Two Years Later, Stimulus Check Investment Proves Value Of Bitcoin Mining

Two years since the U.S. sent COVID-19 stimulus checks to taxpayers, investment in bitcoin mining stocks has generated significant returns.

The two-year anniversary of the first of three coronavirus economic impact payments (aka, stimulus “stimmy” checks) deposited in U.S. taxpayers’ bank accounts came and went on April 11, and headlines about monetary inflation, possible economic recession and generally grim financial tailwinds are everywhere.

The ethos of Bitcoin stands diametrically opposed to the perceived reckless spending and money printing that characterized the past two years, specifically with Bitcoin miners tasked with issuing new units of bitcoin at predetermined, unmalleable intervals. So, at this point, perhaps it’s appropriate to look back on the returns that individuals who received stimulus checks would have enjoyed if they invested their dollars into bitcoin mining and the alternative financial world it supports.

Bitcoin’s Stimulus Check Narrative

Before parsing mining-specific data, it’s helpful to remember how quickly the narrative that supported investing stimulus money in bitcoin exploded across all social media channels before the first checks were signed or mailed. So large was the support for this meme that multiple polls were later conducted to quantify exactly how many Americans actually exchanged their free fiat money for bitcoin or other cryptocurrencies.

Coinbase, the largest U.S.-based bitcoin exchange by volume, fueled the fresh bitcoin by sharing data that showed a surge in stimulus-check-sized bitcoin buy orders on its platform as checks were being mailed.

Bitcoin’s capped and predictable supply acted as the perfect foil for the inflationary, unpredictable monetary policy being created in real time as a response to the coronavirus situation. The same month that the first checks were mailed, a Twitter account was created that tracked the dollar value of the first stimulus check ($1,200) if it was invested entirely into bitcoin. The account still tweets updates today.

But beyond bitcoin itself, what returns would stimulus check recipients have received if they spent their free money on mining stocks?

Mining Stock Price Performance

Dumping the stimulus dollars sent by the U.S. Treasury into bitcoin mining stocks would have returned a fairly handsome profit over the past two years. Through 2020 and 2021, Americans received three rounds of stimulus checks in April 2020, December 2020 and March 2021 that totaled $3,200.

The biggest question is, of course: What mining stocks to buy?

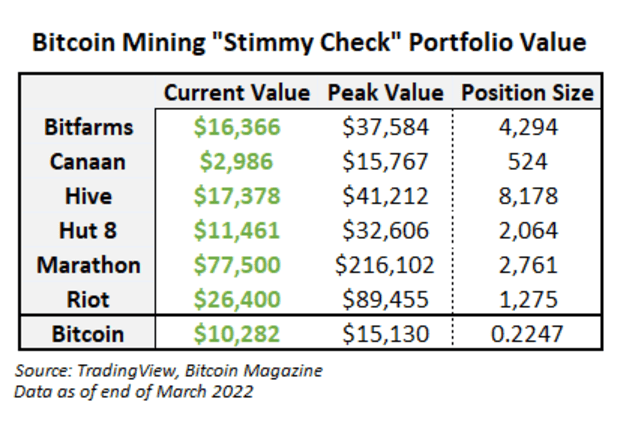

In the table below, peak and current values of what could be called a “stimulus check portfolio” are compared based on investments in one of a few leading public bitcoin mining companies (i.e., Bitfarms, Canaan, Hive, Hut 8, Marathon or Riot). At their peak, any of these investments was worth over $15,000, with a couple in or near six digits. But the stimulus portfolio’s current values are down along with bitcoin itself.

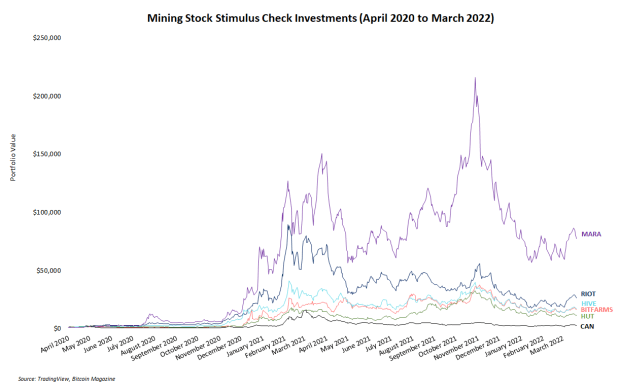

Perhaps some stimulus-check investors would have invested in a basket of mining stocks, instead of just one. But for simplicity’s sake, this article only considers investments in one of a few leading stocks. The line chart below visualizes the time series data for the issuance of each of three checks and the fluctuations in value for each of the companies included in the table above from April 2020 to the time of this writing.

Even though most of these investments are sitting below their highs, their stimulus-check-funded investors sat on triple- and quadruple-digit percentage returns at different periods over the past two years. And to date, these investors are still heavily in the black on these orange coin stocks. Overall, not bad.

Why Mining Stocks?

Instead of just buying bitcoin, some investors prefer to also own mining stocks to get even more exposure to the bitcoin market and potentially outperform bitcoin itself. Mining stocks have a strong positive correlation to bitcoin’s price movement, which means when bitcoin and other top cryptocurrencies are in bullish trends, it’s not surprising to see market tailwinds boost prices for shares of public mining companies. And when bitcoin drops, mining stocks fall too.

But mining stocks are generally considered as a leveraged play on bitcoin, so when bitcoin goes up or down, mining share prices follow the same direction but with larger moves of their own. So, if a particular bitcoin investor is exuberantly bullish, buying mining stocks with the hopes of outperforming bitcoin itself is a reasonable strategy.

Besides using mining stocks to speculate on bitcoin, these investments also offer easy exposure to the mining industry. Mining is a very capital-intensive activity, and much of the industry’s processes and frameworks have yet to fully mature and be standardized. Bitcoin bulls who want exposure to this industry without the headaches of sourcing machines, building a mining site or maintaining the operation often opt to simply buy shares of mining companies.

Similarly, mining stocks also offer strongly-principled bitcoin investors an opportunity to diversify their portfolios and potentially outperform their primary investment (BTC) without allocating capital to alternative cryptocurrencies. Without derailing this article with the politics of altcoins, the primary goal of most active bitcoin investors is to find a way to outperform the price of BTC. Most altcoins characteristically do outperform bitcoin in dollar-denominated returns, but many bitcoin holders reject altcoin investments on principle, if nothing else. Mining stocks are bitcoin-centric investments that can outperform bitcoin in bullish market cycles without compromising the ideals of some bitcoin holders.

In short, where the price of bitcoin will go next isn’t always clear. But whatever direction it takes, mining stocks will almost certainly follow.

If You Invested Your Stimulus In Bitcoin Mining Stocks, You Aren’t Disappointed

For many Americans, the stimulus funds were spent on things arguably much more important than bitcoin mining stocks (e.g., rent payments, utility bills, groceries, emergency savings). But for other recipients who weren’t significantly affected by the economic turmoil following coronavirus response measures, the data visualized in this article shows the free money was an opportunity to invest in essential infrastructure supporting the Bitcoin network. And the short-term returns on these investments were not disappointing.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.