US Recession Woes, Fed’s Rate Hike, Bitcoin at $24K, ETH Pushing for $1.8K: This Week’s Crypto Recap

The past seven days saw the total cryptocurrency market add a considerable $40 billion to its total capitalization as the majority of it is painted green.

Bitcoin’s dominance is a commonly-used metric that gauges its share relative to that of the entire market. Over the past seven days, it declined slightly, which means that the primary cryptocurrency didn’t fare as well as altcoins. As a matter of fact, BTC is up 4.5% on the week, whereas ETH, for example, is up 10.4%.

Speaking of BTC, it managed to reclaim the important $24K level and is currently trading slightly above it. The cryptocurrency declined halfway through the week, dipping below $21,000 on Tuesday, but the bulls regrouped and staged a recovery, pushing the price towards its current levels.

The altcoin market has clearly been doing better. Ethereum is charting gains upwards of 10%, pushing its entire ecosystem forward. One of the most vivid examples of this is its layer two scaling solution – Optimism. Its native coin (OP) skyrocketed by almost 100% before retracing to where it’s currently trading. ETH conquered the $1.7K level, and now all eyes are on the important $1,800.

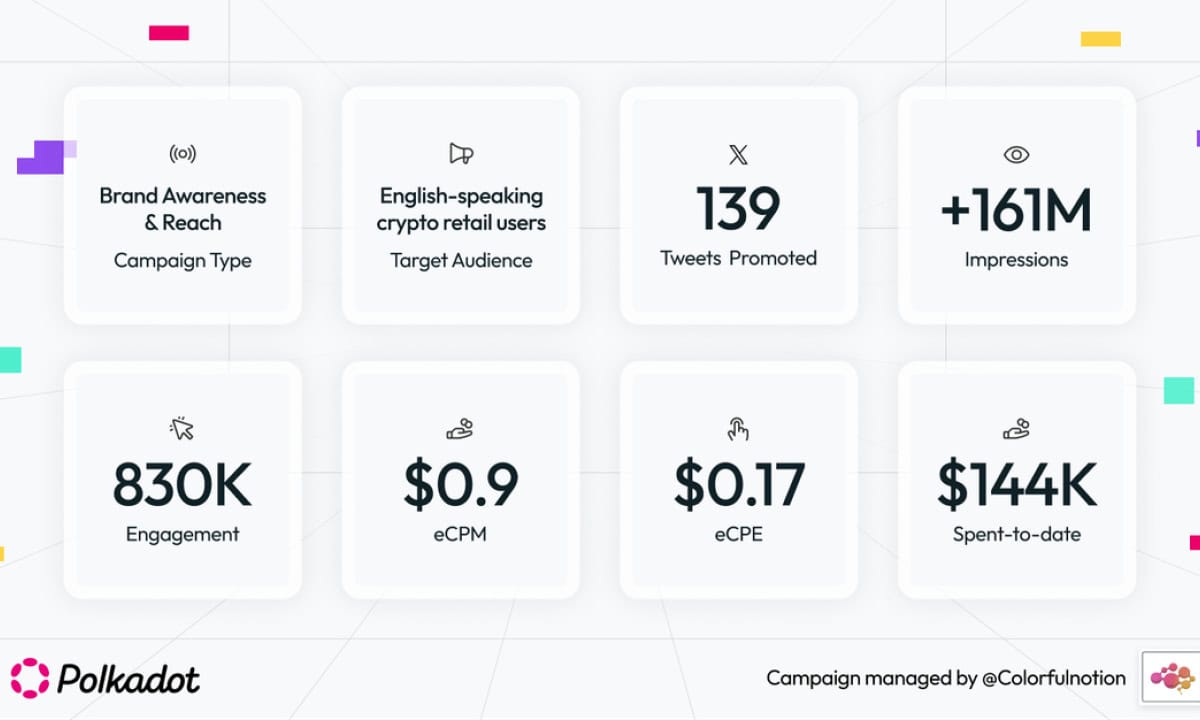

Elsewhere, BNB is up 9.6%, Cardano is up 6.8%, Polkadot is up 10%, and so forth. Most of the major cryptocurrencies are well in the green.

Interestingly enough, this comes on the back of news a second consecutive negative GDP growth in the US. Technically, this falls within the standard definition of a recession, but US politicians have made it clear that they don’t consider the economy to be in recession. In any case, the Fed hiked interest rates again, this time with 75 bps – slightly below the expected 100 bps, which was well-perceived by the cryptocurrency market.

If one thing is clear, we are in for exciting weeks and months ahead.

Market Data

Market Cap: $1140B | 24H Vol: $152B | BTC Dominance: 39.9%

BTC: $24,120 (+4.5%) | ETH: $1,730(+10.4%) | ADA: $0.53 (+6.8%)

This Week’s Crypto Headlines You Better Not Miss

What is the Merge? What You Need to Know About the Transition to Ethereum 2.0. The Merge is one of the most highly-anticipated events this year in the world of cryptocurrencies. It will mark Ethereum’s transition to a proof-of-stake-based consensus algorithm. This is everything you need to know about it.

Bitcoin Is Not Out of the Woods Yet According to This Metric. Despite Bitcoin’s recovery in the past few days, the cryptocurrency might still not be out of the woods yet. This is according to the Whales Exchange Ratio – an important metric that tracks the inflows and outflows of large sums to exchanges.

Crypto Markets Rally on President Biden’s Redefined “Non-Recession.” The US Government reported two consecutive quarters of negative GDP growth. According to standard definitions, this means the country is in a recession. However, politicians have so forth declined these statements and even argued that this is not the definition of a recession.

World Teeters on Recession: What it Means for Crypto (Opinion). As the global economy continues to be torn by massive inflation and even recession, the question remains of how this will impact the cryptocurrency market, if at all. So far, it seems that cryptocurrencies remained somewhat resilient, especially in the past couple of weeks.

Ethereum Daily Active Addresses at ATH, But There’s More. The number of daily active addresses on the Ethereum network reached a new all-time high above 1.1 million on July 27th. According to some experts, this is because the market weighed mundane things to do at highs versus what most would classify as productive (such as DeFi and NFTs).

Cathie Wood’s Ark Invest Dumps Coinbase Shares at All-Time Lows of $53 (Report). ARK Invest – the hedge fund spearheaded by Cathie Wood – sold more than 1.4 million shares worth of Coinbase Global (COIN). It appears that they sold the stock at an all-time low price and may have lost around $280 million.

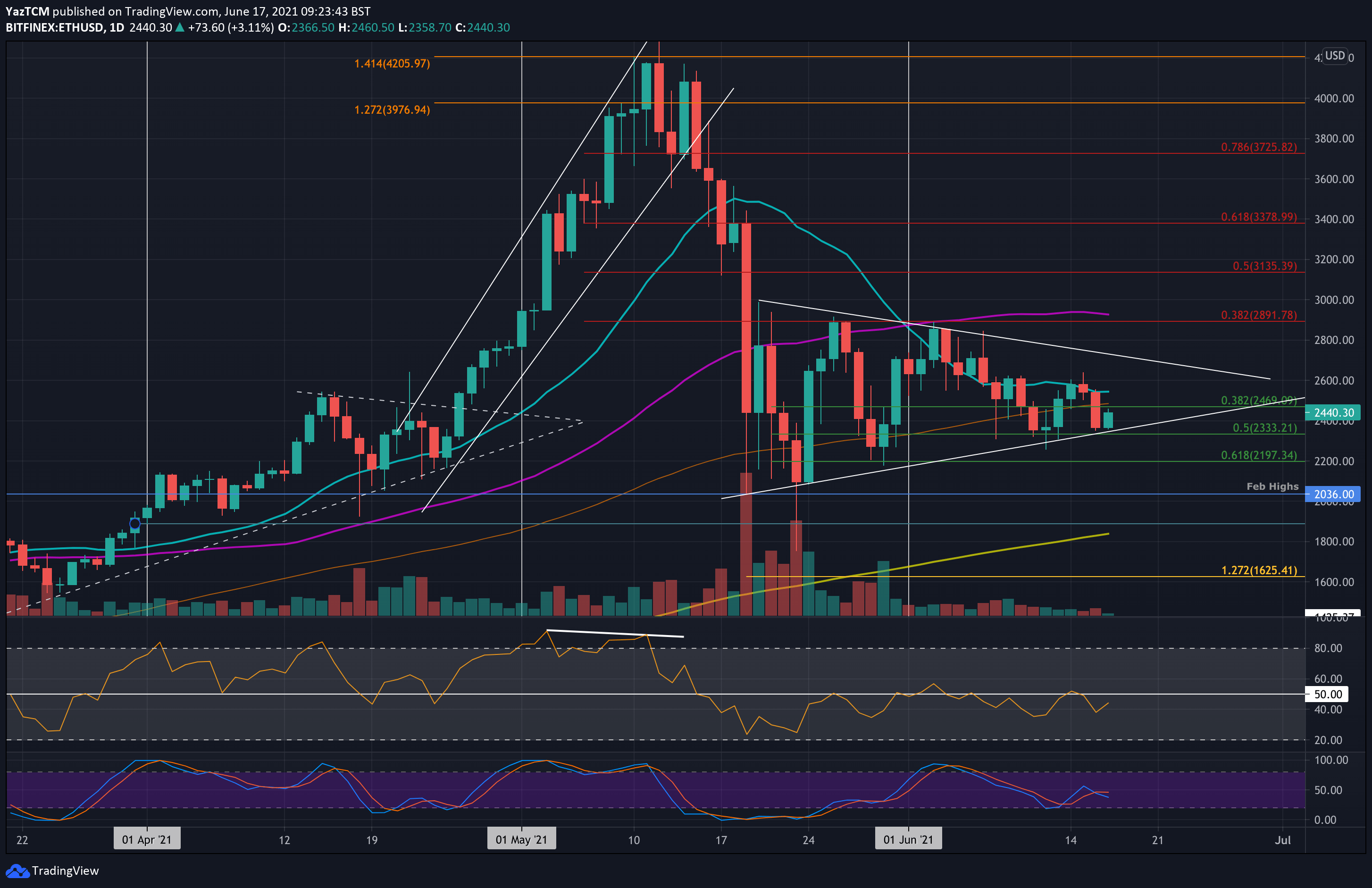

Charts

This week we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Solana – click here for the complete price analysis.