U.S. Futures Watchdog Issues Compliance Rule for Crypto Activities Among Members

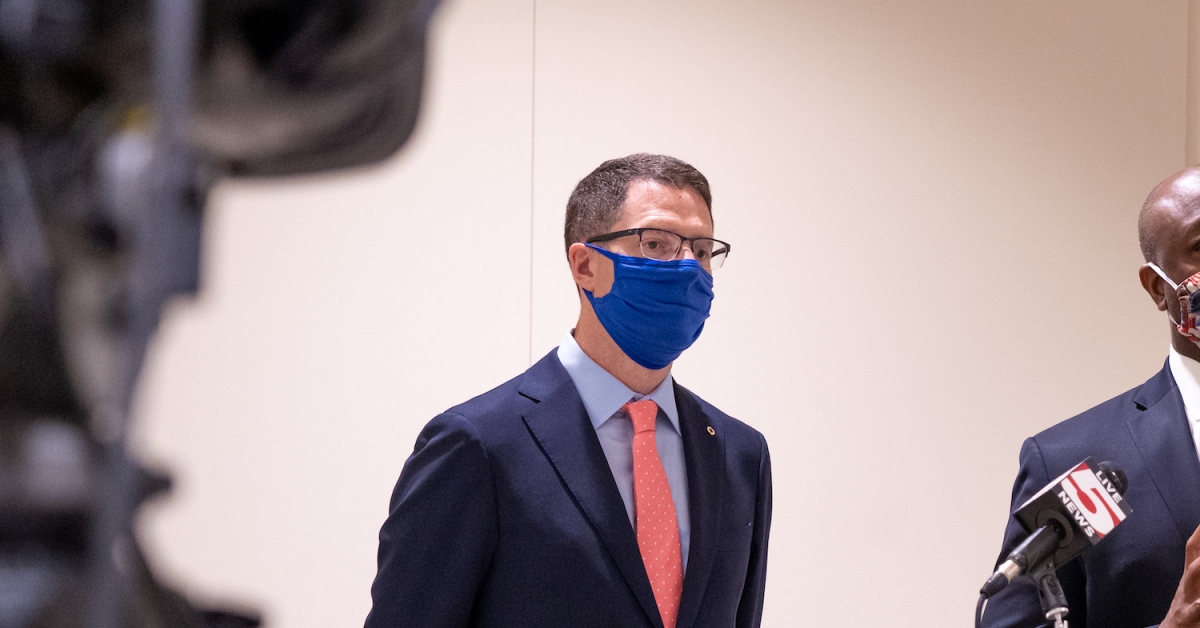

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

Christy Goldsmith Romero

Commissioner

U.S. Commodity Futures Trading Commission

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.

In the absence of formal crypto rules from U.S. government agencies, the National Futures Association is setting up standards for its members that deal in digital-assets commodities.

The NFA – which as a so-called self-regulatory organization occupies a space between the federal government and industry – has more than 100 members involved in digital assets, the organization said in a statement on the new rule, which is set to go into effect on May 31. The NFA’s self-regulation of the derivatives industry allows it to impose standards on its members under penalty of fines and other punishment, and this rule extends that power more explicitly to the crypto sector.

The compliance rule – now limited to involvement with bitcoin (BTC) and ether (ETH) – gives the NFA “the ability to discipline a member or take other action to protect the public if a member commits fraud or similar misconduct with respect to its spot digital asset commodity activities,” the group said in the statement on Wednesday. It also requires members to supervise their activity closely and says that members involved in spot crypto commodity activity “must adopt and implement appropriate supervisory policies and procedures over these activities.”

The Commodity Futures Trading Commission oversees the NFA and the wider industry, though questions remain about the extent of its authority over digital assets. A number of legislative efforts in Congress have sought to give the CFTC undeniable powers over crypto commodities and the spot market, but the bills haven’t produced any results.

“This is a clear example of using existing authority to ensure that there are customer protections in place,” CFTC Commissioner Caroline Pham said Friday in a statement posted on the CFTC website. “These obligations will require NFA members and associates to explicitly disclose the risks associated with trading spot bitcoin and ether, so that customers are fully informed before making any trading decisions.”

UPDATE (March 31, 2023, 18:11 UTC): Adds comment from CFTC Commissioner Pham.

Edited by Nikhilesh De.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)

Jesse Hamilton is CoinDesk’s deputy managing editor for global policy and regulation. He doesn’t hold any crypto.