US Lawmakers Don’t Want Proof-of-Stake Networks to Get Overtaxed

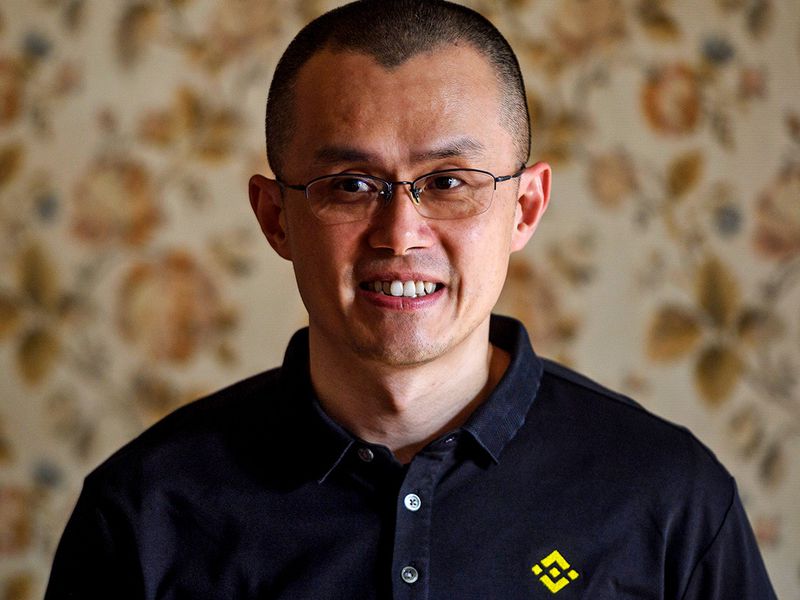

Rep. David Schweikert of Arizona and other members of the Congressional Blockchain Caucus are asking the IRS to ensure “tax policy does not indirectly dissuade U.S. taxpayers from participating” in crypto staking networks. (Gage Skidmore/Flickr)

US Lawmakers Don’t Want Proof-of-Stake Networks to Get Overtaxed

Crypto holders earning new tokens by staking their coins might be at risk of being overtaxed, believe several members of Congress.

Four lawmakers wrote a letter to the Internal Revenue Service Wednesday, asking the U.S. tax agency to ensure stakers don’t face tax liabilities for receiving block rewards before they sell their new tokens.

The letter, dated July 29, was sent to IRS Commissioner Charles Rettig, Chief Counsel Michael Desmond and Assistant Secretary for Tax Policy David Kautter and was signed by the Congressional Blockchain Caucus’ co-chairs Reps. David Schweikert (R-Ariz.), Bill Foster (D-Ill.), Tom Emmer (R-Minn.) and Darren Soto (D-Fla.).

“It is possible the taxation of ‘staking’ rewards as income may overstate taxpayers’ actual gains from participating in this new technology,” the letter said. “It could also result in a reporting and compliance nightmare, for taxpayers and the Service alike.”

The caucus clarified staking rewards should be taxed appropriately. “We believe that taxpayers’ true gains from these tokens should indeed be taxed,” the letter said.

Abraham Sutherland, a lecturer at the University of Virginia, told CoinDesk these concerns include the fact that staking protocols could create new blocks – and therefore, release new tokens – every few minutes, hours or days.

Each of these blocks could be treated as an independent taxable event, meaning taxpayers could potentially have hundreds of taxable events every year, which would be a headache for both the taxpayer and the IRS to assess, he said.

Metaphors

Treating staking as a source of income might cause issues for participants in the U.S., said Sutherland, who assisted in writing the letter.

The metaphors individuals use to explain staking might be misleading in a harmful way, he said, although the implications might not be immediately obvious.

“The example here is it’s misleading to say that validators get paid to create blocks and to maintain the network,” he said. “And it might seem harmless but this metaphor can lead to the idea that block rewards are income, and of course income gets taxed.”

These implications are starting to be felt by the industry.

If a network’s value grows 5% over a year, but an individual staker has seen the number of tokens they hold grow 6%, this does not mean the staker has a 6% gain, he said.

The IRS has yet to say how or when staking rewards should be taxed, said Shehan Chandrasekera, Cointracker head of tax strategy. In an email, he said there are a few different positions as to how staking rewards can be taxed.

“Technically speaking, staking income is similar to rental income. This is because cryptocurrencies are treated as property. Income you get after lending property is rental income by default,” he said.

However, staking income can also be treated as interest because rewards might look like interest payments (though he said it would have to be fiat money to comply with case law).

Property

Sutherland said the appropriate approach to taxing staking rewards could be to treat it like new property.

New property isn’t taxed as income right away, he said, but taxed when it’s sold.

The congressmen agreed in their letter.

“Those who help validate transactions create new blocks in the cryptocurrency blockchain and also create these new tokens. Similar to all other forms of taxpayer-created (or taxpayer-discovered) property – such as crops, mineral, livestock, artworks and even widgets off the assembly line – these tokens could be taxed when they are sold,” the letter said.

Chandrasekhara said there is an argument to be made in support of this method, though in his view the “most conservative approach” would be to tax rewards as income at the time they’re received, which is similar to how the IRS approaches mining rewards.

Sutherland said he believes the issue is less important for mining than it is for staking because it’s more likely token rewards are more diluted in a proof-of-stake network. Still, Wednesday’s letter is mainly a first step in getting clarification on how tokens are treated by the nation’s Tax Man..

As part of that, Sutherland hopes the crypto industry gets better at using metaphors in explaining how new consensus mechanisms or token reward systems work.

“Block rewards are not a money machine,” he said. What they are is one part of an amazing system to incentive the maintenance of a decentralized network where nobody is in charge.”

Read the full letter below:

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.