We Asked ChatGPT Whether Bitcoin or Gold Will Perform Better Amid Israel-Hamas War

Ever since the conflict, or war, between Israel and Hamas started a couple of weeks ago, two assets have been showcasing notable price increases – bitcoin and gold.

As such, we decided to ask the AI chatbot which one of the two will continue its positive movements and perform better as long as the conflict rages on.

Gold Vs. Bitcoin During a War

Geopolitical tension is always taking its toll on financial markets, just like what happened last year when Russia launched its “special military operation” against Ukraine, but some assets tend to perform better than others.

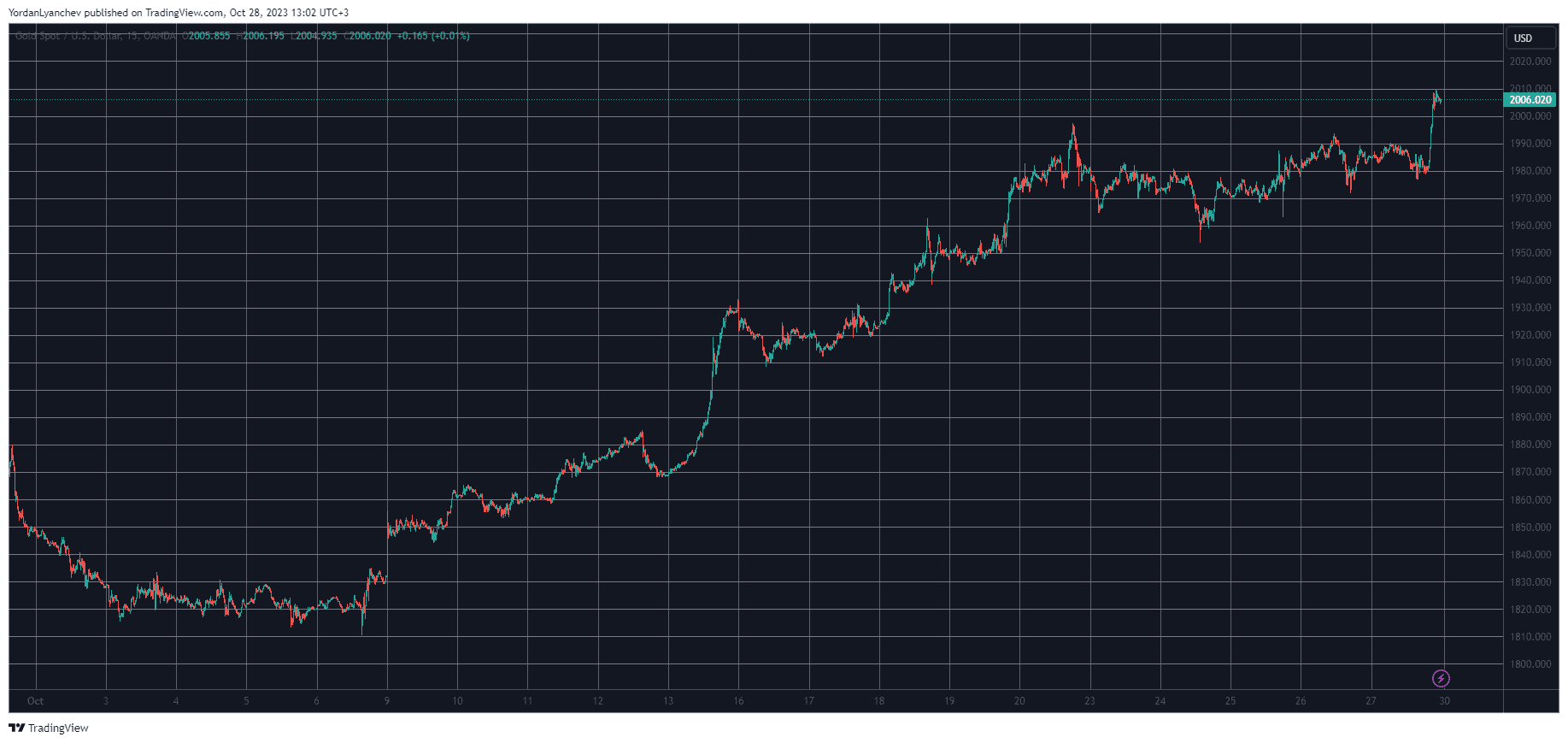

The Israel-Hamas war started exactly three weeks ago, and gold’s price against the dollar was at a local low of around $1,830. As reported at the time, the precious metal had lost its yearly gains after a 7% decline in two weeks.

However, the political uncertainty started affecting the market, and gold went on a massive roll. It quickly reclaimed $1,900, kept surging, and even flew past the coveted $2,000 mark late on Friday night. As such, the bullion has jumped by roughly 10% since October 6.

Bitcoin’s performance has been somewhat identical, although there’re some speculations that its rise could be attributed to the possibility of a spot BTC ETF getting approved in the States. However, such a product is yet to see the light of day.

BTC’s price stood at around $28,000 when the war broke and initially declined to sub-$27,000 levels. However, it started gaining traction quickly, sometimes even influenced by fake news. The most substantial price surge was on Monday and Tuesday when the cryptocurrency skyrocketed by several grand in hours and tapped a 17-month peak at over $35,000.

Despite losing some ground since then, BTC currently trades above $34,000. This means that its three-week gains stand at 23%.

What Does ChatGPT Think?

When asked about the possible future performance of BTC and gold amid the ongoing war, the AI chatbot refused to answer directly. Instead, it asserted that both assets can be influenced by a “wide range of factors, including political events, economic conditions, investor sentiment, and more.”

It added that every investment tool carries certain risks, and even though some, such as gold, have had a long history of serving as a hedge against inflation and political uncertainty, future performance cannot be forecasted based on past movements.

On the question of whether bitcoin or the precious metal are the better safe haven tools, ChatGPT said:

“Gold has a proven track record of being a reliable hedge against inflation. It tends to maintain its value over long periods, even in times of high inflation.

Bitcoin is often touted as “digital gold” and is seen by some as a potential hedge against inflation due to its limited supply and the belief that it could act as a store of value in the digital age. However, it’s important to note that Bitcoin’s short history (compared to gold) means it hasn’t yet been tested through multiple economic cycles.”

The post We Asked ChatGPT Whether Bitcoin or Gold Will Perform Better Amid Israel-Hamas War appeared first on CryptoPotato.