WATCH: Dash CEO Looks Forward to Stability and Adoption

Dash, one of the top-20 cryptos by market cap, has picked up momentum over the past month with five new exchange listings.

Coinbase, Coinbase Pro, and local exchanges in Mexico, Brazil and Switzerland have bucked the trend against delisting so-called privacy coins and added Dash to their listings.

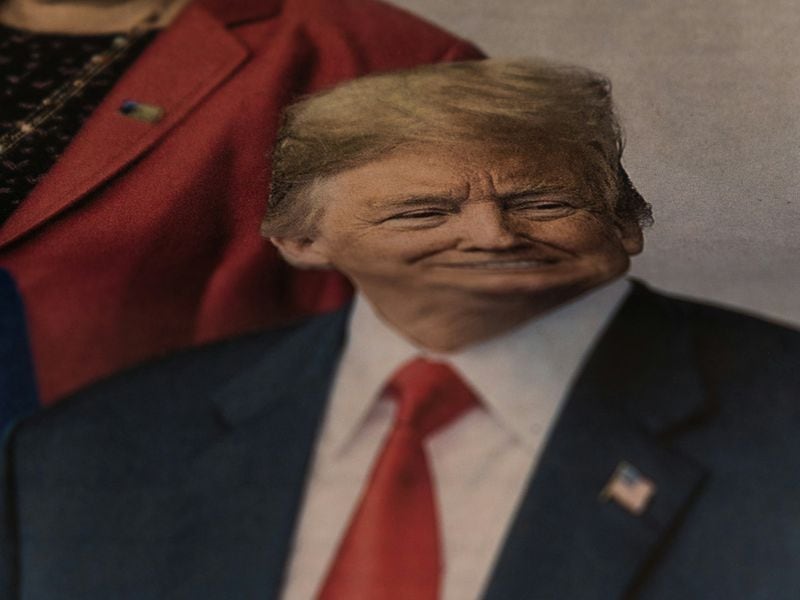

Dash Core Group CEO Ryan Taylor recently sat down with CoinDesk to discuss the recent spate of announcements and take the temperature of Dash’s decentralized network.

“There’s kind of a natural equilibrium that occurs over time and we’re kind of there right now,” Taylor said, referring to the network of masternodes that provide a second layer of security.

This stability comes in the face of growing adoption both at the consumer and exchange level. As more exchanges list Dash, the potential avenues for trading widen. Taylor said Dash’s instantaneous transaction validation opens up the possibility of arbitrage, or taking advantage of price differences, between exchanges. And that’s a good thing for everyone, in his view.

“Arbitrage helps with price stabilization not just for Dash but for any pairing,” Taylor said. “That’s obviously economically valuable for exchanges.”

Dash’s technical features that allow high-speed trading also make it a convenient coin at the consumer level, Taylor said:

“We’ve really addressed a lot of the new user experience issues, and made it much more fluid experience for paying, especially at the point of sale where time really matters.”

Concluding the discussion on the recently announced Crypto Rating Council, Taylor said the initiative put forward by Coinbase addresses a lack of guidance at the regulatory level.

“I applaud the effort. I think that it helps to bring some level of clarity to the market and at least makes out a position that people could begin to debate and challenge,” Taylor said. “But I think that there’s only so much the exchanges can do. There is also a potential for perceived or real conflicts of interest.”

Dash Core Group CEO Ryan Taylor Screenshot via YouTube