We’re Repeating The 2017 Bitcoin Bull Cycle

The 2017 Bitcoin bull market was a wild ride, with prices soaring from under $200 to nearly $20,000. As we look at the current market, many are wondering if we might see a similar surge again. In this article, we’ll explore the data and trends that suggest we could be on the brink of another massive bull cycle.

Key Takeaways

- The current Bitcoin cycle shows strong correlations with the 2017 cycle.

- Historical data indicates potential for significant price increases.

- Investor behavior patterns are mirroring those from previous cycles.

Understanding Bitcoin Bull Cycles

Bitcoin has had several bull cycles, each with its own unique characteristics. The most notable was in 2017, where the price skyrocketed. Now, as we analyze the current market, we see some interesting parallels.

The recent price action has been choppy, with Bitcoin hitting a new all-time high above $108,000 before retracing to below $90,000. However, it has since rebounded, and this fluctuation is not uncommon in bull markets.

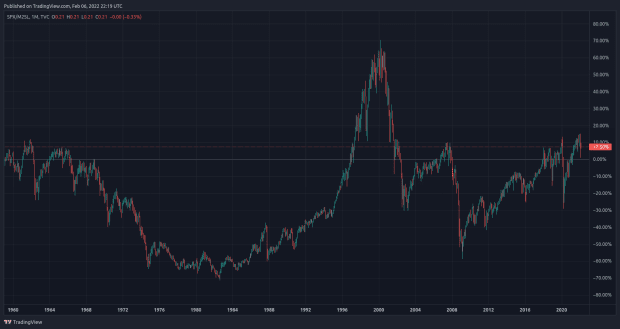

Comparing Current Cycle to Previous Cycles

When we compare the current cycle to previous ones, particularly the 2017 cycle, we notice some striking similarities. The following points highlight these correlations:

- Cycle Length: The 2017 cycle peaked at 1068 days from its low, while the 2021 cycle peaked at 1060 days. Currently, we are 779 days into this cycle, suggesting we have a significant amount of time left.

- Price Action Correlation: The correlation between the current cycle and the 2017 cycle is at an impressive 0.92. This means that the price movements are closely aligned, indicating that we might be following a similar trajectory.

- Investor Behavior: The MVRV (Market Value to Realized Value) ratio shows a strong correlation of 0.83 with the 2017 cycle, suggesting that investor behavior is also mirroring past trends.

The Role of Halving Events

Bitcoin halving events have historically been significant markers in the price cycle. The last halving occurred in 2024, and as we look at the current cycle, we see that it closely follows the pattern established in 2017. The halving events in both cycles occurred within a similar timeframe, which could indicate that we are on a similar path.

Future Predictions

Looking ahead, if the current cycle continues to follow the 2017 pattern, we could see a significant price increase throughout 2025. While some predictions suggest prices could reach as high as $1.5 million, it’s essential to approach such forecasts with caution. A more realistic peak might align with historical trends, potentially occurring in late 2025.

Conclusion

In summary, the current Bitcoin bull market shows strong correlations with the 2017 cycle, both in terms of price action and investor behavior. While we may not see the same explosive growth as in 2017, the data suggests that we could be in for an exciting ride in the coming months. As always, it’s crucial to stay informed and make decisions based on thorough analysis.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.