Whales Bought the Dip as Bitcoin Reclaims $40K: Analyst

As bitcoin dropped to a monthly low at $39,000 after a few days of consolidating above the $40,000 mark, there was a growing bearish sentiment regarding its immediate price action. When the bears came out to push bitcoin south, dipping into the 37K – 40K area, some considered it an excellent opportunity to accumulate.

High Volume of BTC Spot Exchange Outflow

Minkyu Woo, a technical analyst on CryptoQuant, claimed that as the BTC sell-off went on, a noticeable volume was seen out of spot exchanges recently. Whales may have bought out a large sum of BTC, Woo implied, because this size of outflow can only be made possible via “checking Top 10 BTC outflow for spot exchanges.”

Woo saw the price range of BTC between 37K ~ 40K as a critical accumulation phase which has been ongoing since Mar 2022 and urged investors to hold or buy the dips if they could. Previously, in the wake of scenarios where the outflow volume spiked, as a considerable quantity of bitcoin was being removed from exchanges, upward price action soon reversed the market’s short-term bearish sentiment.

Something similar transpired now as well since BTC recovered all losses and even challenged $41,000.

In addition, Woo stated that as long as bitcoin has traded beneath the 200 MA support line since Q4 of 2020, a sufficient amount of “smart money” would start accumulating the largest cryptocurrency by market cap. As Woo’s chart indicates, BTC dipped into the “bottom zone,” and buying interest has also spiked accordingly.

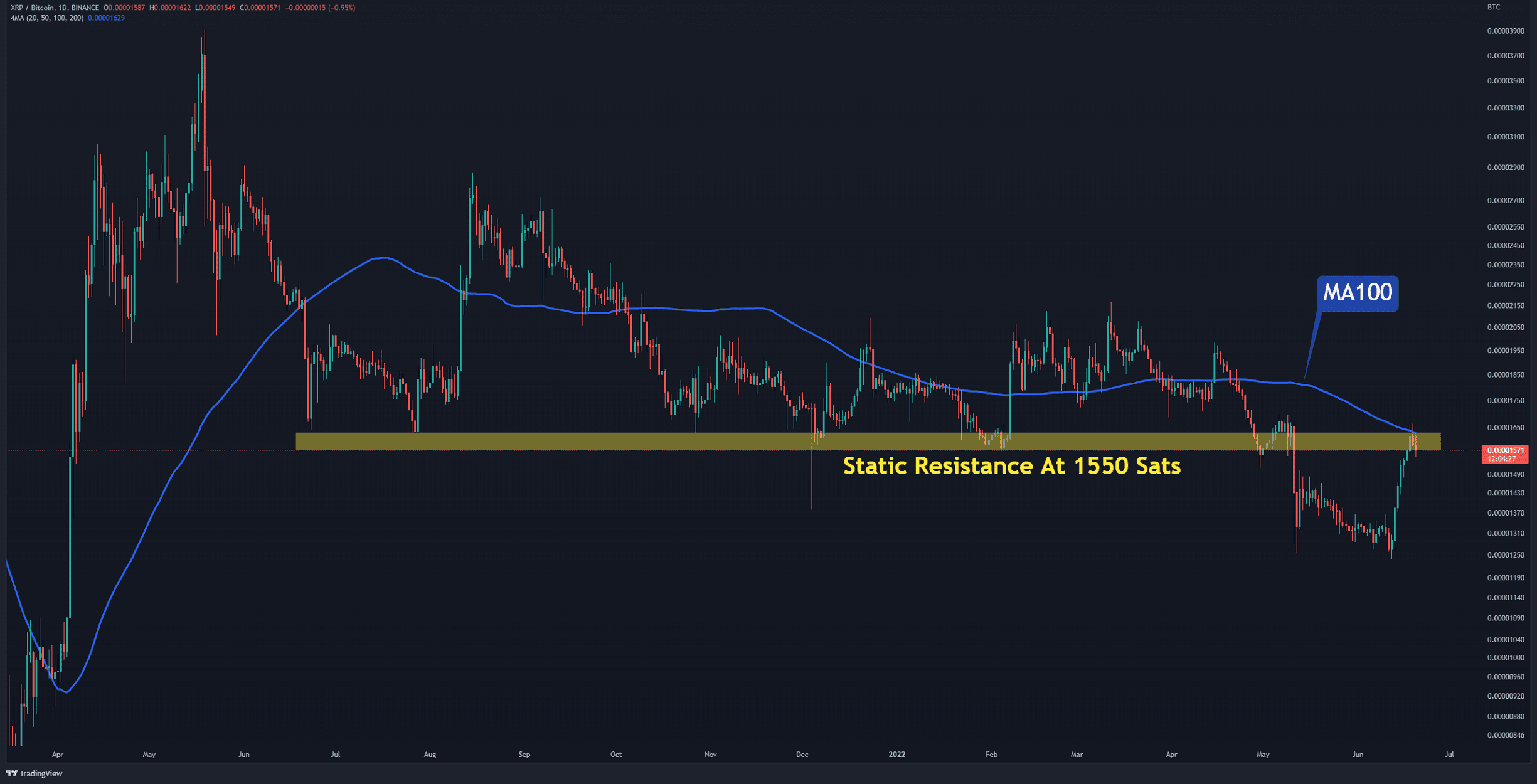

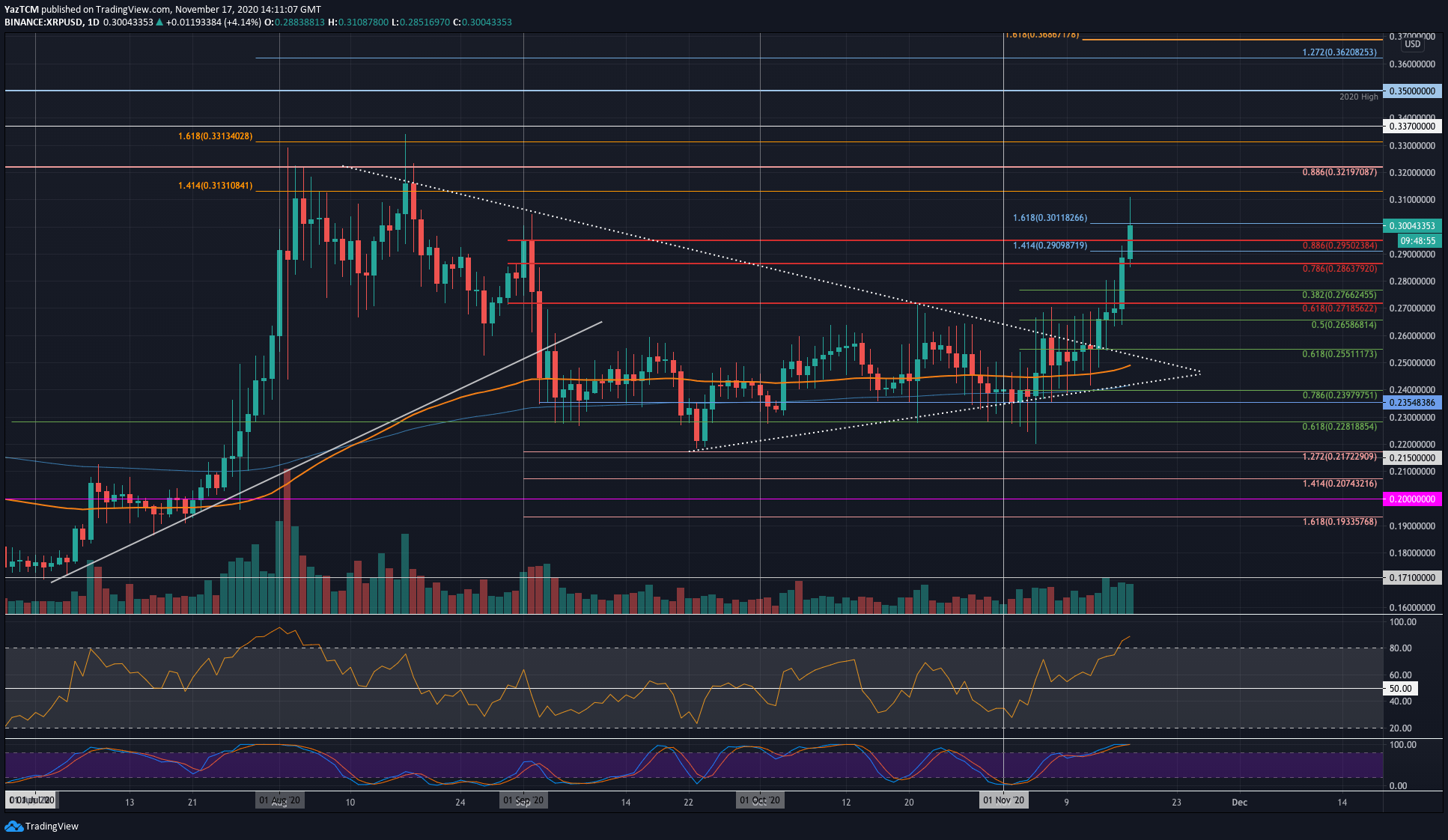

#BTC Daily Chart,

Since Q4 of 2020 until the present, clear movement from smart money has been detected. (Stablecoin inflow MA)

By seeing below chart, BTC is in the bottom zone clearly and it is really hard not to buy BTC now. #BTC #Bitcoin pic.twitter.com/ofbtH8UqLQ

— Minkyu Woo (Min) 우민규

(@minkyutekken) April 18, 2022

Uncertainties Ahead of BTC

Bitcoin’s bearish sentiment was mirrored across the broader crypto market, with Ethereum also dropping below the $3,000 level and major altcoins entering the red sea.

Nevertheless, the landscape seems entirely different today as almost the entire market has started its recovery. Ethereum reclaimed $3,000, BNB is well above $400, etc.