US Market Watch: Boeing Shares (BA) Surged 7% Intraday As Panic Disappears

Following the past bloody week, we had opened up a new week, which turned out to be a direct continuation of the ending hours of the trading day last Friday.

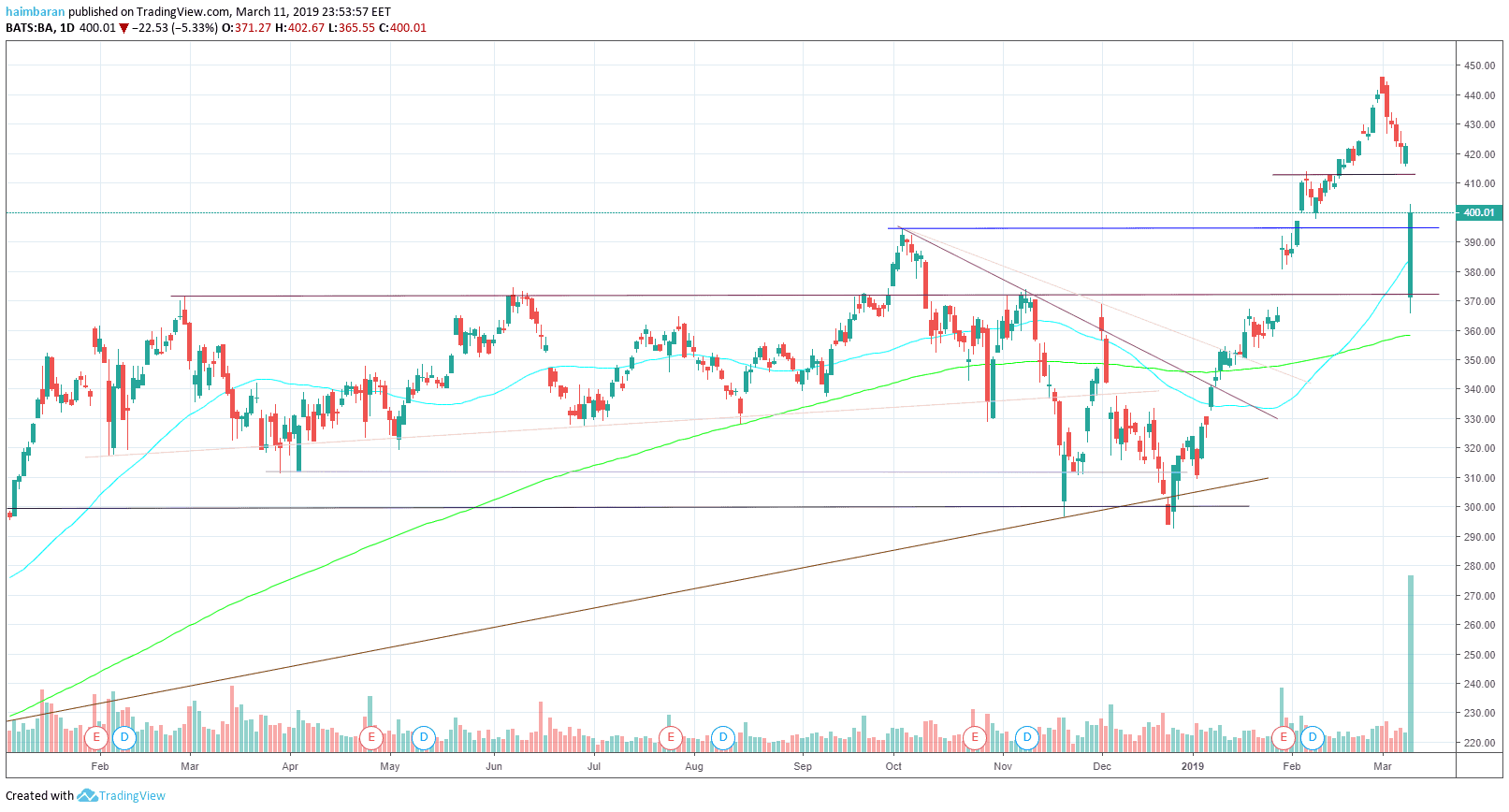

In the news: an Ethiopian Airlines’ Boeing 737 Max crashed, the second of this kind in six months. In response, China is shutting down the entire fleet (100 planes) of this model, for ‘safety reasons’. Was this a political move? Part of the battle in the Trade War is to bend Trump, while China is the only country to do so.

In response to the situation, the Boeing share (BA) opens with a free fall of 12.7%, which also affects the Dow index. However, as happened in many similar cases, the panic was huge. From the opening the buyers jumped in and didn’t stop working, mostly buying technology companies. The reason is not clear, although some positive macro data released. Boeing shares had ended up only with a minor 5 percent drop.

Major Indices

S&P ended +1.47% to 2783: The index had broken up the 2750 level as well as 2770 following a nice green candle. Resistance: 2800-17. Support: 2725 and below: 2680-5.

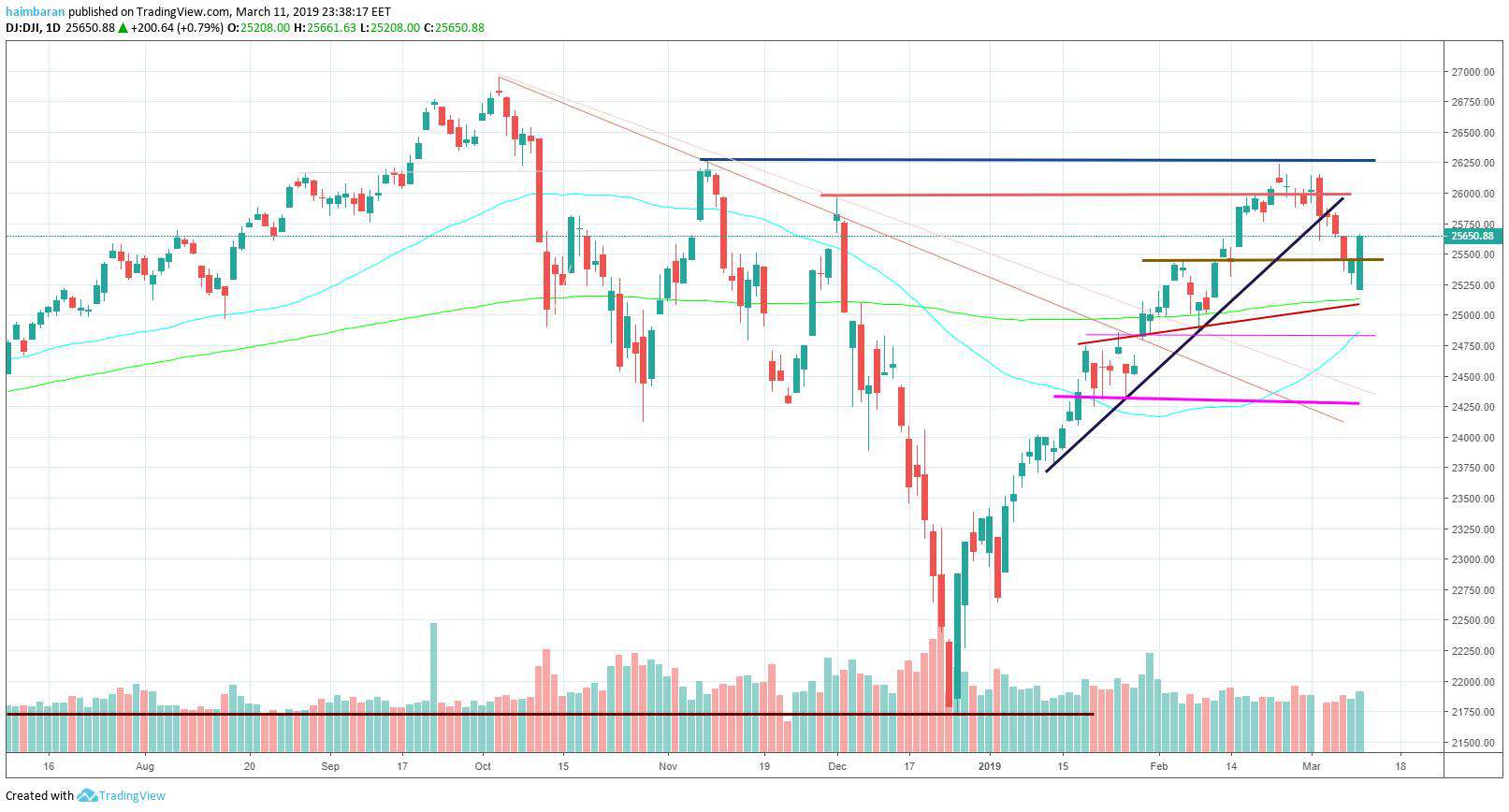

DOW ended +0.79% to 25650 also following a full buyers’ candle. Resistance: 25800, 26000. Support: 25200-50, 25000-100.

NASDAQ ended +2.02% to 7558 and is in an excellent position to breach the 7600 area and above. Support 7380-400, 7200. Resistance: 7600, 7670.

The fear index, the VIX, had plunged today to 14.3 and returned to a region that’s considered a stable market. According to the trading we saw, the buyers came back while the market has aimed upwards after a few red days. Has the market gained enough momentum to break through? Time will tell.

Significant Gainers and Losers

Green: GWR +9%, RPD +8.5%, VIPS +8.4%, XPO +7.9%, MLNX +7.8% following acquisition, MELI +7% (never stops), NVDA +7%, EXAS +6.4%, PVTL +6.4%.

Red: NIO continues to fall with another -6.7%, BA -5.3%, WYND -4.9%, CRON -3.8%, SPR -3.8%.

The post US Market Watch: Boeing Shares (BA) Surged 7% Intraday As Panic Disappears appeared first on CryptoPotato.