What 460 Million Bitcoin Addresses Tell us About the State of Cryptocurrencies

Amid the constant price fluctuations, project updates and news about regulations, it’s hard to tell exactly how well the process of bitcoin adoption is going. A recent report published on Chainalysis.com revealed data about the activity of bitcoin wallet users.

The first interesting data point shows that only 37% of the 460m addresses (172m) are ‘economically relevant’, which means they are controlled by people or services who hold BTC. Of these 172 economically relevant addresses, 86% (or 147m) belong to a named service (Binance, Tezos wallet, etc.) or darknet market. None Economically relevant addresses seem only to have single use cases like holding bitcoin for a short period to facilitate a transaction between 2 people (similar to an escrow).

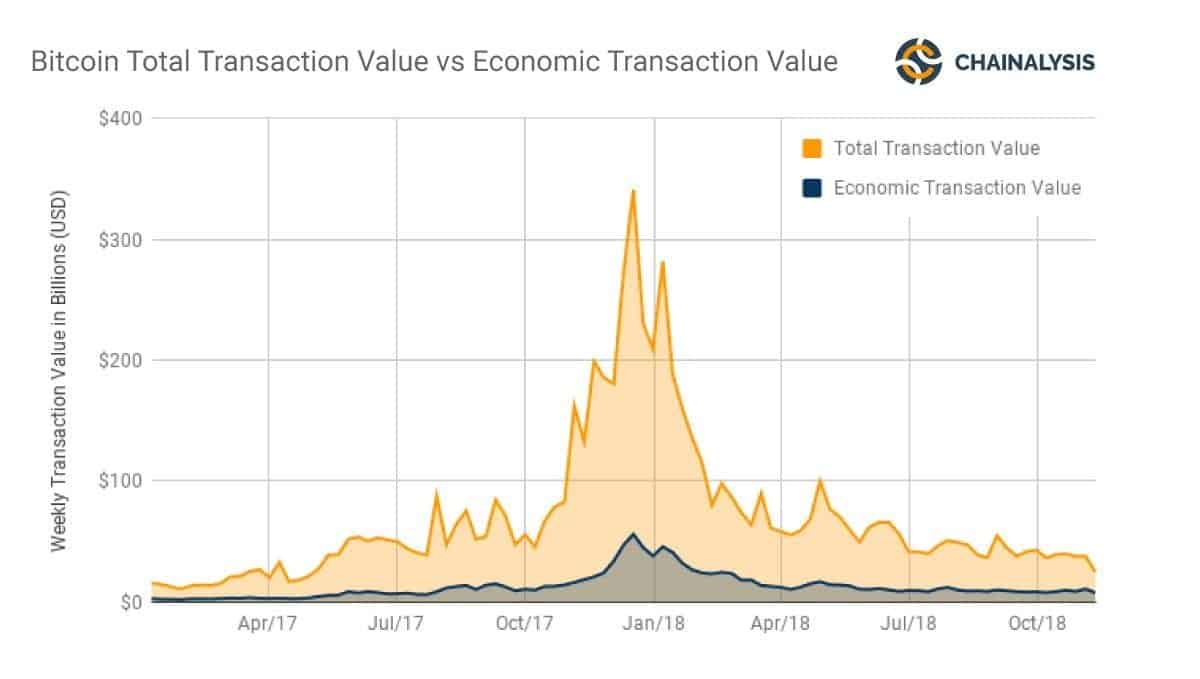

In the second the part of the report there is being an attempt to predict how many of the value of the transaction in the network is having a real economic value, that is that is happening between economic addresses. The report suggests that only 20% of the transactions are being done between economically relevant addresses.

“Between August and October 2018, some $41 billion of transactions were executed — and only $9 billion had real economic value.”

What this data reveals is that we still have a long way to go until true adoption of bitcoin occurs. Outside factors, such as high volatility and lack of implemented scalability solutions have had the most significant impact on Bitcoins inability to achieve more substantial adoption as a form of payment:

- Bitcoins price has dropped by more than 80% in the past year, discouraging many people who would have been happy to use it as a form of payment to shy away due to the fear of losing their funds in the bear market.

- Lightening network is progressing at a slow but steady pace. The throughput of its 11,000 nodes just recently surpassed $2 million in transaction capacity, a significant step for Bitcoins premier scalability solution.

- The number of merchants willing to accept bitcoin seems to have declined at almost the same rate as the price. Data from Chain analysis showed that Bitcoin usage across merchants and payment providers has dwindled by as much as 80%, despite the innovations with Lightning network and growth in public awareness of the technology.

Ultimately, if these three key factors can be improved (volatility, scalability and merchant adoption), then we will be sure to see not only more bitcoin addresses but also a more significant percentage of bitcoin addresses being economically relevant.

The post What 460 Million Bitcoin Addresses Tell us About the State of Cryptocurrencies appeared first on CryptoPotato.