USDC Issuer Circle Has Ditched All U.S. Treasuries From $24B Reserve Fund Amid Debt Ceiling Showdown

Stablecoin issuer Circle Internet Financial has ditched all U.S. Treasury bonds from its USD Coin (USDC) backing reserves as part of precautionary measures to protect from a potential fallout from the looming U.S. debt ceiling showdown.

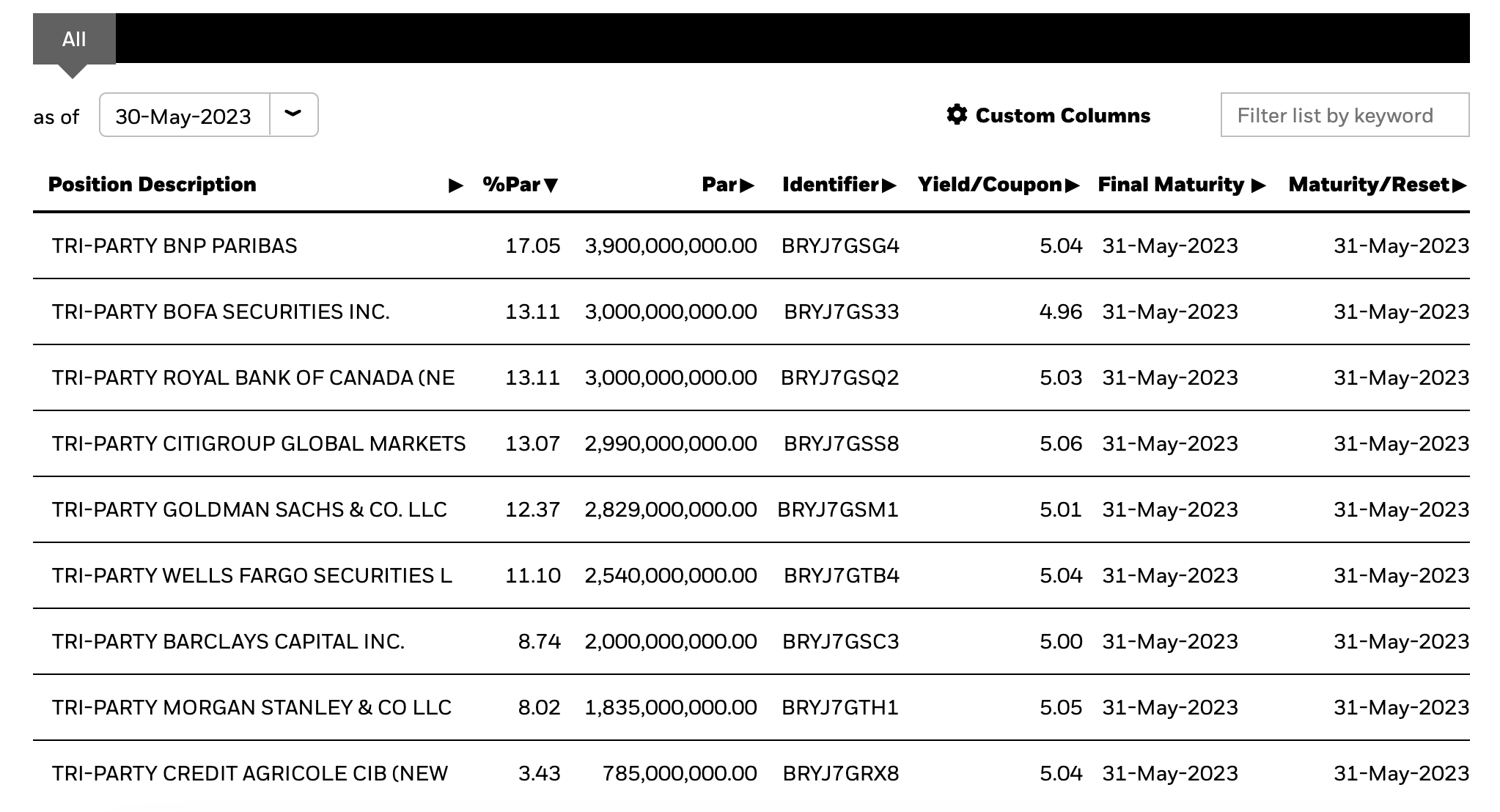

The Circle Reserve Fund, managed by global investment giant BlackRock, held all of its $24 billion of assets under management in overnight repurchase (repo) agreements as of May 30, according to the fund’s website.

This is a significant change since the end of April, when the fund held more than $30 billion in U.S. Treasury bonds, according to Circle’s monthly attestation. The last Treasury bond worth $4 billion among the fund’s holdings matured on Tuesday, the fund’s website showed.

The milestone is a result of Circle’s attempt to protect the $29 billion USDC stablecoin from potential turbulence on the bond market while U.S. lawmakers are scrambling for a deal to avert a government default.

Circle CEO Jeremy Allaire said in early May that the company would not hold Treasury bonds maturing beyond the end of month in the reserves that back the value of USDC. In parallel, Circle’s reserve fund has been replacing maturing bonds with overnight repurchase agreements over the month.

The U.S. House of Representatives is poised to vote on a bill to raise the government’s ability to issue new debt on Wednesday evening.

Edited by Nelson Wang.