Under A Bitcoin Standard, Legacy Institutions Will Adapt And Improve

When bitcoin becomes the global reserve currency, central banks won’t go extinct, but they will have to evolve.

This is an opinion editorial by Jonathan Garner, a Bitcoin, finance and economics blogger at The Capital.

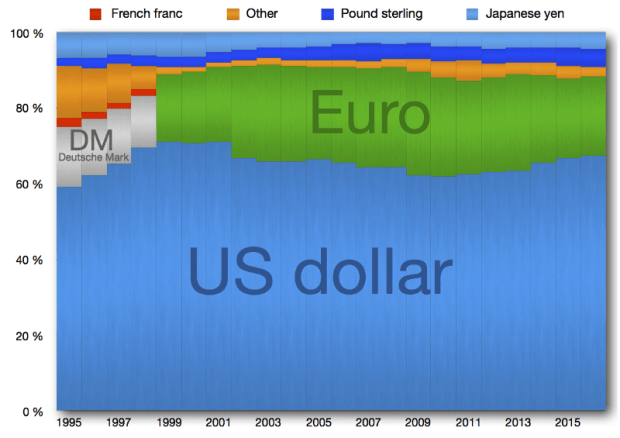

If bitcoin were to really become a global reserve currency, that would mean that the U.S. dollar’s days would be done. What would our daily lives look like under a bitcoin standard? And what would that mean for bitcoin?

It would seemingly mean that things would be priced in bitcoin at the store. In other words, bitcoin would function as a unit of account. So, instead of things being priced in U.S. dollars all over the world, things would be priced in bitcoin. I admit that it’s still early and that this is probably a long time away but still, it is possible even though bitcoin is still pretty volatile, at least compared to the current global reserve currency of the U.S. dollar.

Contrary to what some people seem to think, my contention is that bitcoin already is a currency. Bitcoin is a medium of exchange, which is why bitcoin is, in fact, called a “cryptocurrency” instead of a “crypto-store-of-value” or “crypto-gold” (although, bitcoin certainly is those things as well). This isn’t just science fiction either. Bitcoin is already being used as a currency in certain places, like El Salvador. When bitcoin is the global reserve currency, everyone will be using bitcoin as a currency this way. In short, Bitcoin is money. It’s a medium of exchange, store of value and unit of account.

The Legacy System On A Bitcoin Standard

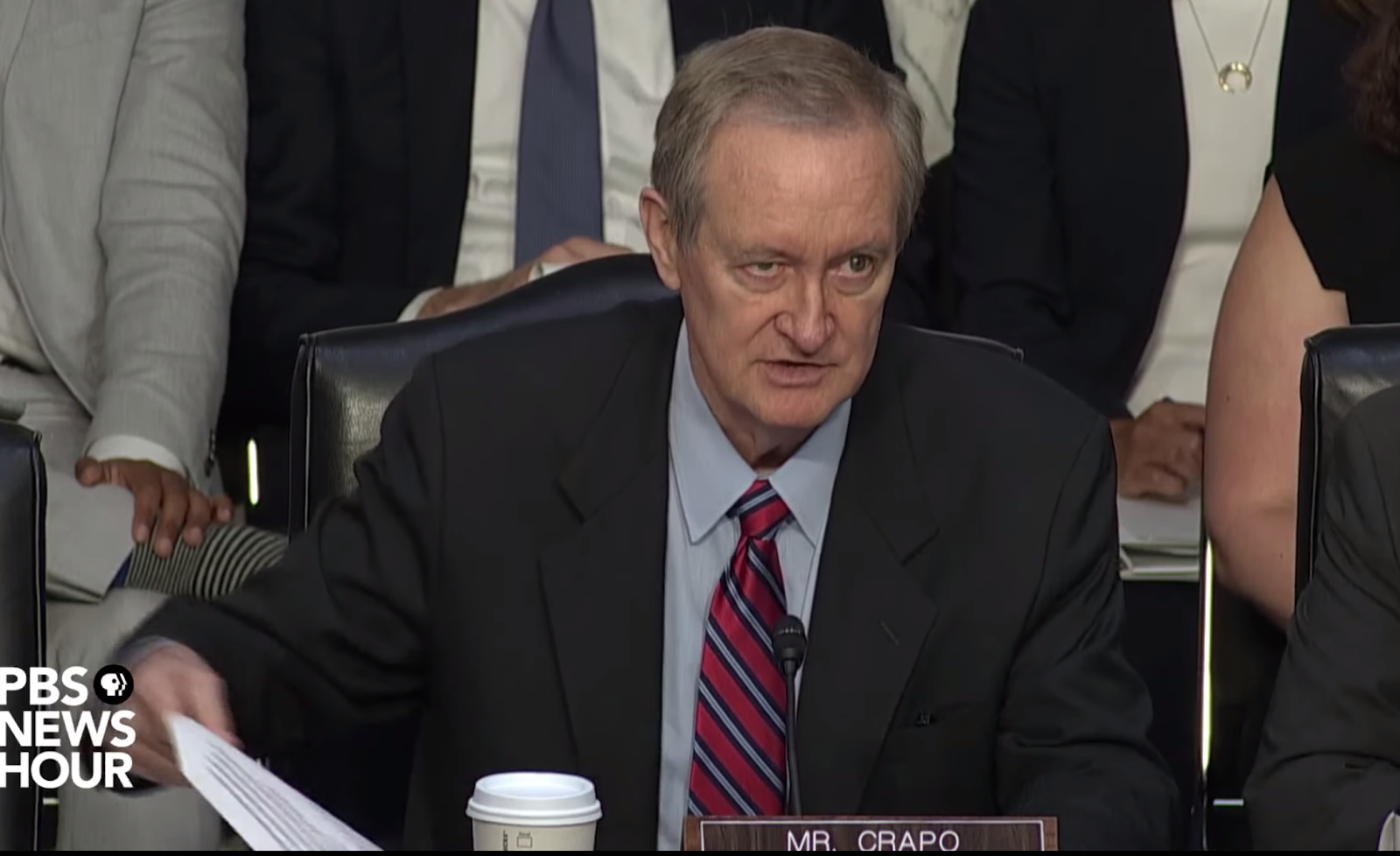

The bitcoin standard would mean that central banks would and should hold bitcoin on their balance sheets. Perhaps this would mean that central banks would not be needed anymore, but like any government agency or quasi-government agency, that doesn’t necessarily mean they will go away. Central banks will hold bitcoin because it will give their countries an advantage over other countries where the central banks don’t. The more free that a country is, the stronger it is against other countries. Bitcoin is freedom. Bitcoin is freedom from financial oppression.

The bitcoin standard would also mean that the bond market would be superfluous, as outlined in “The Bitcoin Standard,” or at least most of it would be. Under bitcoin, the economy would move from a debt economy to a savings economy. The economy would also move back to being more about production than consumption because consumption and debt don’t grow economies. This means that the current system, which is not under a bitcoin standard, is very sick, as outlined in “The Fiat Standard.”

In my estimation, the bitcoin standard would mean that the stock market would shrink. With sound money, people would actually have savings, which would change the way they invest. But that doesn’t mean there wouldn’t be an economy or economic growth. Again, it just means that people will use savings more than they do now. They will rely on savings instead of debt.

A lot of current businesses will go out of business, but that’s capitalism. Some companies need to go belly up. The companies that are productive and provide value will survive. This includes companies that are involved with Bitcoin. Bitcoin companies provide value and can pay dividends in bitcoin.

Curing Bubbles

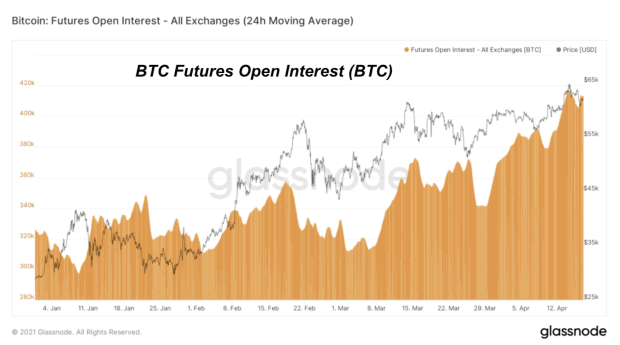

The Bitcoin standard would also mean that we wouldn’t have fiat credit bubbles. The current system of colossal asset bubbles and huge crashes is mainly, if not exclusively, related to central banks like the Federal Reserve. Assets bubbles aren’t just some abstract idea. Instead, bubbles cause a Herculean misallocation of resources in the real economy. Bitcoin fixes this. Yes, this means housing prices will come down, but they need to come down. Home sellers are not any more important than home buyers.

Lastly, Bitcoin should eat inflation alive! Consumer prices will come down because they should come down over time. A more productive economy should bring down prices over time. Technological deflation is a good thing that is not to be feared. Consumer prices coming down will not make me stop drinking my morning coffee because I won’t delay purchases in the way.

For some things? Yes. But again, technological deflation is seemingly a good thing. And bad deflation is a product of the current fiat system.

None of this is to say that there wouldn’t be any pain whatsoever in the transition from the U.S. dollar fiat standard to the Bitcoin standard. There would be some pain in the process. But, like a workout, it will be worth it in the end. The elite in society will adopt Bitcoin because they will be fine. The future is the bitcoin standard.

This is a guest post by Jonathan Garner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.