Important to note, bitcoin and the dollar have both stair-stepped higher over the last 10 years, only on slightly different schedules.

Last, we take a look at the euro and discuss how and why it is in the most trouble out of the major currencies. We mention fragmentation risk several times. I did a podcast episode dedicated to that topic recently.

Please check out the Fed Watch Clips channel on YouTube, subscribe and share.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.