Weekend Watch: Bitcoin Stopped at $22K, Uniswap Soars 9%

After yesterday’s multi-week high, bitcoin was stopped and pushed south to under $22,000. Similar to last weekend, this one starts with little-to-no substantial movements from the altcoins as well. Uniswap is among the very few exceptions with a notable price surge.

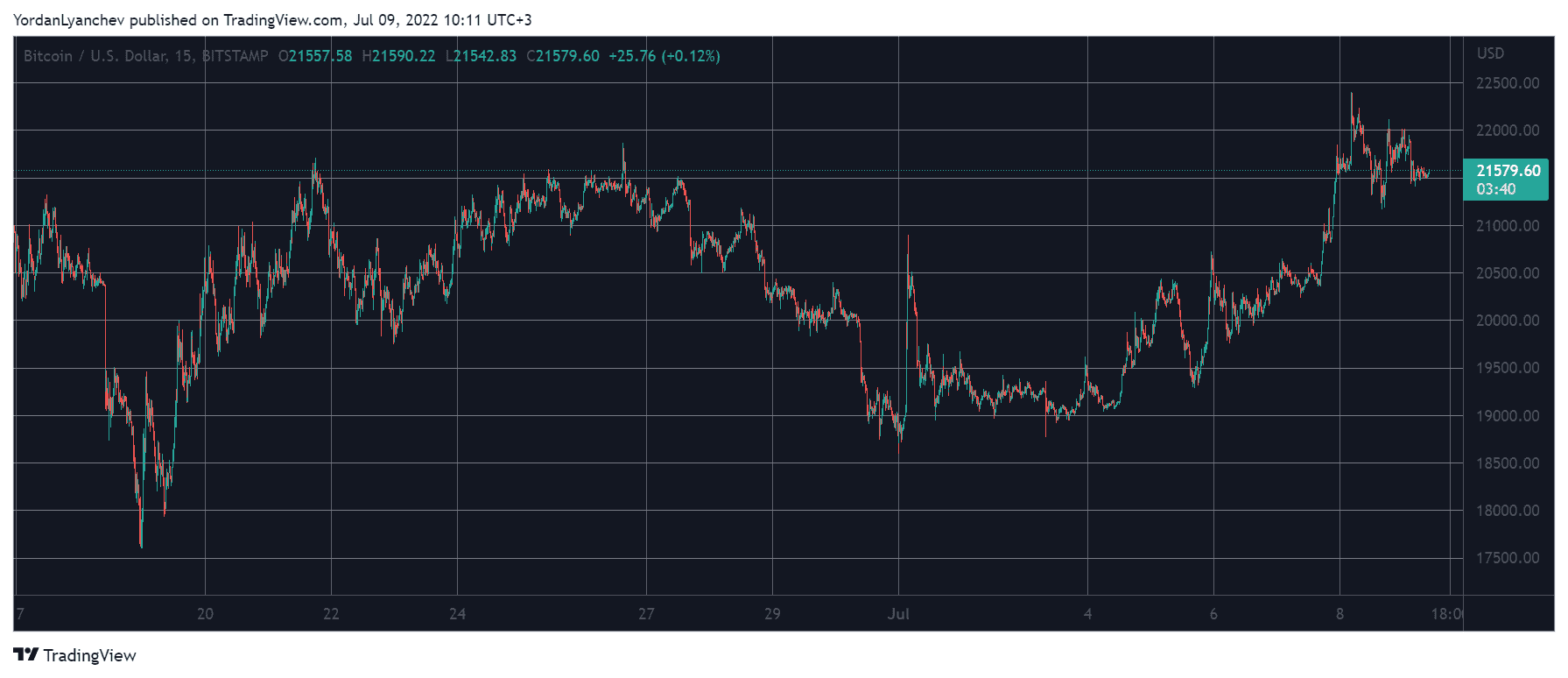

Bitcoin’s Voyage Above $22K Halted

As reported recently, last weekend was quite still in terms of price action, perhaps propelled by the national US holiday, which was on Monday. Once that was coming to its end, though, BTC started to gain value and jumped from $19,000 to $20,000.

After a few rejections, the asset managed to break above it and even kept climbing. As a result, it was soon knocking on the door of $21,000, which was taken down on Thursday.

The cryptocurrency continued its hike, surged past $22,000, and tapped a new three-week high at around $22,500. However, it was stopped at this point, and the bears pushed it south by approximately $1,000.

Nevertheless, its market capitalization stands well above $400 billion, and its dominance over the alts is just over 43%.

Notable Bitcoin News

Unlike several other crypto miners, Marathon Digital said it had not sold any of its BTC holdings during the market crash last month.

The Bitcoin premium on Coinbase finally turned green, suggesting institutional investors are back buying.

UNI Stands Out

Most altcoins registered some impressive gains during the working week but have calmed as the weekend started.

Ethereum tapped a multi-week high of its own above $1,250 but has retraced by just over 2% and now stands at $1,220. Ripple and Dogecoin are also slightly in the red on a daily scale.

In contrast, BNB, ADA, SOL, DOT, SHIB, and TRX are all in the green, even though their gains are quite insignificant now.

From the lower- and mid-cap altcoins, ICP, XCN, and UNI stand out as the most substantial gainers. ICP trades above $7, UNI has reclaimed $6, and XCN is north of $0.1.

Somewhat expectedly, the cumulative market cap of all crypto assets stands still around $950 billion.

Industry News

In a lawsuit filed at the beginning of the month, a California resident accused Solana Labs of selling unregistered securities.

Despite repaying its loan to Maker, Celsius’ situation continues to worsen, with new reports claiming its strategies led to multimillion losses for customers and being slapped with a fraud lawsuit from its former money manager.

BlockchainCom faces a $270 million loss on the loans it had provided to the struggling hedge fund Three Arrows Capital.

Citing the Twitter team’s inability to provide sensitive data about its operations, Elon Musk terminated the deal to purchase the social media platform.