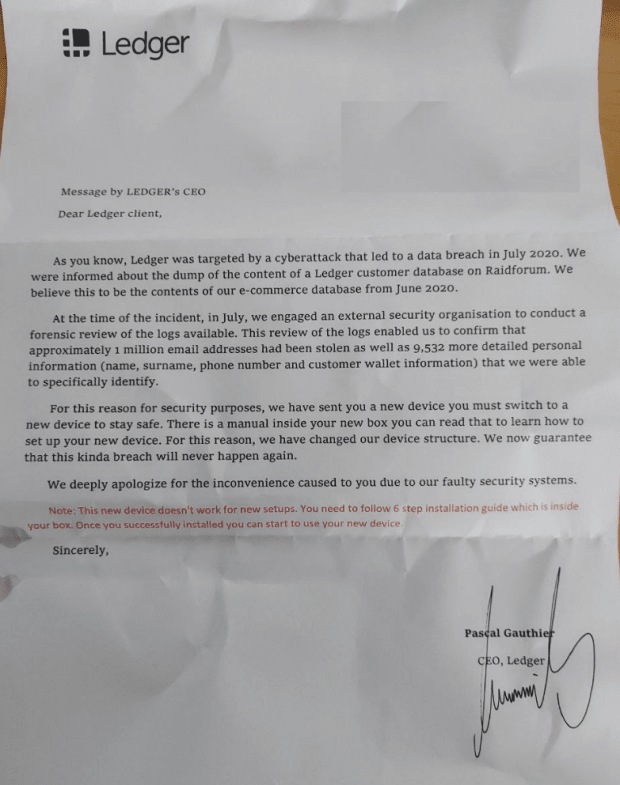

The UnionBank of the Philippines, one of the leading financial institutions in the country, has launched a two-way bitcoin automated teller machine (ATM), according to a story in local media outlet Philstar.

This is the country’s second crypto ATM that provides users with the ability to sell and purchase digital assets like bitcoin for pesos, the country’s official currency. The country’s first bitcoin machine was installed in Manila by BitCoiniacs in 2015.

The UnionBank has reportedly collaborated with the Filipino Central Bank, Bangko Sentral ng Pilipinas (BSP).

UnionBank, the country’s seventh largest bank told Philstar, “In the bank’s continued quest to cater to the evolving needs and tastes of customers, including clients who use virtual currency, the ATM will provide these clients an alternative channel to convert their pesos to virtual currency and vice versa.”

So far, the bank hasn’t mentioned its intention to deploy more ATMs in the future, but it will be monitoring the usage and performance of the ATM, which could impact what it does next.

Bitcoin in the Philippines

In a country where about 77 percent of the population doesn’t have a bank account, crypto bridges the gap and creates inclusion for financial services.

Coins.ph, a leading crypto exchange in the country, celebrated the onboarding of 5 million Filipinos on its platform in May 2018.

Another reason why crypto is so prevalent in the Philippines is remittances, which make up 10 percent of its GDP. The country is the third largest remittance receiving country in the world. For Filipinos overseas, cryptocurrencies offer a cheaper way of sending money to relatives at home.

For a country that is proactive with crypto regulations and was among the first nations to recognize it as an asset class, the deployment of regulated crypto ATMs could foster mainstream adoption of cryptocurrencies, build investor confidence and help develop the local cryptocurrency sector.