Variant Raises $450M for Web3 Startups Focusing on Early-Stage Projects

Web3 venture firm Variant has raised a $450 million umbrella fund, including a $150 million seed fund for early-stage projects and a $300 million to support teams “with demonstrated traction from our portfolio and beyond,” according to the official press release. Led by a16z veterans Li Jin, Jesse Walden, and Spencer Noon, the venture emphasizes investments in users-owned networks that could create favorable economic terms.

- With a core focus on user experience and ownership, Variant’s new fund – its third so far – is targeting areas such as DeFi, blockchain infrastructure, consumer application, stablecoins, and projects that experiment with a new form of capital ownership.

- Variant’s diverse portfolios include high-profile Web3 projects, including Uniswap, Mirror, Foundation, Magic Eden, and Polygon.

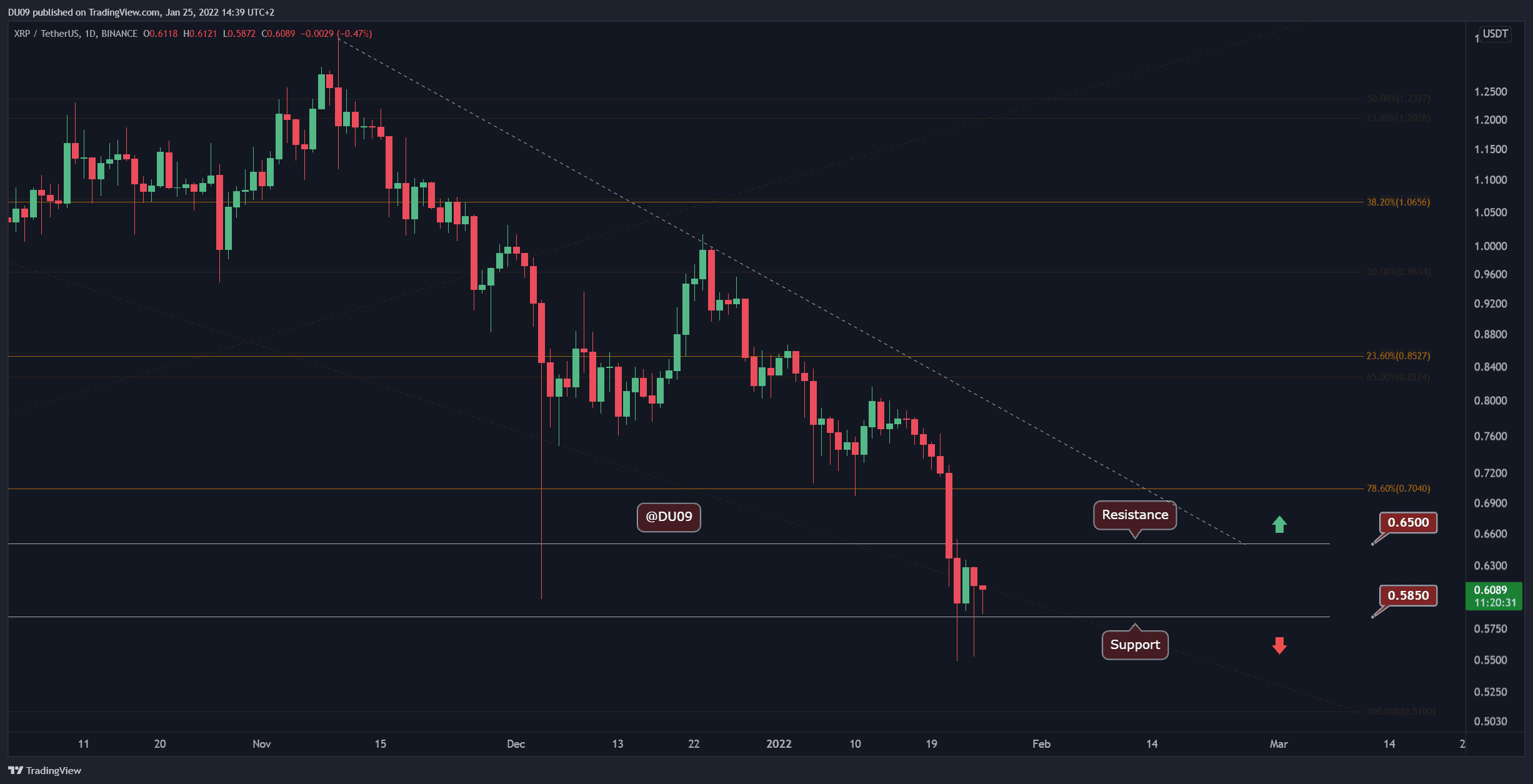

- The fund is launched at a time when the crypto winter has put off capital inflow for relevant investments. According to data from Crunchbase, crypto VC investments totaled $9.3 billion in the first half of 2022, down 26% from last year.

- General partner Jesse Walden described the fund’s investment thesis as “being the marquee seed fund in Web3” since he believed such strategy acts as the base that determines the fund size. It partly explained why the first two only raised $110M and $22.5M, respectively – a relatively small amount compared to VC giants such as a16z.

- By remaining small-sized, the founders believe they could guide entrepreneurs through the difficult phases “they face early on in their journey.”

- Co-founder Li Jin viewed the next three to five years as a critical period when a group of highly competent Web3 projects will drive mainstream adoption. In comparison to traditional Web2 giants, she argued, Web3 projects would financially empower users by letting them genuinely own their capital output.

“Web2 was digital feudalism, and Web3 is digital capitalism. Web3 is a paradigm shift, in that it introduces capitalism to the internet. It introduces the ability for people to actually own capital and become capital owners of their own output.”