Warren’s Crypto Bill Is Likely Unconstitutional. It’s Also Unlikely to Pass

Sen. Elizabeth Warren (D–Mass.) is trying to force feed the American people a poison pill. The high-profile legislator, known today as much for her disdain of cryptocurrency as for Big Banks, has submitted a bill for consideration looking to crackdown on crypto’s alleged use in illicit finance.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

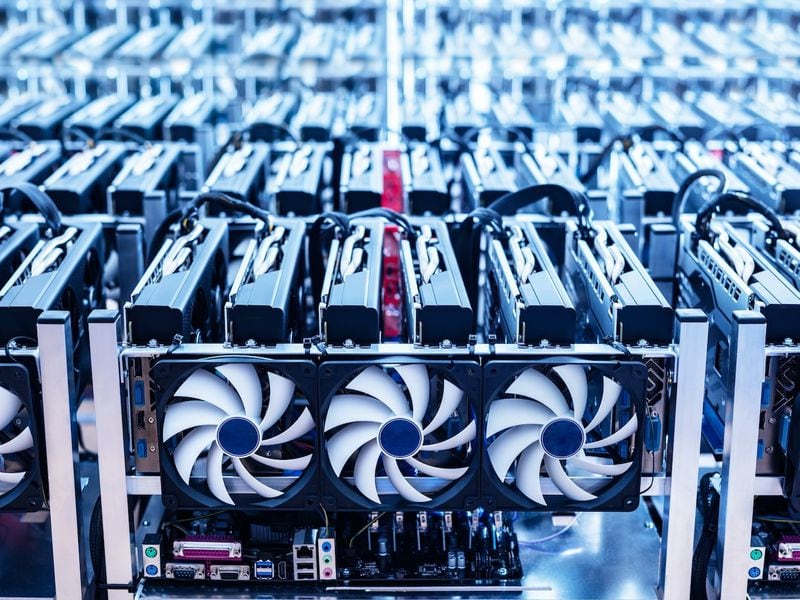

On Monday, five Democratic lawmakers joined to co-sponsor the so-called “Digital Asset Anti-Money Laundering Act.” If passed, the law would extend Bank Secrecy Act requirements including know-your-customer (KYC) rules to miners, validators, wallet providers and other crypto industry actors.

Three of the five new sign-ons are colleagues of Warren on the Senate Banking Committee. They are: Sens. Raphael Warnock (D-GA), Laphonza Butler (D-CA) and Chris Van Hollen (D-MD). The committee is a powerful body in the Senate, responsible for passing laws that regulate one of the U.S. largest economic sectors and that will likely influence what legislative proposals will be considered next year.

That said, Warren’s bill, as it exists, is unlikely to pass for many of the same reasons U.S. governance is often hamstrung: partisan politics, infighting and gridlock.

And that is a good thing, not only for the crypto industry — where many leaders have already come out forcefully against the bill — but for the American public. The anti-money laundering act, while likely conceived with the best intentions, comes with some truly worrisome conditions attached.

Much ink has already been spilled over the bill, so I won’t rehash much of the debate other than saying Warren’s bill essentially would make it illegal to use crypto in the U.S. and put severe restrictions around writing code meant to provide people with similar privacy guarantees as paper money.

Some, like industry lobbyists at Coin Center, have noted the law would likely be unconstitutional.

It likely won’t pass for other reasons — in part, after the mess that FTX caused, U.S. legislators are intent on passing actual crypto regulatory reforms, and Warren’s bill — instead of taking aim at the issues in blockchain that enabled Sam Bankman-Fried’s rise and fall — is focused on the incredibly narrow issue of surveillance. It just isn’t a good use of time, to say nothing of all the other ways U.S. lawmakers seem to waste the days of the years.

But it is interesting that this bill is coming up at this time. In fact, Warren’s DAAMA bill is likely unconstitutional in a very similar way that another truly worrisome congressional proposal is likely unconstitutional: it’s seeking to expand surveillance over the bits and bobs of popular digital technologies.

‘Surrogate spies’

As Elizabeth Goitein, co-director of the Liberty and National Security Program at the Brennan Center for Justice, noted on social media about the FISA Reform and Reauthorization Act of 2023:

“RED ALERT: Buried in the House intelligence committee’s Section 702 ‘reform’ bill, which is schedule[d] for a floor vote as soon as tomorrow [Dec. 12, today], is the biggest expansion of surveillance inside the United States since the Patriot Act.

“Through a seemingly innocuous change to the definition of ‘electronic service communications provider,’ the bill vastly expands the universe of U.S. businesses that can be conscripted to aid the government in conducting surveillance.”

Without going into too many specifics, the so-called reform bill (meant to reauthorize Section 702 of the Foreign Intelligence Surveillance Act, aka FISA) would expand provisions in existing laws that already compel internet and other communication service providers to assist law enforcement and intelligence agencies to turn in information about suspect users.

Goitein notes that by expanding a definition of a “provider,” those agencies would now be able to compel even more information from even more phone, email and text messaging records.

She mentioned companies that may offer clients WiFi like “hotels, libraries and coffee shops,” because they may run a router that connects to the internet and that figures into the communications chain. It’s not just deputizing these companies, it’s turning them into “surrogate spies.”

This is, in the grand scheme of things, exactly how Warren’s AML operates. Warren’s proposal is written in such a way to increase reporting requirements for nearly every corner of crypto. This includes anything from centralized exchanges, where filing “suspicious activity reports” (SARs) might make sense, and for parts and players in blockchain where the concept of collecting information on users is … asinine, like node operators and software developers.

Whether or not the bill makes sense, or even if its proposed expansion of the Bank Secrecy Act is the right tool for the job (the BSA is arguably unconstitutional, as Coin Center’s Peter Valkenburgh argues, and ineffective because SARs do not prevent crime just limit banks’ liability, as ex-CoinDesk David Z. Morris writes), the matter of intent matters.

Warren, who has used her “war on crypto” as a means of soliciting campaign donations, is clearly trying to make a name for herself being tough on crime. Crypto may think crypto is punk and radical, but there are clearly parts of the industry that benefit Wall Street, big time. So Warren’s messaging is at least on brand.

Her legislative proposals are not always successful (though out of the 330 bills she’s written in a decade-long career, she did enact the Consumer Financial Protection Bureau, which for better or worse is impressive). But some have argued she’s just trying to shift the “Overton Window” (what is politically possible to get done) and to reinforce crypto’s (deserved and undeserved) association with crime.

The bill serves the big aim of attacking crypto as a trend as well as the narrow issue of crypto’s use to fund terrorism, launder ill-gotten gains and in other criminal activities.

“Crypto should be governed by the same transparency rules as traditional banks to protect Americans and help ensure it isn’t used to facilitate illegal behavior by criminal enterprises and rogue nations,” Warren’s new co-sponsor Van Hollen said.

That’s all well and good, until you consider how the supposed finance experts in the room are trying to get there: by criminalizing communications. More troubling, it’s not the first time and likely won’t be the last.

“At the end of the day, though, the government’s claimed intent matters little. What matters is what the provision, on its face, actually allows—because as we all know by now, the government will interpret and apply the law as broadly as it can get away with.”