Unicrypt Network: Introducing the Era of Decentralized Crowd Sales

[Featured Content]

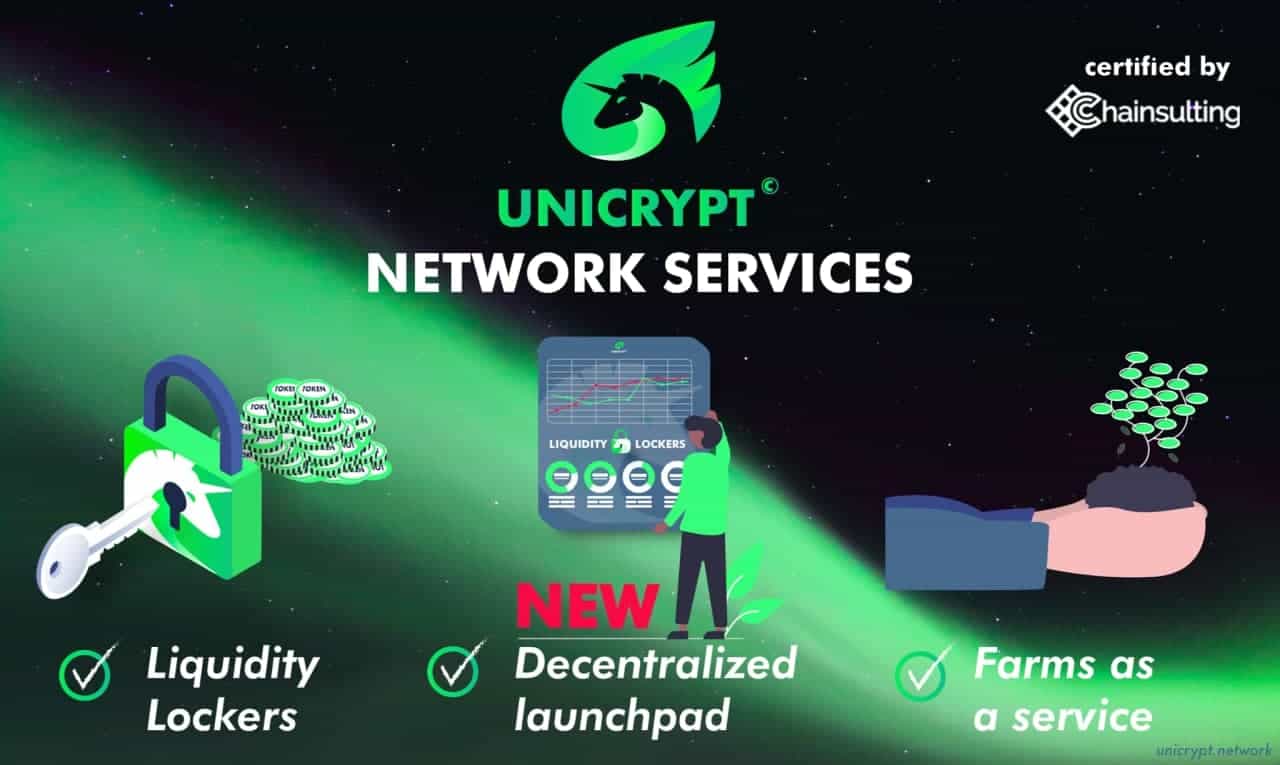

The Unicrypt network is pioneering the field of DeFi with an innovative approach to establish user trust. The platform works in tandem with liquidity pools on Uniswap to reward yield farmers while facilitating startup projects to launch swiftly and successfully.

Unicrypt utilizes its UNCX token as a means for developers to pay fees and access presales in advance. Unicrypt currently has $94.57 million in liquidity locked across 2700 liquidity lockers, well-known projects such as COIN, MahaDAO, YFDAI, LGCY, DEXT having already locked millions in the protocol.

The platform has quickly gained popularity among DeFi investors due to its easy-to-use interface that lets users browse through all locked liquidity pools on Uniswap. They can then access essential details required to make an informed decision for each locked pool, such as total funds locked termination date.

The blockchain-powered project also offers smart contracts known as Liquidity Lockers that dev teams can use to lock liquidity on Uniswap for a predetermined period.

This functionality enables developers to publicly lock liquidity that cannot be withdrawn abruptly, thus bolstering investor confidence in all projects. What’s more, all investors are redeemed fully for their ETH contribution if a startup project fails to hit its soft cap.

Unicrypt is currently the only product and browser that allows investors to lock liquidity while facilitating liquidity migration to Uniswap V3.

The Unicrypt Decentralized Launchpad Is Live

Unicrypt has just finalized the rollout of its fully decentralized, autonomous, and scalable launchpad, offering the best option for centralized launchpads.

The team behind the project announced on Twitter that they were finally ready to move onto Mainnet following the successful completion of the product audit with Chainsulting. The project aims to further increase its credibility by allowing whitelisted auditors to detect suspicious activity such as malicious minting functions, proxies, or blacklisted projects.

Nevertheless, all users are advised to do their own research before investing in any project. The team has no say in which tokens list on their autonomous and decentralized platform. Investors should always proceed with caution, examining all tokens in the same manner as they do new tokens on Uniswap.

The new platform ushers in the era of decentralized crowd sales, where any startup project can run its pre-sales. The launchpad is touted as the “Uniswap for pre-sales,” as any token can launch on here, much like on Uniswap.

What’s more, the automated platform is fully connected to Unicrypt liquidity lockers. It will finally bridge pre-sales, market initialization, and liquidity locking on the Uniswap liquidity locking platform. To celebrate the new milestone, the Unicrypt team has just burnt 350 UNCX – total supply now stands at 48 650 UNCX,

Most importantly, the launchpad is designed to champion equity and fairness in the projects wishing to list their pre-sale on the platform. All new ERC 20 projects are welcome to use the automated and open platform and get the best possible environment to start their journey.

Projects get all the opportunities they need to launch without worrying about the lack of funding, promotions, support, or investor confidence.

Presale Preconditions on the Decentralized Launchpad

Every presale wishing to list on Unicrypt must lock between 30–100% of the raised ETH / DAI / USDC on Uniswap as counter liquidity to the sale token.

Pre-sales on Unicrypt are conducted in two rounds. The first “private round” is reserved for native token holders (UNCX and UNCL) and lasts 2 hours. Participants in round one must hold either 4 UNCX or 50 UNCL in their wallets. Besides this requirement, users must also be on the whitelist (where applicable) to get into private pre-sales.

The top 100 stakers of UNCX or UNCL are rewarded with a share of fees from the pre-sales. Furthermore, there is an opportunity for partnered token holders to participate in this round. After the 2 hours lapse on round one, the presale moves to round 2, open to all (no requirement to hold UNCX or UNCL). This round is still subject to a whitelist check when the project team chose to make the sale private.

After the end of the presale rounds, either when the token soft cap is reached by endblock or hard cap is achieved, a publicly callable function will show on the pre-sale page.

At this point, anyone can end the pre-sale, add the pair to Uniswap, lock liquidity and allow withdrawals of the sale token. This unique functionality essentially turns Unicrypt into the Uniswap of pre-sales.

All tokens will be held in the presale contract for participants until the event has been completed. This measure prevents any one individual from initiating markets at an unfavorable rate.

Yield Farming-as-a-Service dApp

Unicrypt also brings forward its yield farming dApp. The product allows any token developer on the ETH blockchain to create a farm, with rewards available for any liquidity providers for token pairs listed on Uniswap.

Project teams incentivize LPs to stake by ensuring there is always sufficient liquidity for their Uniswap pairs, an innovation that could soon become industry-standard.

The Unicrypt yield farming dApp will soon integrate staking for any ERC 20 token and facilitate UNCL holders to stake and get rewarded in ETH.