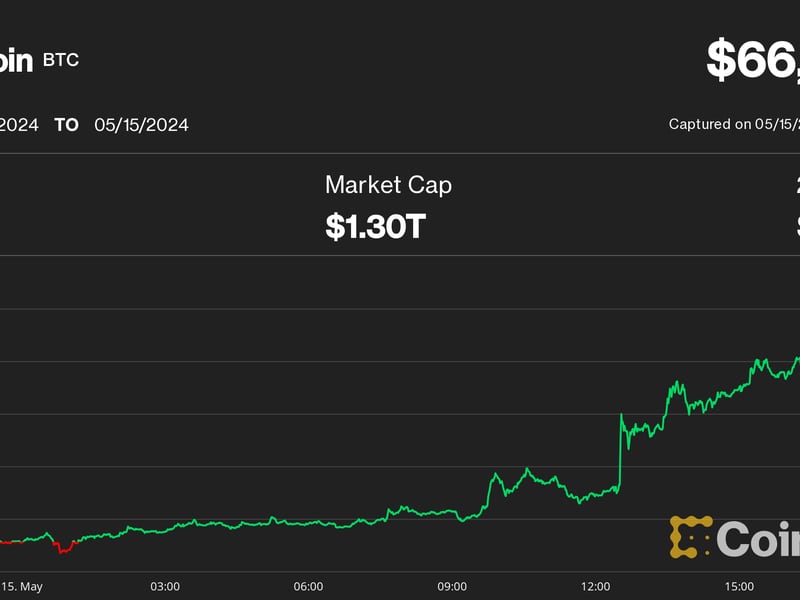

U.S. Crypto Stocks Ride BTC Momentum in Pre-Market Trading

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Shares of U.S. crypto-centric companies were ticking upwards in pre-market trading after bitcoin’s (BTC) price rose to the highest level since May 2022.

BTC climbed above $36,000 for the first time in around 18 months during Asian trading hours on Thursday, and the bullish momentum fed through to U.S. publicly-traded firms with crypto exposure, such as the Coinbase (COIN) exchange, software developer MicroStrategy (MSTR) – which owns a large number of bitcoin, trading platform Robinhood (HOOD) and mining firms Marathon Digital (MARA) and Riot Blockchain (RIOT).

Most of the companies fell Wednesday, and bitcoin’s latest rally appears to be turning their price movement upward. COIN had added about 4% as of 11:03 UTC (6:03 ET). MicroStrategy, which held 158,400 BTC on its balance sheet as of the end of last month, rose almost 5%, while mining firms Marathon and Riot are up 9.8% and 6% respectively.

Robinhood is showing more restrained gains of 2.5%, having closed on Wednesday down over 14% after reporting big drops in its revenue and trading activity earlier this week.

These gains may also reflect fresh optimism of a spot bitcoin exchange-traded fund (ETF) finally being approved in the U.S., following reports that the Securities and Exchange Commission (SEC) has opened talks with Grayscale Investments about converting its bitcoin trust product into an ETF.

Edited by Sheldon Reback.