The U.S. added 150,000 jobs in October versus economist expectations for 180,000 and down from 297,000 in September. The unemployment rate rose to 3.9% versus forecasts for 3.8% and September’s 3.8%.

In addition to the headline miss, downward revisions to August’s and September’s jobs gains totaled 101,000.

30:00

Steven McClurg: Bitcoin Spot ETF Race

01:14

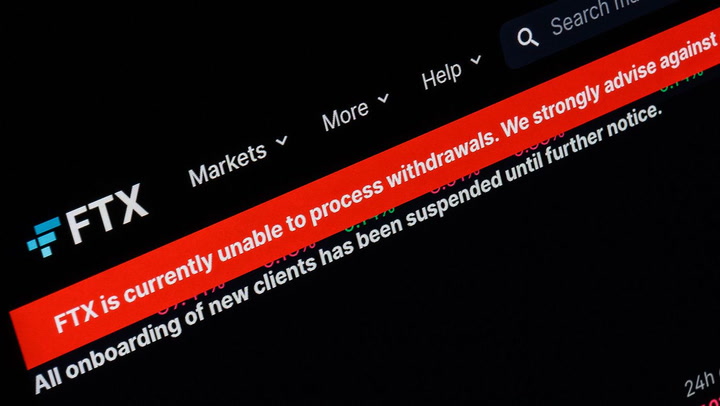

Bitcoin Price-Volatility Correlation Turns Negative Again as Crypto Traders Eye FTX Liquidations

02:12

FTX’s Sam Bankman-Fried Wants a ‘Temporary Release’ From Jail; Is Bitcoin Becoming an Election Issue?

01:16

Bitcoin and U.S. Real Yield Notch Strongest Inverse Correlation in Four Months

Bitcoin (BTC) remained lower on the session in the immediate aftermath of the release at $34,300.

The U.S. bond market has quickly turned tail over the past two weeks, moving from panicky selling action to the idea that Federal Reserve rate hikes are over this cycle, making the coast clear to begin adding fixed income to portfolios. After pushing through 5% on Oct. 19, the 10-year Treasury yield had tumbled back to 4.64% prior to this employment news. The two-year Treasury yield has slid a similar amount, yielding 4.99% ahead of the report.

Falling yields have been a boon to stocks, which have pulled out of a slump begun in late July. The S&P 500 and Nasdaq are each higher by about 5% over the past few sessions. Similarly so for bitcoin. The recent bull move for the crypto has been attributed to what could be imminent approval of a spot ETF, but to the extent that falling interest rates reignite animal spirits in risk assets like stocks, bitcoin would seemingly also benefit.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)