Turkey’s Presidential Elections: BTC Critic Erdogan vs. Crypto Enthusiast Kilicdaroglu

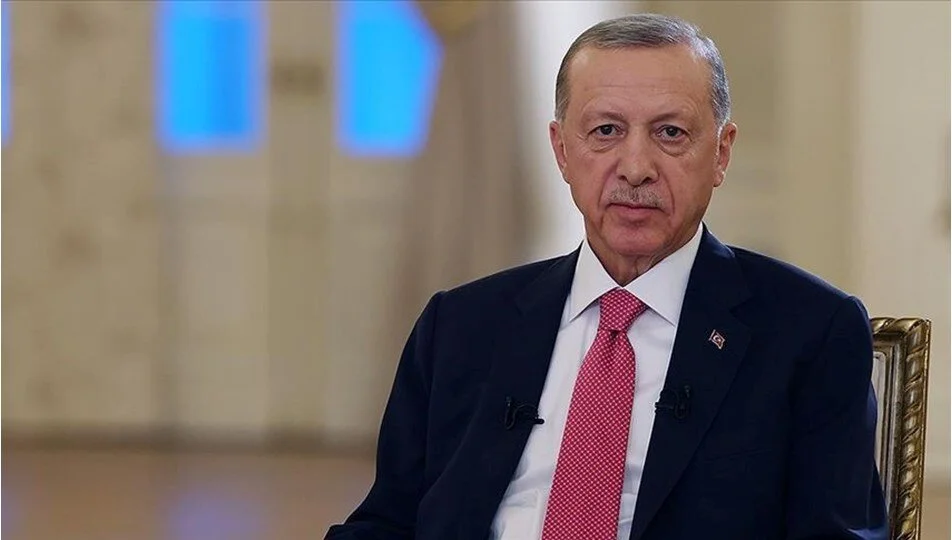

The Presidential elections in Turkey (May 14) could have a pivotal role in the country’s future financial condition. They could also affect the local cryptocurrency industry since the two leading candidates – Recep Erdogan (the current political leader) and Kemal Kilicdaroglu – share entirely different views.

The former declared “war” on bitcoin in 2021 and supported the central bank’s efforts to launch digital lira. Kilicdaroglu stands on the opposite corner as a proponent of cryptocurrencies and Web3.

A Real Chance for a Change

The upcoming presidential elections in Turkey this weekend seem to be the most contested in over a decade, with Erdogan facing a strong rival – Kilicdaroglu.

The current president has been in charge since 2014 and has received huge criticism for some of his political decisions. For one, he took the country to a conservative path, distancing it from the Western world and keeping strong ties with Russia (even though Turkey is part of NATO).

The shaking economic condition of the transcontinental nation during his reign could be another point used by the opposition. The inflation rate in Turkey is one of the highest in the world, while its official currency – the Turkish lira (TRY) – recently plunged to a record low against the US dollar.

Kilicdaroglu’s political view appears to be entirely different than Erdogan’s. He vowed to bring freedom and democracy to Turkey, saying that’s what the youth wants.

“We want free media and complete judicial independence. Erdogan does not think that way. He wants to be more authoritarian. The difference between us and Erdogan is the difference between black and white,” he told the BBC.

Besides standing as the preferred choice for the younger generations, the 74-year-old politician could win solid support from the Kurdish minority since the Peoples’ Democratic Party (HDP) would rather see him as president than Erdogan. Approximately 15% of Turkey’s voters have Kurdish origin.

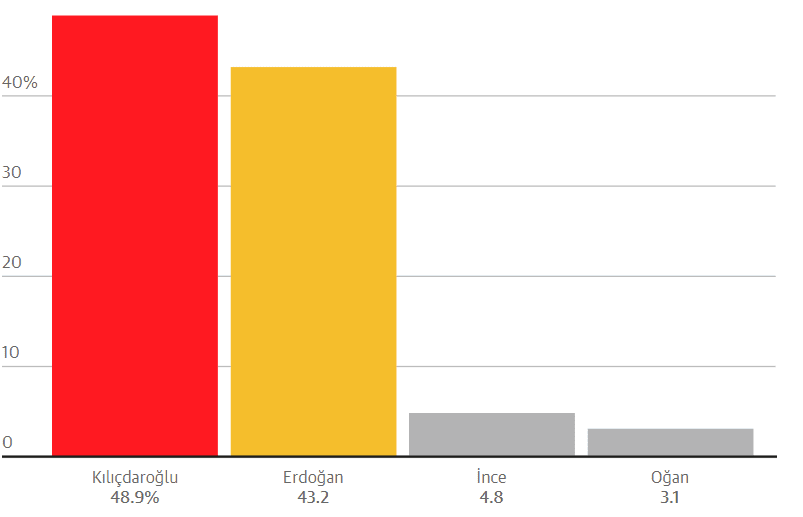

According to a recent poll, Kilicdaroglu could secure around 49% of the vote on May 14, while Erdogan could collect 43%. Still, a candidate needs more than 50% to be elected, meaning a runoff could be on the cards.

Another major difference between Erdogan and his rival is their stance on cryptocurrencies. In the following lines, we will observe how the results of the elections could affect the domestic digital asset sector.

War on BTC for Five More Years

President Recep Erdogan stated in September 2021 that the government is at war with cryptocurrencies and has “absolutely no intention of embracing” them.

“We will not give them such a premium, nor will we. Because we will continue on the road with our money, which is our main identity in this matter,” he added.

Turkey is also among the numerous countries which have not imposed comprehensive supervision on the digital asset sector. The lack of rules was one of the factors that led to the multi-billion scandal related to the crypto exchange Thodex.

According to several sources, the CEO of the entity defrauded customers out of $2.6 billion and left the country. He was captured in Albania two years later and deported back to his homeland to face justice.

Despite Erdogan’s hostile stance on crypto and the chaotic regulatory environment, the Turks have shown an increasing appetite for digital assets (seen as an alternative to the depreciating TRY). In fact, interest was rising after each time the government introduced anti-crypto policies.

However, it remains doubtful (given his controversial views) that the current president will change his position on the matter and give crypto his blessing.

The Opposite Scenario

Kilicdaroglu’s potential win could significantly boost the domestic crypto industry since the candidate has vowed to let it thrive. He is also fond of Web3 technologies, saying:

“As soon as we come to power, we will lift the PayPal ban and expand Web3 platforms. Entrepreneurial ecosystems will be our main stakeholders. We will end the economic, scientific, and political interregnum in Turkey.

A country where our entrepreneurs and young people can exist freely is very close. We will do this with the brightest minds of the world and our country.”

Furthermore, Kilicdaroglu criticized the central bank’s decision to ban crypto as a payment method inside Turkey’s borders.

“I talked to different stakeholders all day. Blockchain and crypto are the only areas where our $1 billion (Unicorn) initiatives will emerge,” he added.

It is safe to assume that Turkish crypto enthusiasts would be among the voters of Kilicdaroglu this weekend.

The post Turkey’s Presidential Elections: BTC Critic Erdogan vs. Crypto Enthusiast Kilicdaroglu appeared first on CryptoPotato.