U.S. Banking System Turmoil Has Spurred Bitcoin Outperformance: Coinbase

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Cryptocurrency markets have displayed resilience in the face of recent upheaval in the U.S. banking system, with bitcoin (BTC) in particular outperforming, Coinbase (COIN) said in a research report Friday.

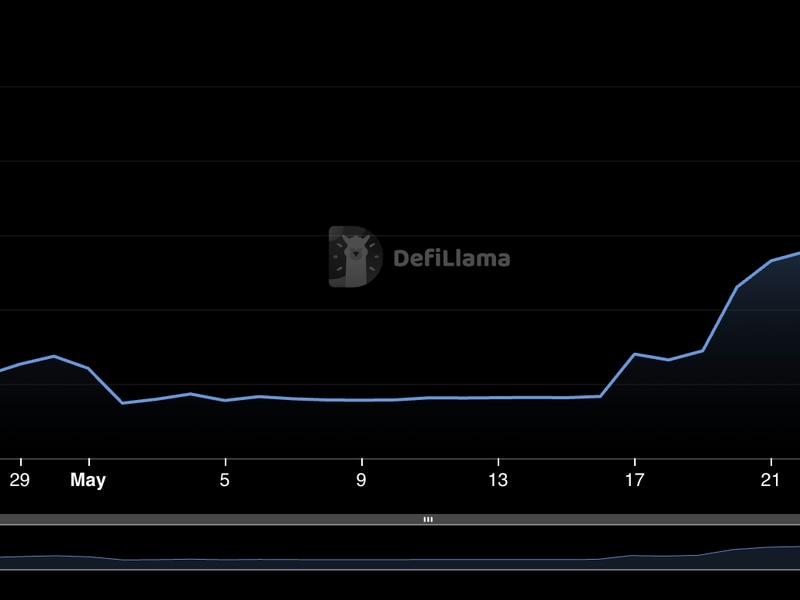

Coinbase notes that bitcoin has outperformed its digital asset peers since the middle of February, with the cryptocurrency’s dominance as a percentage of total crypto market cap increasing to 47.7% from 43.9% during March. This outperformance accelerated early in the month, which coincided with the onset of the U.S. banking system turmoil, the note said.

“Part of the reason is that the stress in the banking system reinforced bitcoin’s store-of-value properties,” the report said, and because BTC mainly exists outside of the traditional financial system “it offers a hedge against current conditions.”

It has also benefited from investor concerns about the regulatory status of other cryptocurrencies, analysts David Duong and Brian Cubellis wrote.

Bitcoin’s correlation to the S&P 500 stock index dropped to 25% at the end of March from a peak of 70% in May last year, the note observed.

The cryptocurrency’s relative outperformance versus peers also reflects investor concerns about the regulatory status of other digital assets, and thinner liquidity specific to some BTC versus stablecoin trading pairs, the report added.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/downloads.coindesk.com/arc/failsafe/user/1x1.png)

Will Canny is CoinDesk’s finance reporter.