VanEck Files For an Ethereum ETF With The SEC

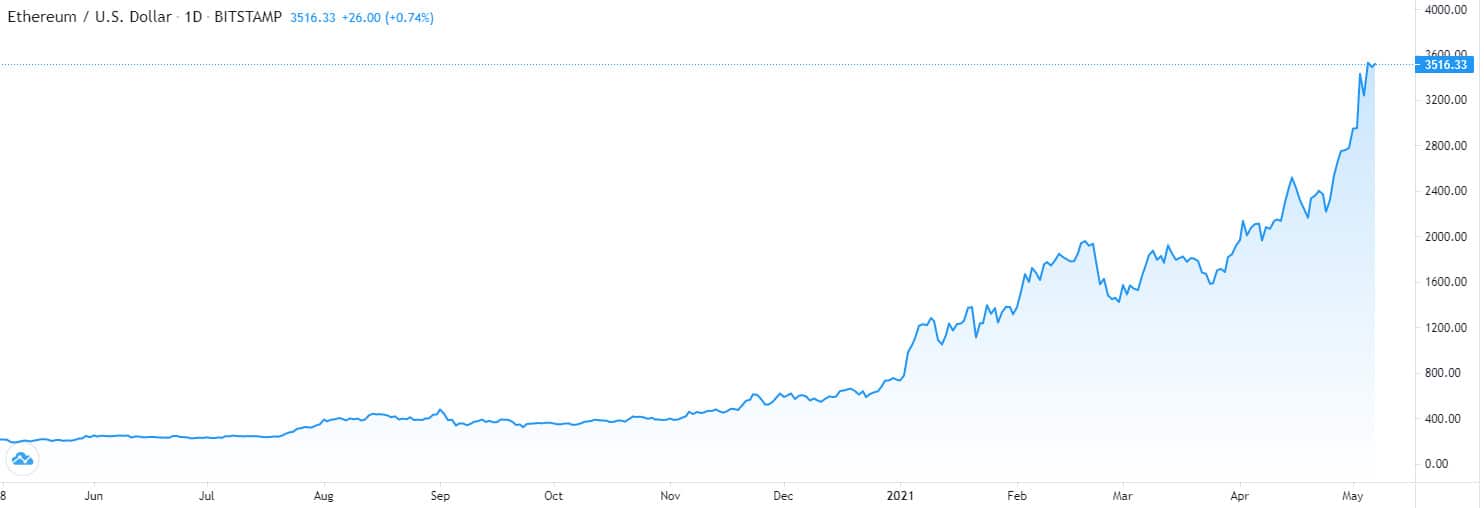

The second-largest cryptocurrency by market cap, Ethereum, has recently crossed the $3,000 mark for the first time in history.

Earlier on Friday, VanEck has filed for an Ethereum ETF with the SEC. VanEck has already submitted a Bitcoin ETF, which is pending review – this is their first Ethereum ETF application. If successful, it will become the first Ethereum ETF to be available on US stock markets.

Ethereum’s Growing Momentum

Ethereum (ETH) has been hitting new highs on several metrics recently. Several outspoken leaders in the crypto space like Mark Cuban have expressed their belief that ETH will surpass BTC’s market cap in the long run.

As of now, despite having the highest hash rate and market capitalization, Bitcoin falls short when it comes to use-cases. It’s primarily used as a store of value and a medium of exchange, but there’s a lot of things neo-cryptocurrencies can do that Bitcoin can’t.

Ethereum’s EVM allows for native smart contracts and tokens, which open up worlds of possibilities – decentralized exchanges (like the increasingly popular Uniswap), stablecoin tokens secured by the Ethereum blockchain (like USDT or USDC), and much more.

Ethereum currently only holds approximately 37% of Bitcoin’s value – but it has over 59% of its trading volume and a whopping 570% of its transaction count. This is because decentralized trading platforms built on other blockchains like Ethereum and Binance Smart Chain allow people to trade a myriad of tokens instead of just the underlying gas token.

This currently isn’t possible with Bitcoin – and even if it was, Bitcoin’s transaction fees would be prohibitive to the average end-user. With Ethereum 2.0 on the horizon, ETH is looking like an extremely attractive investment to traders across the globe.

Bringing Ethereum to Mainstream Retail Traders

An Ethereum ETF would allow retail traders to buy & sell ETH directly on their brokerage accounts. This would open up a whole new world of demand, as many retailers who didn’t have the means or technical expertise to purchase their own Ethereum will be able to do so with the click of a button, using the existing interface they know and love.

Additionally, the regulatory framework surrounding ETFs is much clearer than the murky tax implications of buying crypto directly. This will make it easier for institutions to purchase Ethereum as well, as they can have it on the books and pay off capital gains tax in a structured manner that they’re used to. The implications of a crypto ETF are far-reaching.

It’s likely that if a Bitcoin ETF is approved, this Ethereum ETF might also be approved. Over the past few months, we’ve seen signs that the legacy finance industry is warming up to the crypto space: for example, S&P DJI released Bitcoin and Ethereum indices earlier this week.