Ukraine Demonstrates How Bitcoin Can Transform Developing Countries

The growth of bitcoin adoption in Ukraine offers a template for other countries where people seek dependable stores of value.

This article describes the failure of centralized planning and government interventions in developing countries from the perspective of the Austrian school of economics. Numerous institutional and financial problems prevent ordinary citizens from achieving financial stability and economic freedom.

The case of Ukraine is used to demonstrate the positive transformation that can be achieved via the growing adoption of Bitcoin. The relevant implications for personal finance, pensions, capital accumulation, economic independence and blockchain education are outlined below. The possibility of reaching a compromise on Bitcoin use among members of the public and private sector for radically transforming Ukraine’s economy is explained. The potential for promoting further positive changes in Eastern Europe and the Commonwealth of Independent States (CIS) region is specified.

Austrian Economics And The Struggles Of Developing Countries

According to the Austrian school of economics (with the original contribution of Eugen von Böhm-Bawerk and further developments of Ludwig von Mises and Murray N. Rothbard), capital accumulation and investments are the major preconditions of a sustainable economic growth.

Other things being equal, lower time preferences contribute to more sophisticated production cycles and higher long-term output. However, most developing countries suffer from lack of savings and investments. Moreover, a high degree of socioeconomic uncertainty and low financial stability result in comparatively high time preferences and insufficient capital accumulation.

The existing intergovernmental and International Monetary Fund (IMF) programs do not affect the underlying causes of economic problems, thus preventing such countries from realizing their socioeconomic potential.

The rapid adoption of Bitcoin by residents of developing countries offers a unique and decentralized solution to most of the current challenges.

Ukraine As A Case Study For Bitcoin

The case of Ukraine effectively illustrates both the problems associated with traditional economic policy solutions and potential Bitcoin-related benefits. The prevalence of the fiat paper system and centralized management has created the following issues in the country:

- The average inflation rate in Ukraine during the past ten years equals 11.2% per year. Such high inflation negatively affects savings and long-term investments in strategic projects.

- According to the 2021 Index of Economic Freedom, Ukraine’s economy is characterized as being mostly unfree with the lowest scores in the investment and financial freedom sectors. With the undeveloped stock market and unstable banking system, ordinary citizens have minimal opportunities for effectively investing their funds.

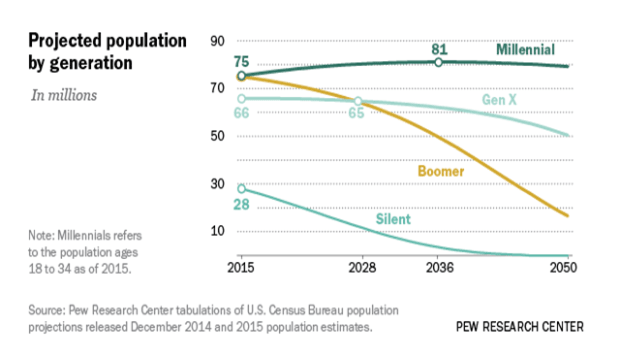

- The large-scale crisis of the post-Soviet “solidarity pension system,” intensified by demographic problems, has resulted in 80% of single pensioners living below the poverty line and Prime Minister Denys Shmyhal making warnings about the risks of the government’s inability to pay pensions in 15 years. Such a situation directly affects both current pensioners and all employees.

While the ineffectiveness of traditional, centralized approaches is generally recognized, even by government officials, the growing adoption of Bitcoin in Ukraine may provide unique opportunities for ordinary citizens and innovative startups:

- Bitcoin allows achieving a deflationary economic environment for its owners. Bitcoin has appreciated to the Ukrainian national currency hryvnya by about 17,000% since its creation in 2009. Thus, every person receives an adequate opportunity to not only protect their savings from inflation, but also enjoy their considerable appreciation of the invested funds in the following years.

- The decentralized nature of Bitcoin makes it available for all people globally, although some governments impose restrictions in this field. However, most authorities, including the Ukrainian government, recognize the emergence of a new economic reality and have legalized Bitcoin. For this reason, even despite the existing regulatory issues with open markets in the country, Ukrainians can effectively integrate into the global financial and innovative system.

- Startups can effectively present their innovations to foreign partners and strategic investors. Blockchain technologies contribute to the growing demand for new projects based on a peer-to-peer network and cryptographic keys. Thus, the rates of capital accumulation may increase proportionally with positive implications for different sectors of Ukraine’s economy.

- Bitcoin also creates additional opportunities for minimizing the prevalence of corruption and government inefficiencies of different types. According to recent declarations, Ukrainian government officials own some 46,351 BTC, implying their recognition of the unique benefits of Bitcoin as a store of value and decentralized blockchain system. The growing consensus on Bitcoin among members of the public and private sector is crucial for transforming Ukraine into a more open society with the recognition of basic economic rights for all citizens.

- Regardless of the progress in government reforms’ implementation, current employees can invest their funds in bitcoin to accumulate sufficient savings that will allow them to increase the purchasing power of their assets in the long run. The most important aspect is that every person becomes able to independently and effectively ensure their financial stability, rather than remaining a passive object of government policies.

- Bitcoin significantly affects the intellectual climate in Ukraine, creating the higher demand for the quality of cryptocurrency analytics. Bitcoin Magazine recently established a news bureau in Ukraine that may provide the informational assistance to increasing Bitcoin adoption in Eastern Europe and the CIS region. The CEO of Bitcoin Magazine, David Bailey, stressed the critical role of such developing countries as El Salvador and Ukraine in determining the future of money.

The above evaluation indicates that developing countries experience the most urgent need for utilizing the unique financial and technological opportunities associated with Bitcoin adoption by residents of their countries. The case of Ukraine proves the possibility of the rapid transformation of the regulatory, institutional and intellectual environment under the impact of innovative and decentralized solutions. The higher rates of innovation and capital accumulation may contribute to the growing national and global sustainability with the main priority assigned to economic freedom of every person.

This is a guest post by Dmytro Kharkov. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.