US Senator Cynthia Lummis: Bitcoin is Going to be an Important Player for a Long Time To Come

Americans have just elected Cynthia Lummis (R) as their first female pro bitcoin senator, and she seems ready to make history.

Lummis (R) became senator-elect from the state of Wyoming after beating the democrat candidate Mike Enzi. She has a long and well-known career in politics, but few know about her proud past as a Bitcoin hodler.

And Lummis’ story doesn’t seem to be stuck in the past. The new senator is willing to give a better future to the Bitcoin ecosystem by putting the debate about the benefits of Bitcoin adoption on the U.S. political agenda.

Cynthia Lummis Wants To Put Bitcoin On Top Of The Political Debate

In an interview for the TV show “Good Morning America,” Lummis spoke about Bitcoin’s advantages and its appeal as a store of value, something she learned during her role as Wyoming’s State Treasurer.

I do hope to bring bitcoin into the national conversation. I’m a former state treasurer, and I invested our state’s permanent funds. So I was always looking for a good store of value, and bitcoin fits that bill.

The senator discussed how Bitcoin’s scarcity provides a competitive advantage over the inflationary U.S. dollar. Lummis said this was one reason she decided to invest in Bitcoin as the best storage value mechanism.

Lumis explained that there will only be 21 million Bitcoins with no further emissions. She believes that such resistance to manipulation will be a significant component of the geopolitical debate in the future.

Our own currency inflates; bitcoin does not. 21 million bitcoin will be mined, and that’s it. It’s a finite supply, so I have confidence that this is going to be an important player in stores of value for a long time to come.

Cynthia Lummis had already expressed her preference for Bitcoin. During her candidacy, she revealed that she bought her first Bitcoin in 2013 after learning about its characteristics.

She said that since then, Bitcoin has been a part of her investment portfolio, which she compares to gold as a means of “preserving the relative value” of her labor over time.

During her campaign, Lummis issued continuous warnings regarding the government’s inflationary policy, especially during the coronavirus pandemic. She has spoken about the need to create economic solutions that do not reduce the dollar’s purchasing power.

Is Bitcoin Really a Storage of Value?

Cynthia Lummis’ words certainly are a relief and an endorsement for those who advocate for Bitcoin. For several years, the nature of BTC has “mutated” from being primarily money (something meant to be spent) to being considered a store of value (something meant to be kept).

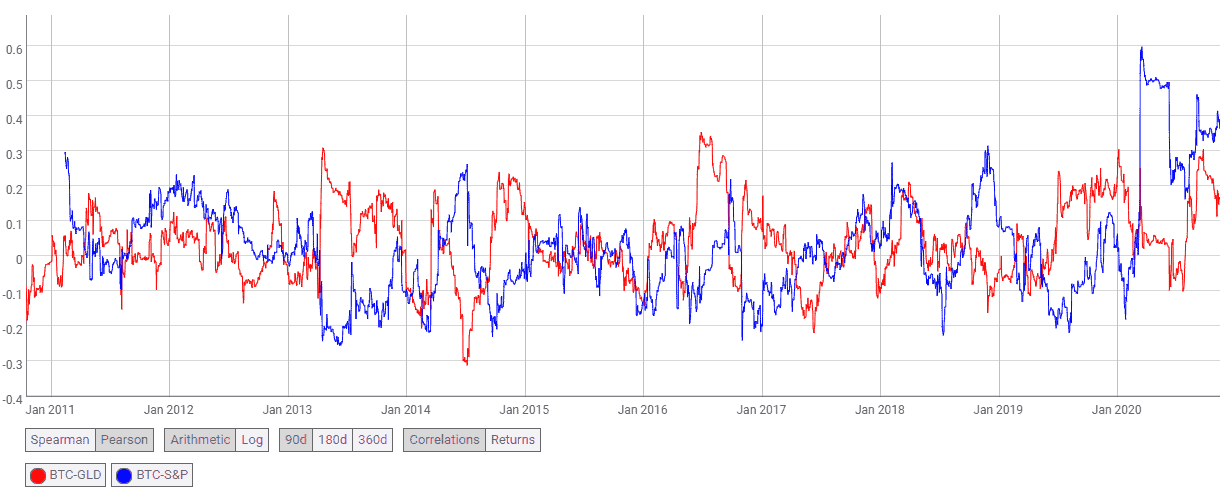

During 2020 Bitcoin has been a better reserve of value than gold. In fact, it’s been a better investment than most commodities in times of pandemic. During 2020, Bitcoin and gold reached a historical correlation, which has already faded, with Bitcoin showing a higher correlation with the SP500 and other speculative assets.

However, a study by Fidelity revealed that Bitcoin behaves independently, so it’s expected that at some moments, it correlates with reserves of value, and at other moments it correlates with speculative assets.

We are excited to share the second report in our Bitcoin Investment Thesis series by @riabhutoria.

In this piece, we explore bitcoin’s role as an uncorrelated alternative investment that may provide portfolio optimization benefits.

Please download: https://t.co/XRLQGSvFpw pic.twitter.com/xuLqS2zdm8

— Fidelity Digital Assets (@DigitalAssets) October 13, 2020

Considering the above, Cynthia Lummis could be at least partially right about Bitcoin. And even though BTC is unlike anything we have ever seen before, its characteristics can make it an acceptable risk diversifier for any portfolio.