Understanding Bitcoin Network Hash Rate Increases

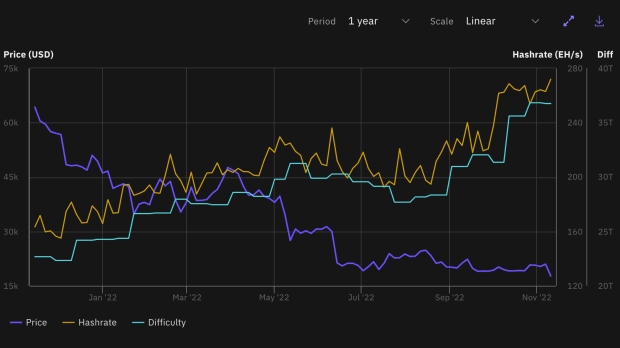

The difficulty adjustment can decrease profits for miners as the difficulty increases just as newer, more efficient hardware is released.

This is an opinion editorial by Alex, a bitcoin miner with Kaboomracks.

It is important for individuals looking at bitcoin mining for the first time to understand the importance of Bitcoin’s difficulty adjustment as well the impact this has on mining profitability. Many newcomers to bitcoin mining will consult the profitability of an ASIC on a mining calculator, expecting that that profitability will stay relatively the same going forwards in the future. This is a misunderstanding as the profitability of any given machine, trends downwards over time. Increases in difficulty should be understood before purchasing an ASIC.

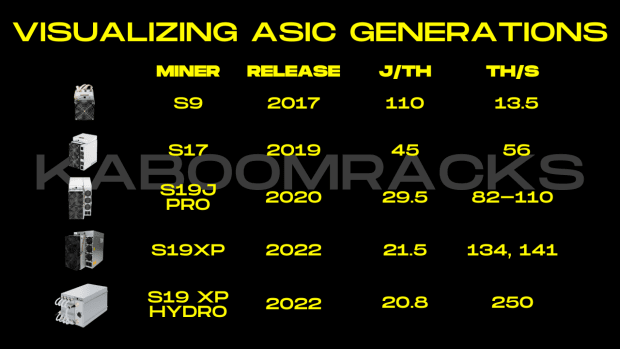

A simple way of understanding this is comparing an ASIC to any other electronic device. The longer the device is in use, the less relevant it is as new software requires more computing power. If you were to use an iPhone from 6 years ago, its performance would be incredibly frustrating. The older the phone gets, the less utility it has.

A very similar process happens in mining. When you are mining, you are competing with all the other miners around the world. As more miners turn on machines, it gets more difficult to compete. Having newer and more efficient hardware makes you more competitive, but that hardware is quickly moving towards being less competitive.

Bitcoin Difficulty Adjustment

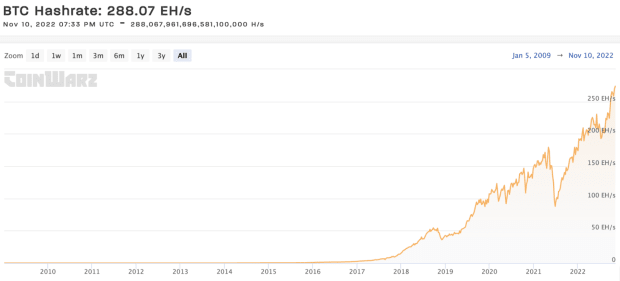

Bitcoin’s difficulty adjustment is something built into the Bitcoin protocol in order to ensure Bitcoin has a stable and predictable supply schedule. If there was no difficulty adjustment, all of the bitcoin likely would’ve already been mined and there would be little to no incentive for miners to secure the network. When more miners join the network, blocks are minted at a faster rate as a result of a hash rate increase. The network responds by adjusting the difficulty higher to ensure that blocks come in around 10 minutes. For miners, increased difficulty adjustments mean less profits. For the average Bitcoin user, it means more security for the monetary network they are using.

Downwards difficulty adjustments mean that miners will be earning more profits as these are a result of hash rate coming offline. The famous example of this happening is when China banned Bitcoin mining and a large portion of the network hash rate went offline for a period of time. Downwards difficulty adjustments are not the norm as mining hardware is always getting more powerful and efficient. Even if there was a stagnation of machine efficiency and hash rate increases, more machines would be produced and plugged in. The Bitcoin mining industry is incredibly immature and there is a tremendous amount of room for growth going forward which means that hash rate is almost certainly going to increase at rapid rates going forward over the long run.

We are currently seeing a bull market in energy prices with a suppressed bitcoin price which means that miners are experiencing quite a bit of pain. There is a possibility that there could be a series of downward difficulty adjustments as hash rate comes offline, but this is not something that miners should put in their models. It is important to prepare for the worst case scenario which is what we have seen the last few months.

New Machines Coming To Market

Every couple years, ASIC manufacturers release a new machine with significant improvements in regards to hash rate and efficiency. Recent network hash rate increases are largely due to seeing Bitmain’s S19 XP and S19 Hydro being deployed. Another factor is that a large amount of older generation machines are finally being turned on as a result of infrastructure being built out.

When you buy an ASIC, its value will be constantly depreciating as both network hash rate increases and new machines come onto the market. The value will fluctuate depending on the Bitcoin price, but it’s safe to say the machine loses value over time. That is why it is incredibly important to have the machine running when you have it. Buying it to plug in later means you are throwing money away unnecessarily.

Bitcoin Purchasing Power

Bitcoin mining is like taking a long position on Bitcoin, but with a lot of headaches and execution risk. If done correctly, it can be incredibly lucrative. If done incorrectly, it is a fantastic way to get poor quickly. The income the machine makes is fairly consistent, but the purchasing power of that income varies tremendously. Power prices may be stable priced in dollars, but are very volatile when priced in the income you are making from that machine. A S19j Pro may make 38,000-40,000 sats a day in income, but if you are mining on $0.10 a kWh, your power costs will be 41,263 sats with bitcoin trading at $17,461.

This is why it is incredibly important to try and get the lowest possible electricity prices in order to be profitable and ROI on your equipment. Finding cheap electricity is neither straightforward nor easy. Oftentimes there are hidden fees or complications that cause miners to fail. All miners regardless of how big or small are subjected to these economics of variable purchasing power, network hash rate increases, and machine devaluation/obsoletion.

ASIC Pricing

There is a base cost for the manufacturers to produce new equipment. We are currently at or reaching that floor for new equipment coming from the manufacturer. As a result, they are either slowing down or halting production of certain models. Individuals choose to pay a premium for new equipment because they come with warranties. Used equipment on the other hand generally does not come with a warranty, and also uncertainty of conditions that it was run in. For this reason, used equipment is often sold at a substantial discount.

ASIC pricing is variable just like every other industry. Supply and demand are the major factors that determine price. Individuals buying ASICs have a million different reasons why they may want to purchase at a certain time, but Bitcoin price and difficulty are major influences. If the purchasing power of the income being earned by an ASIC is low, there will be less demand and the ASIC price will fall. Bear markets are generally good times to buy because the demand drops significantly.

Moore’s Law And The Future Of ASICs

“Moore’s Law: an axiom of microprocessor development usually holding that processing power doubles about every 18 months especially relative to cost or size.” — Merriam Webster

We are coming to the end of the computer chip revolution as chip makers are pushing the boundaries of physics. In no way is this the end of massive increases in Bitcoin’s network hash rate. The mining industry is very rough around the edges in regards to very basic principles such as heat dissipation, software implementations, and relationships with energy producers. Computer chips may have slower leaps as far as increases in computing power, but we have barely scratched the surface in regards to other technological leaps forward that will ultimately lead to more power being consumed and more computing power expended in order to secure the Bitcoin Network.

As bitcoin becomes more widely adopted, and its value understood, the demand for mining is bound to increase globally. The result will naturally be an increase in Network hash rate. As a miner, this is a painful reality as it means the profitability of my hardware will decrease over time. As a Bitcoiner, it gives me confidence in the monetary network that I use daily.

This is a guest post by Kaboomracks Alex. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.