Weekly Crypto Investment Product Outflows Hit $32M: CoinShares

According to the latest edition of CoinShares’ weekly report, outflows in digital asset investment products reached $32 million last week, a level not seen since late December 2022.

The sentiment could be attributed to exchange-traded product (ETP) investors being less optimistic about recent regulatory pressures in the US relative to the wider market.

Bitcoin Bears the Brunt

Outflow figures surged to $62 million the mid-way through last week, even as the sentiment improved significantly by Friday. Bitcoin was the most affected crypto asset during the turmoil in the market, experiencing an outflow of $24.8 million over the past week.

Short-bitcoin investment products, on the other hand, recorded inflows of $3.7 million during the same time while also witnessing some of the largest inflows YTD of $38 million, trailing behind only Bitcoin with $158 million.

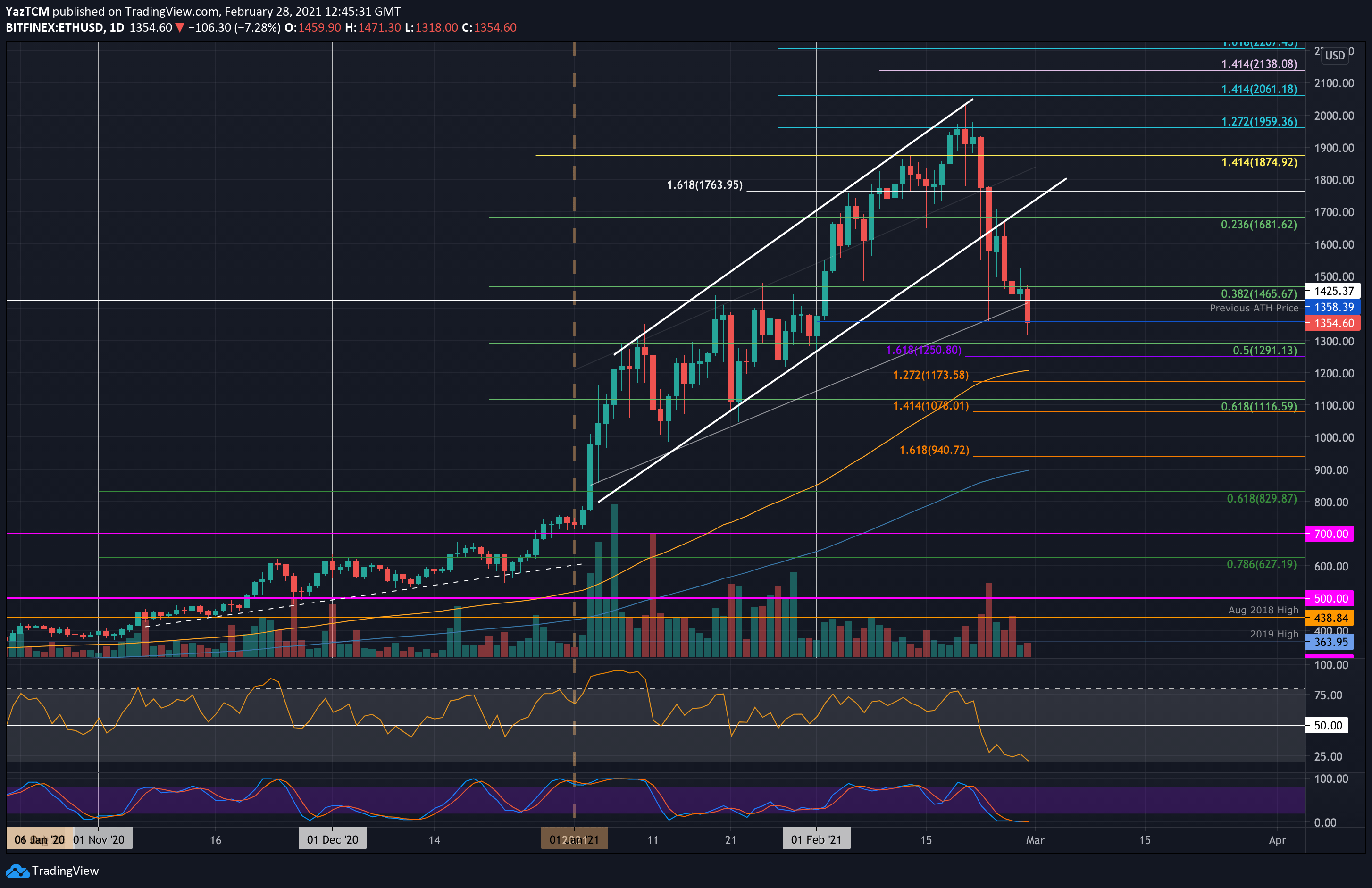

Ethereum also bore the brunt of the negative sentiment and recorded an outflow of $7.2 million. Cosmos, Polygon, and Avalanche $1.6 million, $0.8 million, and $0.5 million, respectively. The negative sentiment remained mixed as Inflows of Aave, Fantom, XRP, Binance, and Decentraland stood somewhere between $0.36 million – $0.26 million.

Furthermore, blockchain equities saw six consecutive weeks of inflows, with the latest totaling $9.6 million, demonstrating a more “constructive sentiment” amongst market players.

SEC Watching Closely

The major catalyst due to the outflows last week was the New York financial regulator ordering Paxos to stop minting new Binance USD (BUSD) tokens after rumors that the US Securities and Exchange Commission (SEC) wanted to take enforcement action against the company.

The SEC hasn’t undertaken official action yet. But it’s safe to say that the agency is closely watching the sector before it starts an official procedure, a move that is expected to have huge implications for all stablecoins, including Tether’s USDT and Circle’s USDC.

Prior to that, the SEC charged the prominent crypto exchange Kraken with $30 million for breaching US securities law.

On the flip side, the negative sentiment amongst ETP investors failed to affect the broader market as Bitcoin prices rose by 10% over the week. It was this price appreciation that pushed total assets under management (AuM) to $30 billion.

The post Weekly Crypto Investment Product Outflows Hit $32M: CoinShares appeared first on CryptoPotato.