US Deputy Treasury Secretary Warns Crypto Exchanges Against Helping Russia Evade Sanctions

Wally Adeyemo – the 15th United States Deputy Secretary of the Treasury – warned cryptocurrency exchanges and monetary institutions not to aid Russia to bypass financial penalties. He asserted that the American authorities will detect and punish those that do not abide by this request.

‘We Will Come and We Will Find You’

The US authorities will hold accountable every sector that tries to help Russia evade financial sanctions imposed on the country after Vladimir Putin launched his “special military operation” on Ukraine. This is what Deputy US Treasury Secretary Wally Adeyemo stated in a recent interview with CNBC:

“What we want to make very clear to crypto exchanges, to financial institutions, to individuals, to anyone who may be in a position to help Russia take advantage and evade our sanctions: We will hold you accountable.”

The 40-year-old government official believes that Russia has not been able to bypass the monetary penalties via crypto trading venues or other financial firms so far. However, he assumed that the largest nation by landmass will keep trying and “use every means possible.”

Digital asset platforms and all other businesses should know that they cannot escape the scope of the responsible agencies, Adeyemo alerted:

“We will come and we will find you, and we will ensure that Russia does not have the ability to get around the sanctions that we have put in place in order to make it harder for them to prosecute the illegitimate war that they have in Ukraine.”

Last week, Christine Lagarde – the President of the European Central Bank – issued a similar warning. She asserted that crypto companies helping Russia bypass sanctions will face enhanced scrutiny.

US Treasury vs. Crypto Platforms That Do Not Abide

The Treasury, which manages all federal finances, has experience with penalizing cryptocurrency exchanges. In September last year, it sanctioned Suex – a Czech Republic-based trading venue.

Back then, Adeyemo alleged the company of facilitating operations involving “illicit proceeds from at least eight ransomware variants.” Additionally, he said 40% of the exchange’s known transactions history is linked to criminals.

The official further revealed that penalizing Suex was the first such action by the Office of Foreign Assets Control against a digital asset trading venue. In his view, exchanges of this kind “are critical to attackers’ ability to extract profits.”

Following the accusations, the US Treasury Department prohibited Suex from doing business with US organizations.

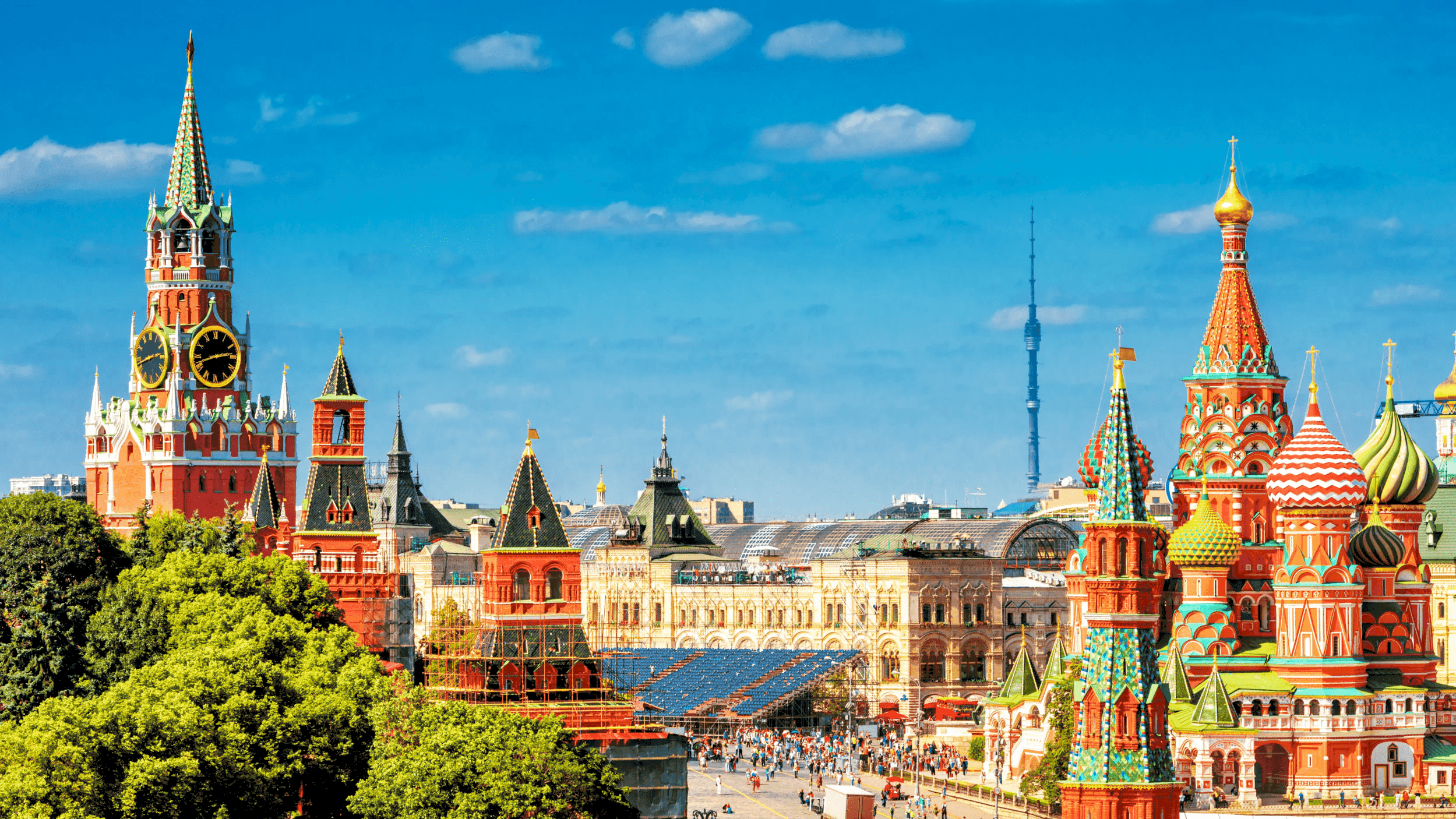

Featured Image Courtesy of Bloomberg