Valuing Open Source: Principles for Acquiring DeFi Projects

Valuing Open Source: Principles for Acquiring DeFi Projects

As decentralized finance sees its first mergers and acquisitions, we’re left with a big question: How do you value an open-source project in a very new field like DeFi?

The whole thing is fascinating, almost a contradiction! An analysis of the issues can help us sharpen a toolkit for understanding value creation and power in a world of open source, programmable blockchains and their assets. It can help us understand why things like “number of blockchain patents” are nonsense, and therefore suggest to financial incumbents a better way to be.

Lex Sokolin, a CoinDesk columnist, is global fintech co-head at ConsenSys, a Brooklyn, N.Y.-based blockchain software company. The following is adapted from his Fintech Blueprint newsletter.

The last time we had a corporate development discussion about tokens was in 2018. Messari CEO Ryan Selkis noted that a number of low quality projects sold their ICO tokens and received ether. So let’s say you sold 10 million of X, and got $10 million of USD equivalent denominated in ETH. As the market realized your project was worthless, let’s say X falls 90% in value. But the treasury still holds $10 million denominated in ETH. So the vulture fund strategy, copying a page from the book of 1980s traders and leveraged buy-out professionals, would be to buy up all the worthless X and somehow get control of the treasury. You pay $1 million USD equivalent for $10 million in treasury assets and profit.

This didn’t work for a few reasons. First, initial coin offering tokens did not have meaningful governance rights, or any enforcement mechanisms. If you buy them all, the only thing you hold is a bunch of digital pets. Yes, you could argue “reliance” to a court and extract damages or file injunctions. But it is highly unlikely that you would find suitable jurisdiction, and by the time you get it done, the house will have burned down. And second, ETH fell from over $1,000 to nearly $100. So the value of the honeypots became irrelevant.

Today, we no longer have ICOs, but we do have decentralized finance. And in the last six months, governance tokens over decentralized autonomous organizations (DAO) have become the standard playbook.

Let’s unpack that. If you buy a container that gives you economic rewards based on the efforts of others, you are very likely buying a security. If that security is sold to you in a way that is not pursuant to securities laws of your resident jurisdiction, there’s a large liability on the issuer.

There have been some signs from regulators, however, that a token changes nature over the course of its lifecycle. It may add securities-like features, while starting out as an empty container. It may be at first motivated by usage (i.e., like a reward) and then become a participant in cash flow. The biggest lifeline came in 2018, when the Securities and Exchange Commission’s William Hinman introduced a concept of “sufficient decentralization,” per below. While far from gospel, many crypto entrepreneurs now believe that turning a protocol/project into a DAO gets the project over the safe line from securities registration. Time will tell whether relying on an SEC speech is valid defense.

It also helps that issuing governance tokens for a DAO creates market capitalizations and enterprise value for token holders. The main DeFi players of 2020 each have $100+ million or more in the market cap of their instantiated tokens. This has accrued from various distribution mechanisms that embedded financial assets as rewards for financial use. As an example, if you deposit your tokens for others to borrow in one venue you get rewards at some interest rate from the borrower.

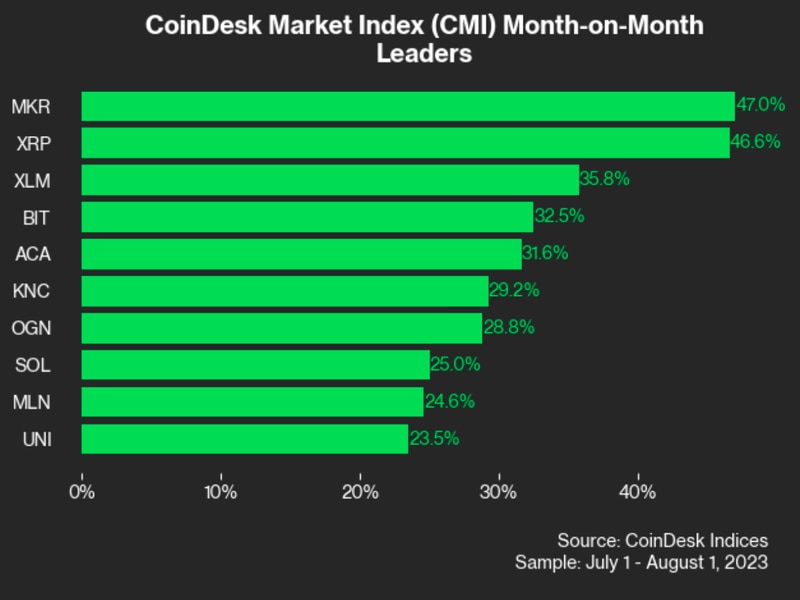

See also: Lex Sokolin – The Smart Money Economy

According to Messari data, Uniswap and Aave are at $900 million, Yearn at $800 million, Maker at $560 million, Synthetix at $530 million, Compound at $470 million, Balancer at $100 million and Curve at $95 million. These numbers may change or go to zero. But currently, there is about $3.5 billion of enterprise value associated with the governance tokens of decentralized finance projects. Certainly there are many other projects, like Chainlink or Hegic or Ren, that are key to this space. But the above are the main DeFi machines in operation.

Now, $4.5 billion is a chunk of change. Envestnet is trading at $4 billion, Jack Henry at $12 billion, Temenos at $8 billion, Broadridge at $12 billion. These are your fintech industry comparisons.

When a large corporate tech player decides to buy up a competitor, the process is clear and well established. Generally, shareholders elect the board of directors, which governs the company and appoints executive management. Shareholders also vote for large, existential transactions that impact their stock holdings. The board applies business judgment to the corporate development path of the company, from issuing debt to buying back shares to investing in acquisitions. Within the company, executives focused on corporate development will hunt down targets and propose various transactions. Everyone knows what it means to maximize shareholder value, which largely boils down to maximizing EBITDA at some multiple in the market, without creating onerous debt.

But what about open-source financial protocols?

Decentralized M&A

Yearn is likely the most sophisticated financial DAO in existence. Whereas Compound and Aave match margin lend/borrow demand at particular interest rates, and Uniswap, Balancer and Curve create automated market making for on-chain trading, Yearn is a blockchain-native, fixed-income, active asset manager. For 2020 at least, Yearn is the Bill Gross of crypto, playing across trading fees, interest maximization, dividend farming, governance rewards and various other technological innovations that lead to capital appreciation.

The “funds” are called “vaults” or “pools” or “jars” and so on. They are just the equivalent of SMAs or fund interests, synthetically structured through code. The interesting thing is that the whole thing is open source, so in principle somebody could just copy the code base. And somebody did! The fork is called Pickle Finance and has between $100 and $400 million in assets. During DeFi’s summer run-up, forks generated trading returns by simply existing. However, over the long term, it is much more difficult to retain a community and assets. It is hard to maintain a thing that works in the highly adversarial DeFi environment, where protocols are under constant attack. A recent $20 million exploit left Pickle … in a pickle.

The recent news is that Pickle is going to be merging with Yearn. Given that the technical architecture is quite similar, and the experience of the developers is comparable, the core part of the merger is on-boarding Pickle developers to work on Yearn. This implies the Pickle protocol converges its path and community back to Yearn, and that Pickle-specific features will be an addition to, rather than a differentiator against, Yearn. Deeper DAO-related features will also be implemented based on a design from the Curve DAO. Holders can tweak the tokenomics of the machine in real time to create incentives in different dimensions (e.g., more issuance of rewards here, less here).

In a world where financial instruments are manufactured by machines on open-source rails, it is not the rails that are valuable.

This merger is not about the technology. It’s about the people writing code to create the technology, and who pays them what. If the incentives from Yearn cash flows are much higher than the incentives from Pickle cash flows, a lagging protocol can’t last long in an adversarial environment. Attackers prefer to go after those who have the least defense, not those who are most capitalized.

There is a fixed cost to defense, which creates competitive barriers and winner-take-all outcomes. And in a world where capital can move without friction between investment venues, a merger will also pull that community to follow you to the new protocol.

Notably, the governance tokens for Yearn had limited input on this “transaction” – in part because governance is not clearly, legally articulated, and in part because the transaction did not involve the sale and purchase of assets. The assets are open sourced, and people have the freedom and ability to switch what they decide to work on. Not only is capital movement much less restricted, but so is the stickiness of “employees.”

Another announcement quickly followed. Yearn is merging with Cream, a fork of Compound and Balancer, making it a combination of lending markets and an automated market maker. In this case, however, it seems that Yearn is delegating to Cream several strategic product developments, like leverage and a pool-agnostic (i.e., collateral agnostic) stablecoin. In traditional finance, we would call this a cash sweep account. The developer teams, again, are merging together. We assume the benefit to Cream is in part driven the lower the costs of potential errors, in addition to higher cash flow.

And another: Yearn and Akropolis. The latter had a $2 million hack earlier in the month, and going forward will play the role of institutional distributor of Yearn products as well as be part of investment strategy formulation. The same compensatory mechanism of issuing tokens to Pickle holders (i.e., a piece of something that looks like debt) will be applied to Akropolis holders.

So what do we observe? Yearn is extending not just its technology but its economics and reputation to “bail out” multiple projects that have great teams but have all suffered in the recent past.

Takeaways

In a world where financial instruments are manufactured by machines on open-source rails, it is not the rails that are valuable. Yes, over time the rails become more sophisticated and are stress-tested by capital and hacking. But what actually holds “value” are (1) the communities that commit assets to protocols, and choose to align economic activity with some particular brand and (2) the entrepreneurs that have the very rare skill-set of building and securing such protocols.

The community is the business asset. It generates cash flow. It improves governance. It fixes hacks. Notably, communities align to brand narratives and the celebrities and influencers that spearhead the narrative. Andre Cronje will represent Yearn, despite decentralizing maximally his project, and is the face of the fund. Popular confidence in his goodwill and judgment is the measure of the project. Similarly, confidence in Vitalik Buterin is correlated with confidence in Ethereum. There is something deeply conservative in the realization that these futuristic finance networks rely on philosopher kings and have increasing returns to scale.

But this was always the case. Humans need torchbearers: Steve Jobs, Elon Musk and the rest. In the case of DeFi, the torch itself is of a different kind. But it burns with the same flame.