Vibe Check: Ether Finds Support: CoinDesk Indices’ Todd Groth

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

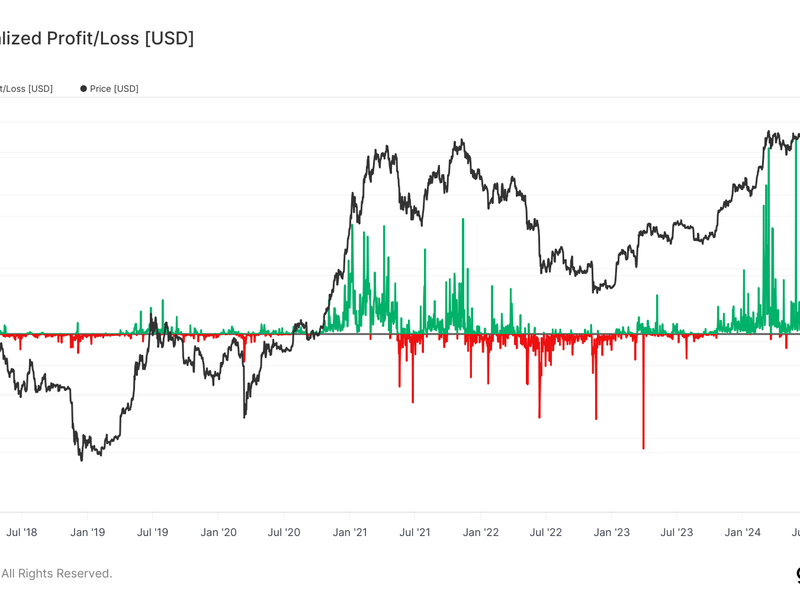

It looks like we’ve hit a decent level of support for ether (ETH) as we hug the $2,200 level and, coincidentally, the 38 Fibonacci retracement level – one of the indicators traders use to gauge potential price stall or reversal.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/DQN6UK72WZB2PEGGNBTCZMXWEI.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/AYE774HOHNGBREZAHFTW7I2QJ4.png)

As we wait for more constructive price trends to re-emerge within the market, it’s a good time to check in on the macro environment. While we’ve recently seen an uptick in interest rates (10-year currently at 4.12%), the longer-term trend lower, for real rates, is still supportive for digital assets, especially the smaller-cap altcoins contained within the CoinDesk 20 Index- a benchmark that tracks top cryptocurrencies.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3KUFOC2HJ5BHLEMROT45TGR2KQ.png)

So how did the crypto options market price in the bitcoin (BTC) spot exchange-traded fund (ETF) launch? From a quick ex-post analysis of option implied vs subsequent realized volatility (see below), expectations in the markets have subsided after the event, and it looks like the bitcoin options market gang correctly priced in the market reaction while team ether options were asleep behind the wheel w.r.t. the rally in ETH post bitcoin spot ETF launch.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UOV75N5FIBDEXNUWRXJEH3TBI4.png)

Bitcoin options have been more efficiently priced over the period, too. Perhaps team ether got too fat and happy off of collecting that implied vs. realized premium spread?

Need more color on what’s happening in the markets? Check out these stories:

-

ETH ETFs Are Inevitable — But When?: As the SEC delays applications from Grayscale and BlackRock, here is a look at how soon the Securities and Exchange Commission might approve these investment products.

Edited by Aoyon Ashraf.