VanEck’s MarketVector Starts Index to Track the Largest Meme Coins

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

MarketVector has started a meme coin index, which is up 195% on a yearly basis.

-

The index constituents include Dogecoin, Shiba Inu, Pepe, Floki Inu, Dogwifhat, and BONK.

VanEck’s MarketVector has jumped on the meme coin bandwagon, starting a new index based on the highly popular token category.

MarketVector’s Meme Coin Index, which trades under the symbol MEMECOIN, tracks the top six meme tokens. The largest holdings of the meme coin index include Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE). Other holdings include dogwifhat (WIF}, Floki Inu (FLOKI), and BONK.

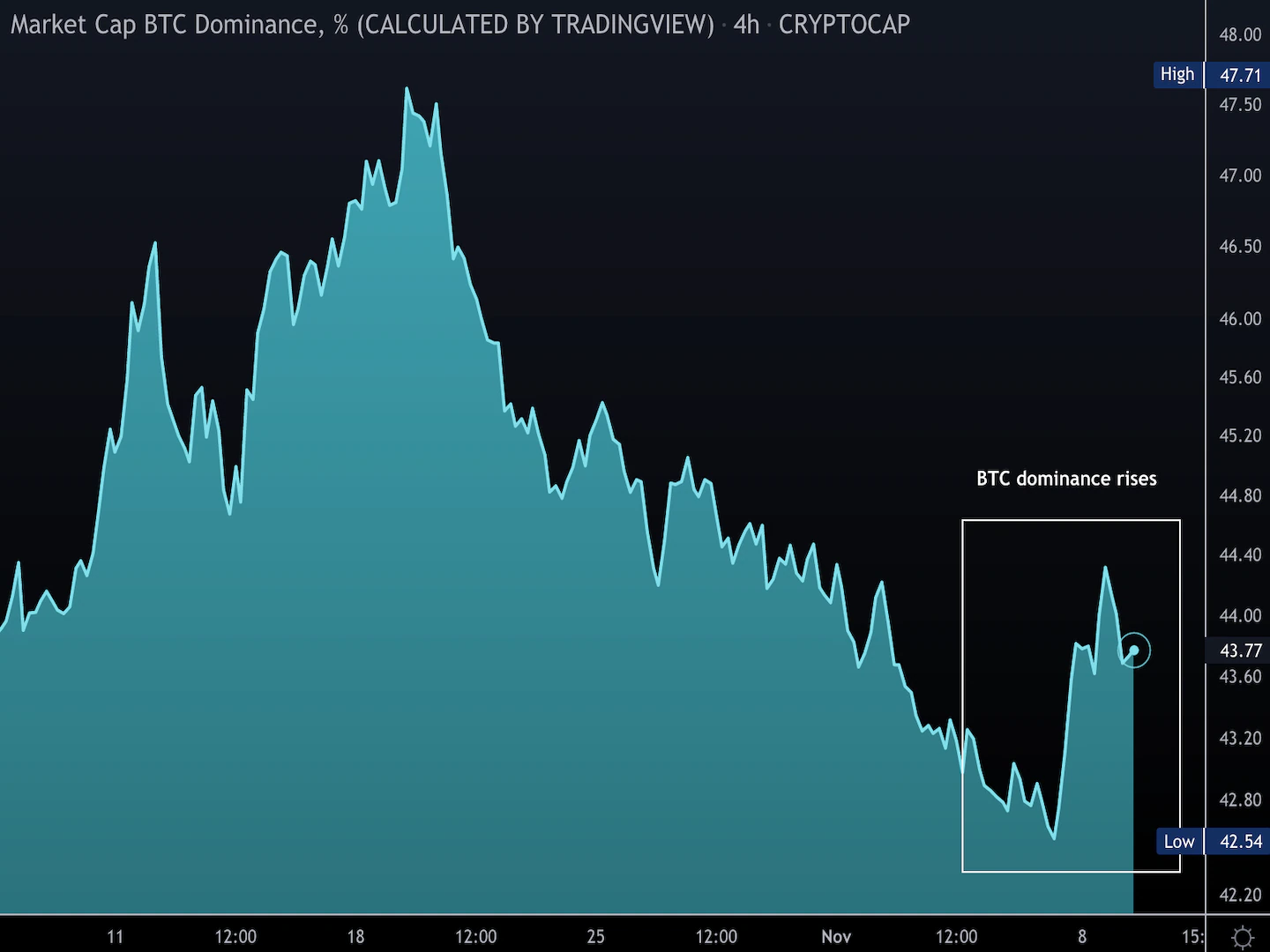

Based on the performance of its constituents, MarketVector’s new index would be up over 195% on a yearly basis. For comparison, the CoinDesk 20, which measures the 20 largest tokens except stablecoins, is up 97% during the same period, while bitcoin (BTC) has risen 123%.

Meme coins have a market cap of $51 billion, according to CoinGecko, and the MarketVector index tracks $44.67 billion of it.

Some investment managers who previously spoke to CoinDesk believe that the meme coin craze will continue due to low fees on Solana, allowing users to make small bets for potentially large profits, unlike previous manias hindered by high Ethereum fees.

Recently, a new category of meme tokens called PoliFi has come into the spotlight. The market cap of the new token category surged to $586 million as the election season heats up.

One token in particular, BODEN, is up 16% after former President Donald Trump made a comment about it at a campaign event, while Trump-themed MAGA is up 28% and TREMP 142%.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/ff7c302f-d3ab-4905-92e1-2f7f5106d13c.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.