U.S.-Listed Bitcoin Miners Have the Upper Hand Over Unlisted Peers: Bernstein

-

Miners listed in the U.S. have an advantage over private peers as they can raise capital easily, the broker said.

-

Bernstein said it sees the large publicly traded U.S. bitcoin miners as consolidators in the sector.

-

Leading miners should focus on growing market share and increasing their hashrates, the report said.

Bitcoin (BTC) miners listed in the U.S. have a large advantage over their unlisted peers because their easier access to funding offers them more financial options than privately held firms or those that trade elsewhere, broker Bernstein said in a research report on Monday.

“Being able to raise debt/equity in the world’s deepest capital markets, presents a natural advantage versus non-U.S. miners, particularly in a capital intensive industry, poised for market consolidation,” analysts led by Gautam Chhugani wrote.

Last week’s fundraising showcases the argument. Marathon Digital (MARA) said it planned a private placement of convertibles to buy bitcoin as a treasury asset. Riot Platforms (RIOT) announced a $750 million equity offering. Core Scientific (CORZ) and Bitdeer (BTDR) also announced that they planned to issue convertible debt.

Bernstein said this supports its long bias towards publicly listed U.S. bitcoin miners being consolidators in the sector.

The broker noted that the mining industry is split between companies focused on bitcoin mining and those pivoting to artificial intelligence (AI) data centers. Both are viable opportunities, the report said, and the common theme is consolidation because scale matters.

Still, “bitcoin mining and AI data centers, while adjacent due to power capacity and high density power specs, are completely different businesses,” the report noted.

The leading miners should remain focused on bitcoin mining market share and growing their hashrates, Bernstein said, and not selling the crypto they have mined at a loss.

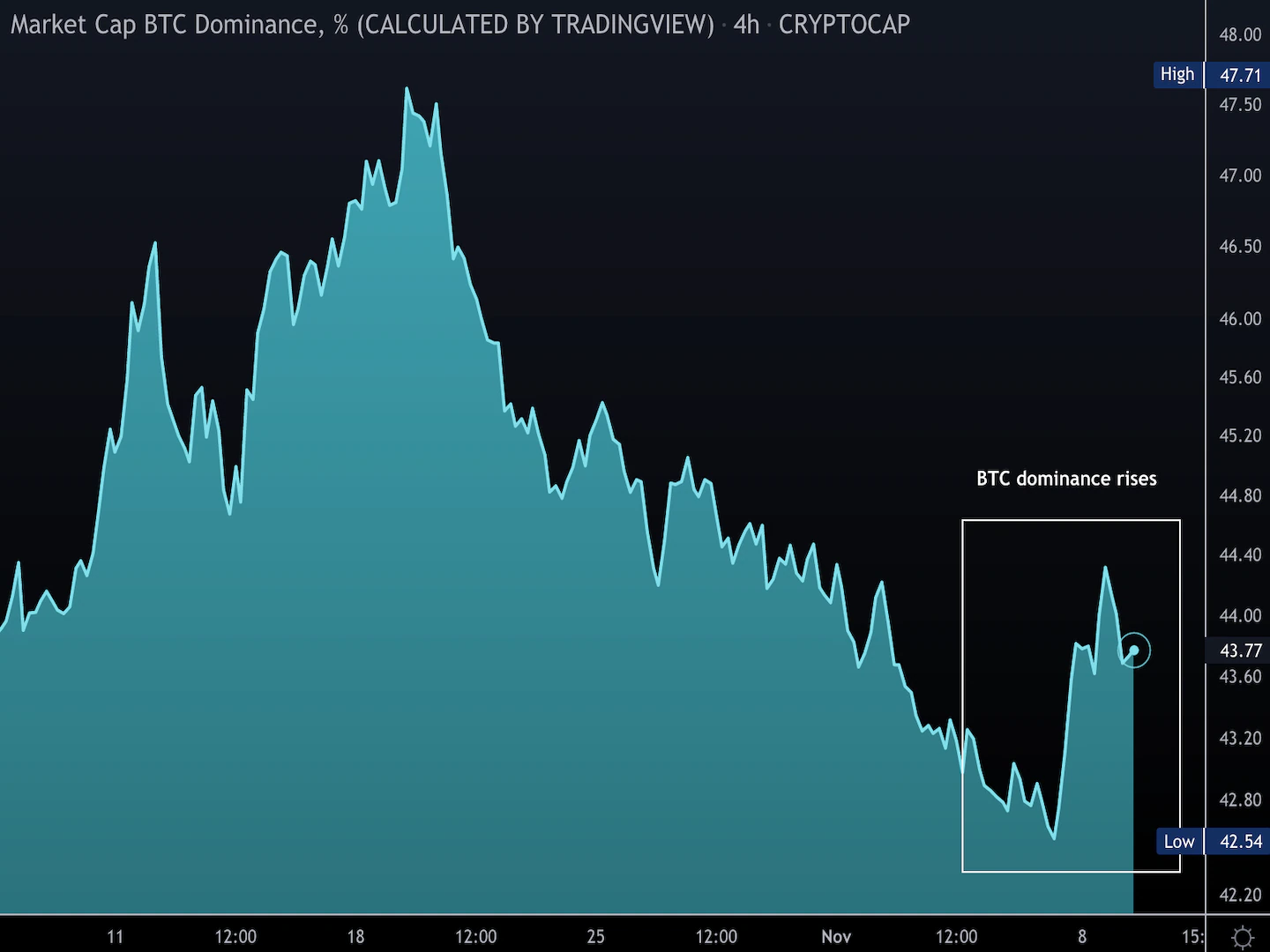

Bernstein reiterated its view that BTC will hit new highs of around $200,000 in 2025 on the back of increased institutional adoption and the uptake of exchange-traded funds (ETFs), the report added.

Edited by Sheldon Reback.