U.S. August Job Adds of 187K Vs Estimates for 170K; Unemployment Rate Rises to 3.8%

The U.S. added 187,000 jobs in August versus expectations for 170,000 and up from a downwardly revised 157,000 in July (revised from 187,000).

The unemployment rate for August was 3.8% versus forecasts for 3.5% and last month’s 3.5%.

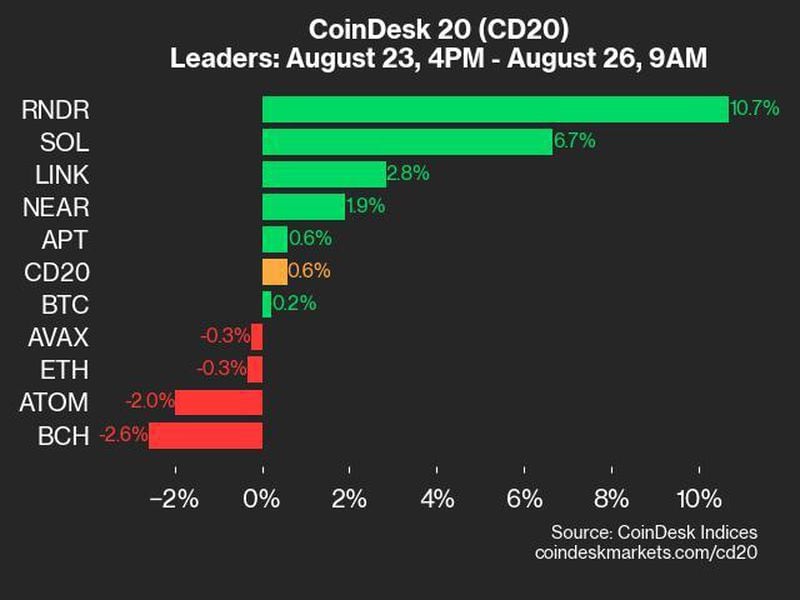

The price of bitcoin (BTC) was little-changed at just above $26,000 in the minutes following Friday morning’s report from the Bureau of Labor Statistics.

It’s been a rough week for bitcoin, which surged to above $28,000 Tuesday following Grayscale’s court victory over the SEC in that company’s quest to convert its Bitcoin Trust (GBTC) into a spot bitcoin ETF. As has been typical of rallies for several months now, bitcoin quickly began reversing those gains. The reversal turned into a full plunge on Thursday, with bitcoin falling more than 4% and below $26,000 as the SEC delayed making decisions on a multiple spot bitcoin ETF applications, including those from BlackRock and Fidelity.

With ETF hopes shelved for what could me many more months, bitcoin bulls might be looking to a softening in the economy and thus lower interest rates as a possible catalyst. While this morning’s report provided some interest in the form of a rising unemployment rate, job growth continues to be chugging along.

Checking other report details, average hourly earnings were higher by 0.2% in August against forecasts for 0.3% and down from 0.4% in July. On a year-over-year basis, average hourly earnings were up 4.3% in August versus forecasts for 4.4% and down from 4.4% in July.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/86c43cde-6640-4a7c-98af-5e25273f0e17.png)

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.