U.K. Details Plan To Regulate Bitcoin, Cryptocurrency Industry

The United Kingdom has released its first consultation on crypto trading and lending regulation within the country.

The United Kingdom has released its plans to regulate the cryptocurrency industry within the country.

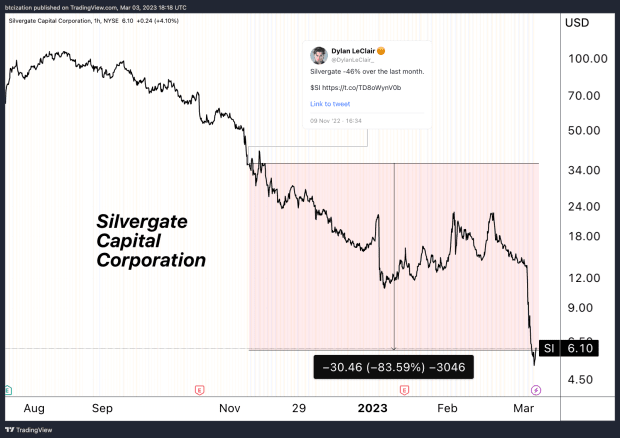

The announcement highlights that “high levels of volatility and a number of recent failures have exposed the structural vulnerability of some business models in the sector,” amongst other reasons, have led to the new set of regulatory guidelines.

Specifically focusing on trading and lending, the report describes how the United Kingdom’s government “will seek to regulate a broad suite of cryptoasset activities, consistent with its approach to traditional finance.” It details how proposals will place responsibility on the cryptocurrency exchanges and firms to define detailed content requirements for disclosure documents, ensuring “fair” standards. In order to ensure the safety of customer funds, the consultation will seek to create a framework with clear guidelines for responsible practices.

“We remain steadfast in our commitment to grow the economy and enable technological change and innovation – and this includes cryptoasset technology,” Economic Secretary to the Treasury Andrew Griffith remarked.

The consultation also highlighted the necessity for cryptocurrency custodial actors and intermediaries to responsibly facilitate transactions and safely store customer assets. This is especially important in light of recent events throughout the cryptocurrency space that have left millions of customers without access to their funds.

Today’s consultation will conclude on April 30, 2023, after which the government will consider feedback and create a response. “Once legislation is laid, the Financial Conduct Authority will consult on its detailed rules for the sector,” states the announcement.