U.S. Financial Industry to Explore Sharing Ledger Technology for Multiasset Transactions

-

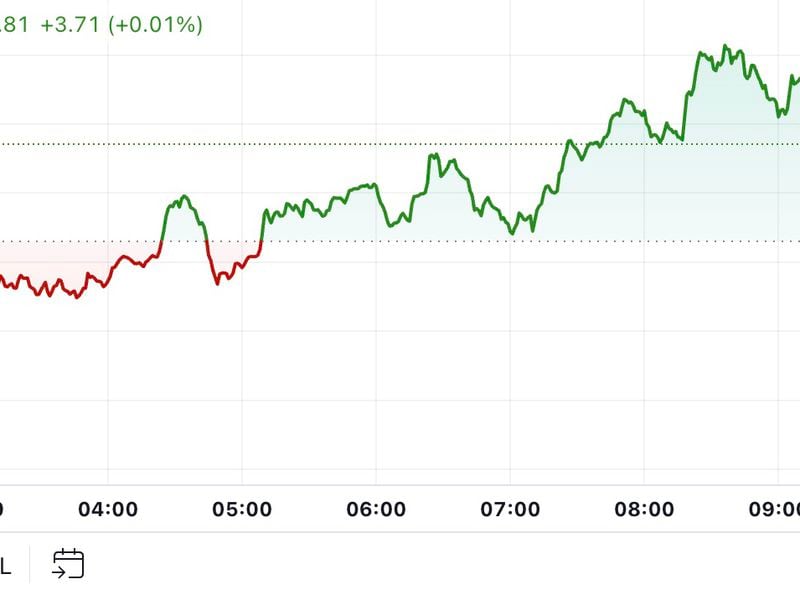

Major U.S. financial industry companies are teaming up to explore sharing ledger technology.

-

The New York Innovation Center of the Federal Reserve Bank of New York will act as a technical observer.

Citi, JPMorgan, Mastercard, Swift and Deloitte are among major companies with an interest in financial services teaming up to explore sharing ledger technology by simulating multiasset transactions in U.S. dollars.

The research project, titled Regulated Settlement Network (RSN) proof-of-concept (PoC), will explore the potential of bringing commercial-bank money, wholesale central-bank money and securities such as U.S. Treasuries and investment-grade debt to a common regulated venue, according to a statement shared with CoinDesk.

The New York Innovation Center of the Federal Reserve Bank of New York will act as a technical observer.

“In today’s digital economy, financial market infrastructures may need to settle a host of digital assets within well-defined legal frameworks. Citi looks forward to exploring the opportunities of this project,” Debopama Sen, global head of payments at Citi Services, said in the statement.

In the U.S., ideas such as central bank digital currencies (CBDCs) have become contentious. While the U.S. Federal Reserve’s Chair Jerome Powell has told lawmakers that the Fed has zero interest in a system in which it would have a view into user data, CBDCs have become a presidential election Issue.

The program’s participants are not committed to any future phases of research once the first is complete. The collaboration was focused on gaining “further consensus on the use of shared ledger technology in the U.S. financial system,” and the findings will be published once concluded, the statement said.

“The application of shared ledger technology to dollar settlements could unlock the next generation of market infrastructures – where programmable settlements are 24/7 and frictionless,” said Raj Dhamodharan, executive vice president for blockchain and digital assets at Mastercard.

The program will be managed by the securities industry’s internal standards organization, the Securities Industry and Financial Markets Association (SIFMA). Other participants include TD Bank N.A., U.S. Bank, USDF, Wells Fargo, Visa and Zions Bancorp.

Nikhilesh De contributed to this story.

Edited by Sheldon Reback.