U.S. SEC Subpoenas PayPal About USD Stablecoin, Company Says

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

PayPal (PYPL) received a subpoena from the U.S. Securities and Exchange Commission (SEC) requesting documentation about its USD stablecoin, the global payments giant said in a filing, without providing more details.

The firm announced it was entering the market with a U.S. dollar-pegged stablecoin, PayPal USD, in August.

“On November 1, 2023, we received a subpoena from the U.S. SEC Division of Enforcement relating to PayPal USD stablecoin. The subpoena requests the production of documents. We are cooperating with the SEC in connection with this request,” PayPal revealed in its quarterly earnings report filed Wednesday.

PayPal’s decision was the first time a major financial firm sought to introduce a stablecoin. The announcement raised concerns in Washington because it was a reminder of the Libra stablecoin, a previous effort by Facebook, now Meta Platforms (META), that didn’t come to fruition. PayPal’s stablecoin threatened to push a divided Congress further apart. Some members, like House Financial Services Committee’s ranking Democrat Rep. Maxine Waters (D-Calif.), said a stablecoin bill would allow big tech to claim the space and that would be dangerous, and now had a live example to refer to.

In September, stablecoin issuer Circle intervened in the SEC’s case against Binance, arguing that financial trading laws shouldn’t apply to stablecoins, whose value is tied to other assets.

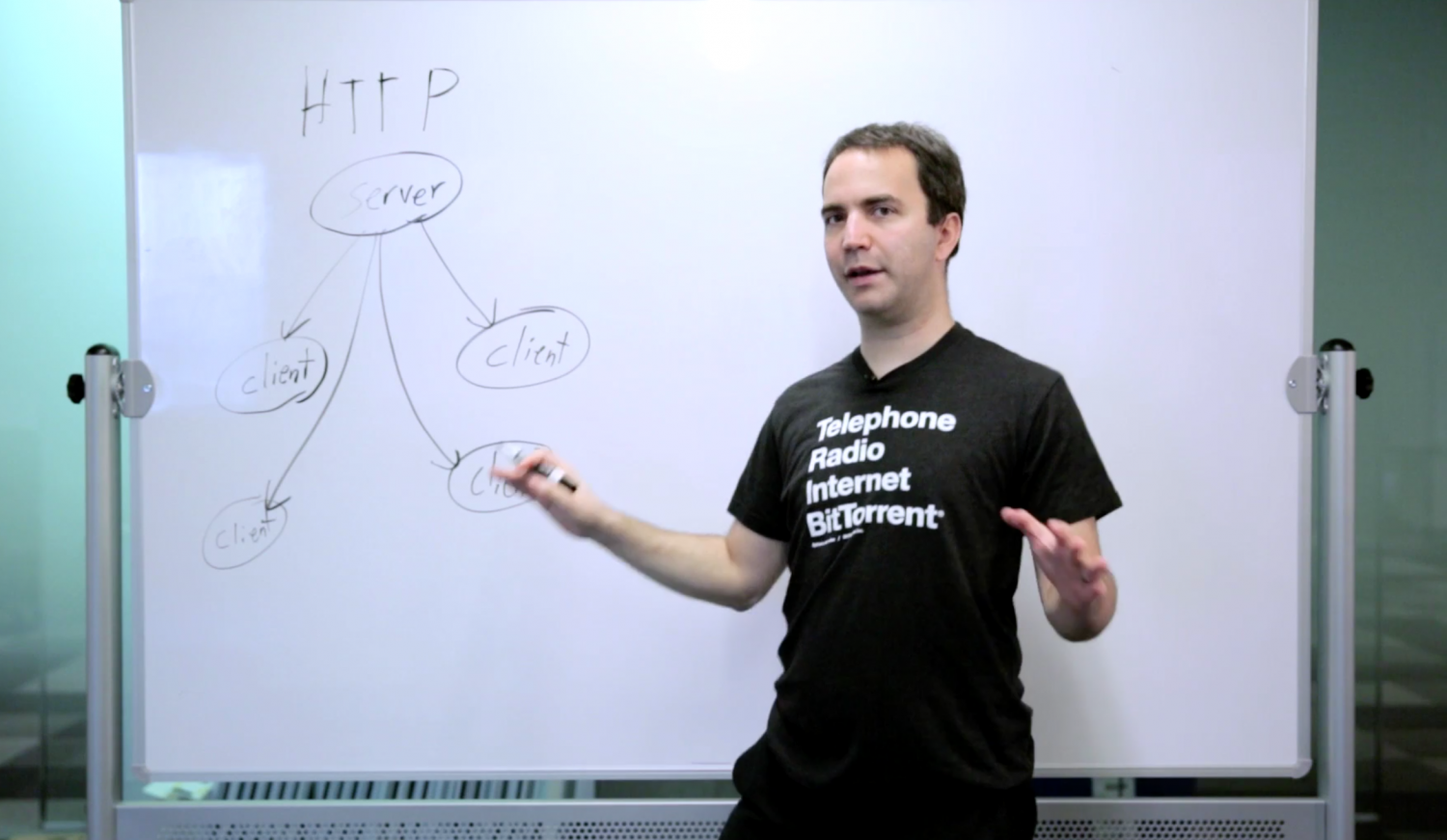

PayPal’s stablecoin will be an Ethereum-based token offered to the company’s online-payments customers before expanding to PayPal’s Venmo app. PayPal allowed customers to buy and sell cryptocurrencies since 2020. Since April 2021 it allowed the same service on Venmo. In 2022, PayPal began allowing users to transfer their crypto assets to third-party wallets and expanded that capability to Venmo in April 2023.

UPDATE (Nov. 2, 2023, 11:25 UTC): Added background throughout; corrects date of filing to Wednesday.

Edited by Sheldon Reback.