USDC Outflows Surpass $10B as Tether’s Stablecoin Dominance Reaches 22-Month High

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Crypto investors are fleeing Circle’s USD coin (USDC) stablecoin, with many of them switching to Tether, which has reached a 22-month high in market share.

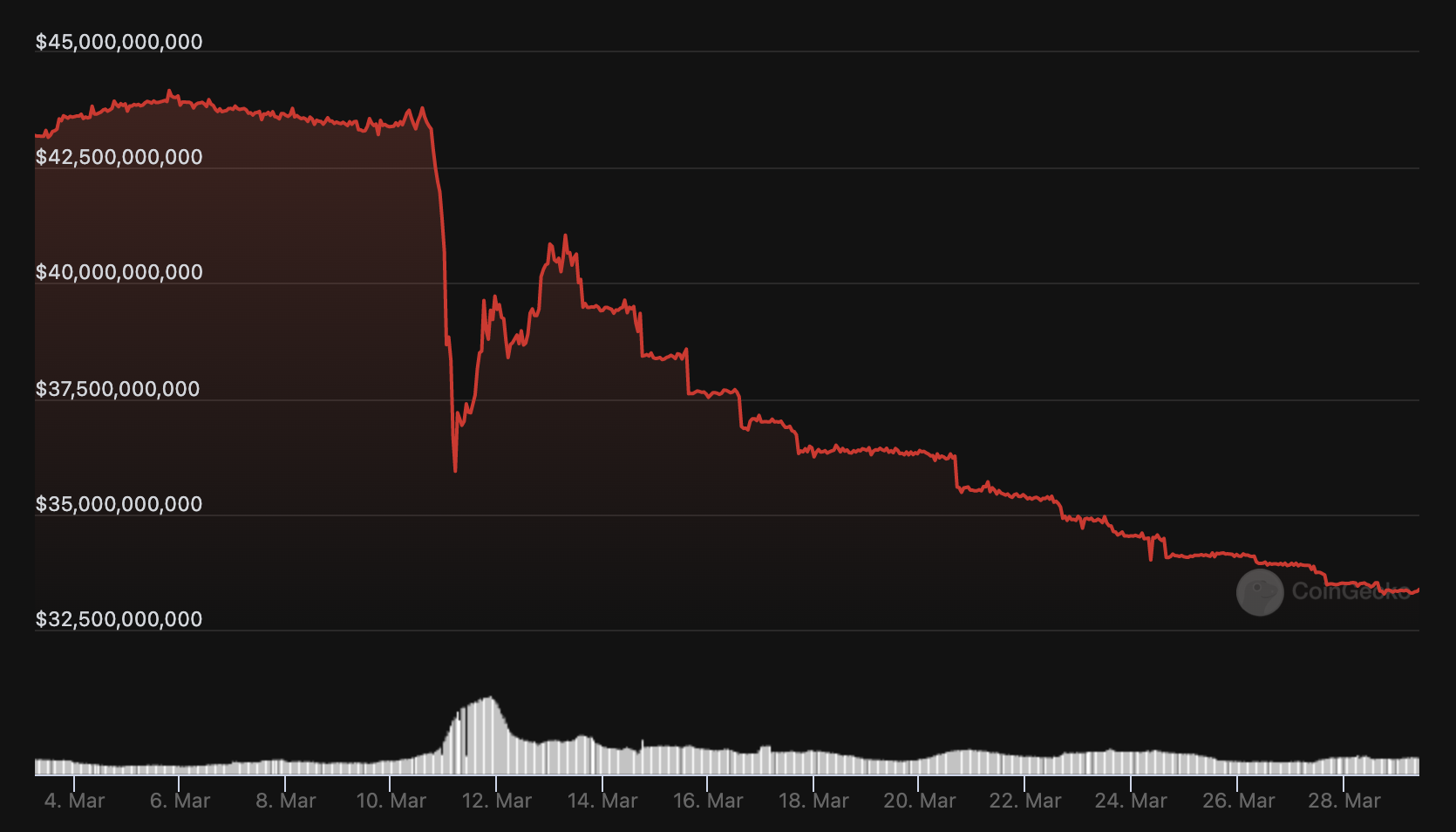

USDC token net outflows have surpassed $10 billion since March 10, when regulators shuttered key reserve banking partner Silicon Valley Bank. U.S. payments firm Circle has weathered SVB’s collapse, and USDC has re-established the dollar price peg it lost in the immediate aftermath, but the token has still dropped 23% from its one-time $43 billion market capitalization, according to crypto price tracker CoinGecko.

USDC’s plunge comes as the stablecoin sector has been severely tested by banking sector uncertainties and increasing regulatory scrutiny. Binance’s BUSD token has also plummeted, among other stablecoins.

USDC remains the second-largest stablecoin with a market capitalization of $33 billion. Circle backs the token’s value with short-term government bonds administered by investment management giant BlackRock and cash reserves at various U.S. banks.

Outflows surged starting March 10 as SVB imploded, locking $3.3 billion of cash reserve deposit in its vaults for days until government intervention. The event tossed the stablecoin market into turmoil as USDC and smaller stablecoins lost their price peg temporarily, and also highlighted how fiat-backed stablecoins rely on the soundness of traditional financial systems.

Over the past week, investors have redeemed $1.5 billion more USDC than new issuance, including bankrupt crypto broker Voyager, which redeemed $150 million on Tuesday. As USDC pegs its price at $1, a decreased token supply means investors have exchanged USDC tokens for U.S. dollars. The result is net outflows.

“USDC has survived the battle, but it remains unclear whether it will win the war,” digital asset brokerage Enigma Securities wrote earlier this month in a report.

USDC market capitalization in March. (CoinGecko)

Tether’s rising dominance

Most investors seem to have fled to Tether’s USDT, the largest stablecoin in the market, boosting its dominance to its highest level since May 2021.

USDT is a key piece of infrastructure of the crypto ecosystem and widely used for facilitating trading on exchanges. Its issuer, Tether, has faced scrutiny over its reserve assets and lack of transparency for years, but those issues appear to have recently become a lesser concern among investors.

The $132 billion stablecoin market has been in the middle of a major reshuffling since February when New York regulators told stablecoin issuer Paxos to stop minting Binance USD (BUSD), the third-largest stablecoin. BUSD’s supply has tumbled below $8 billion from $16 billion in early February.

USDT took advantage of BUSD’s retreat and USDC’s slump, CryptoCompare highlighted in its March market report.

Since March 10, USDT’s market capitalization has grown some $8 billion to $79.5 billion and it holds a 60% market share among stablecoins, according to DefiLlama. The last time USDT had such a large share was in May 2021.

USDT market capitalization in March. (CoinGecko)

“Ironically, the players who have had the strongest position with U.S. regulation and U.S. banking system integration, are considered ‘unsafe,’ with fears that assets could be stranded,” Circle Chief Executive Jeremy Allaire tweeted last week. “Market participants are shifting into platforms with no oversight, totally opaque bank and risk exposures, and histories of lax financial risk and integrity controls.”

Paolo Ardoino, chief technology officer of Tether, said in a CNBC interview that USDT has around $1.6 billion of excess reserves and the stablecoin issuer was on track to book a $700 million profit in the first quarter of the year.

Another stablecoin, trueUSD (TUSD), has gained prominence thanks to Binance touting TUSD as one of the alternatives to BUSD and expanded trading with the token. TUSD’s market cap has grown to $2 billion from below $1 billion, making it the fifth largest stablecoin.

Edited by James Rubin.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.