US Strategic Bitcoin Reserve FOMO Is Being Horribly Oversold

Let’s get one thing out of the way – The United States already holds more bitcoin than any government in the world.

https://x.com/pete_rizzo_/

While this data is true, you wouldn’t exactly know this from the obscene amounts of FOMO being generated by industry lobbyists on social media.

On X, BTC Inc CEO David Bailey, has been pushing for an Executive Order by President Donald Trump that would put this in place on day one, while Satoshi Action Fund founder Dennis Porter has been stoking state-level enthusiasm, pledging to get states active in purchasing before the federal government as some act of patriotic frontrunning.

Look, I’m into the Strategic Bitcoin Reserve. Yes, the United States needs a long-term plan for the dollar, one that finds it (in all likelihood) giving up its status as a global reserve currency.

Yes, the U.S. should be actively boosting the Bitcoin market and industry. But, this sky-is-falling approach just couldn’t be more at odds with all reason.

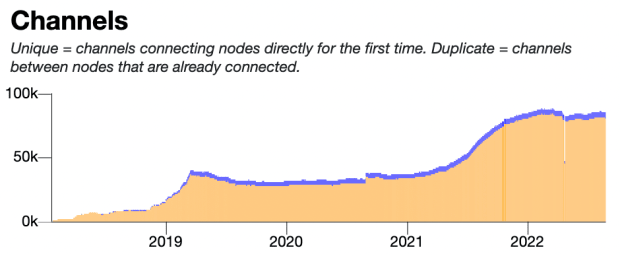

There are no other governments buying Bitcoin, nor with any (public) plans to. The next largest state holder of Bitcoin is apparently China, which has formally banned its use.

Of the countries that are actively buying Bitcoin with intent – Bhutan has just over 10,000 BTC, while El Salvador is stuck around 6,000 BTC. Neither are going to purchase more Bitcoin than the U.S. government already has – nor does either have a widely popular money printer.

Full stop – even if the U.S. government didn’t buy Bitcoin for a decade, its stockpile would be sizable. Sure, you may argue that it’s about sending a message, about showing leadership in the world, but there are many ways this can be done without blowing political capital.

Is a Strategic Reserve more important than regulation that will actually ease barriers to our industry? That will empower businesses to actually grow the sovereign use of the currency?

Let’s not forget the horrible taxation laws that make bitcoin holders think twice before using bitcoin for purchases..

All this is to say, Strategic Bitcoin Reserve advocates shouldn’t overplay their hand – a lot can be gained just by getting the U.S. government to stop selling the Bitcoin it already has, and there are arguably bigger gains to be had, or at least much worse laws to erase.

Would it be great if the U.S. government started buying Bitcoin? Surely. The industry has political capital to cash in, but let’s use it to spread Bitcoin adoption, not just pump our bags.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.