Video: Debating Technology-Driven Deflation

Listen To This Episode:

- Apple

- Spotify

- Libsyn

- Overcast

In this off-the-cuff episode of Fed Watch, Christian and I dove more deeply into the technology-driven deflation debate we started last week with our guest Jeff Booth.

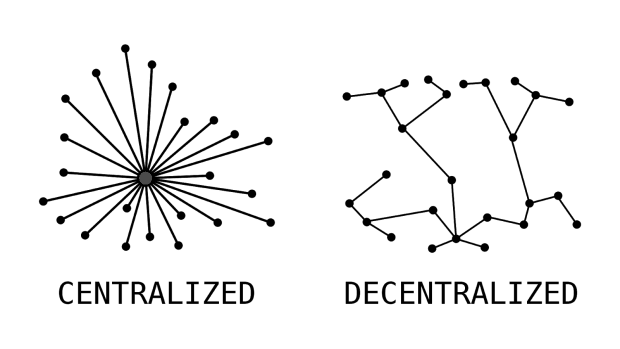

We brought up the “chicken or the egg?” conversation that did not get resolved fully last time: Is the deflation from technology first or is the inflationary environment first? In other words, which force is primary? We discuss that topic again, and also touch on the problem presented by the fact that not all technology is equally inflationary.

Modern finance preceded the industrial revolution and it is widely accepted that technological advance and economic stimulus are directly correlated. I attempted to make the claim that it is the culture and capital structure that results from debt-based fiat money that incentivizes massive technological advancement. Without debt-based fiat money, the deflationary pressure from innovation will return to the natural and gradual speed we saw throughout the days of the classic gold standard.

The post Video: Debating Technology-Driven Deflation appeared first on Bitcoin Magazine.