TTM Bank Crypto Card: Advantages and Overview

[Featured Content]

As cryptocurrencies continue to boom in popularity, many companies have focused on creating crypto cards that are used to pay for everyday goods and services.

As convenient as they may be, many of them come with the same inherent drawbacks that defy the purpose of decentralization. This is where the TTM Bank Card comes into the picture.

The TTM Bank Card – It’s Different

The procedure to start using the majority of popular cryptocurrency cards is oftentimes similar.

At first, the user needs to register on the associated platform, then set up a wallet and transfer funds. Only then they can charge up the card. This procedure forces a potential cardholder to take risks due to partial loss of control over funds. It is against the main principle of decentralization, where holders take full control over their funds. In this sense, most platforms that issue crypto cards are no different from a regular bank that can also exchange cryptocurrencies to fiat.

The TTM Bank cryptocurrency card is different. The platform doesn’t require users to open an account on a third-party platform – they can transfer cryptocurrencies directly to the card account from a wallet of their choice. The cryptocurrencies are converted into fiat upon deposition, and fiat money is stored in the licensed bank.

In this sense, the TTM Bankcard is a bridge between the digital currencies market and conventional financial system that allows holders to pay with crypto cards at any point of sale, online and offline, without compromising the security of cryptocurrency funds.

Receiving and Activating the TTM Bank Card

At first, the user needs to follow the registration procedure on the TTM Bank webpage. The information to be filled in includes e-mail, address, first name, last name, and citizenship. The data is needed to create a personal account on the TTM Bank webpage and order a card.

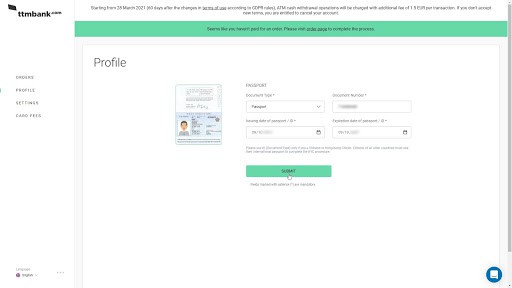

It is worth mentioning that the platform asks to follow the procedure of verifying the user’s identity. It is done automatically via the personal account on the TTM bank webpage. Without verification, the card will not be delivered to the client.

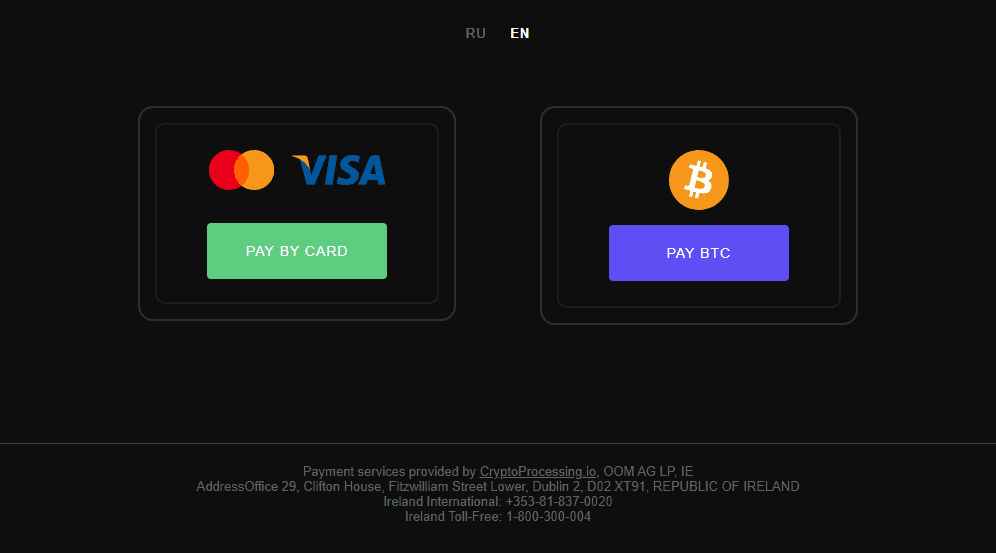

The card can be issued in two versions: virtual and plastic. The emission of a virtual card costs €20. The virtual card can be used via smartphone with iOS and NFC-chip. Android users will be included at the nearest time. The emission of a plastic card costs €100, including the delivery via courier service. The issuance fee can be paid both with a VISA card and bitcoins.

The card can be issued in two versions: virtual and plastic. The emission of a virtual card costs €20. The virtual card can be used via smartphone with iOS and NFC-chip. Android users will be included at the nearest time. The emission of a plastic card costs €100, including the delivery via courier service. The issuance fee can be paid both with a VISA card and bitcoins.

Also, the user will be asked to enter the data in English from the identity verification document. The password and PIN code are set up in the personal account on the TTM Bank webpage. To start using the card, the user needs to charge up the account with cryptocurrencies and check the card at any ATM. If the ATM shows the deposited sum in euros, it is active and is ready for purchases at any shop with a POS terminal that accepts VISA cards.

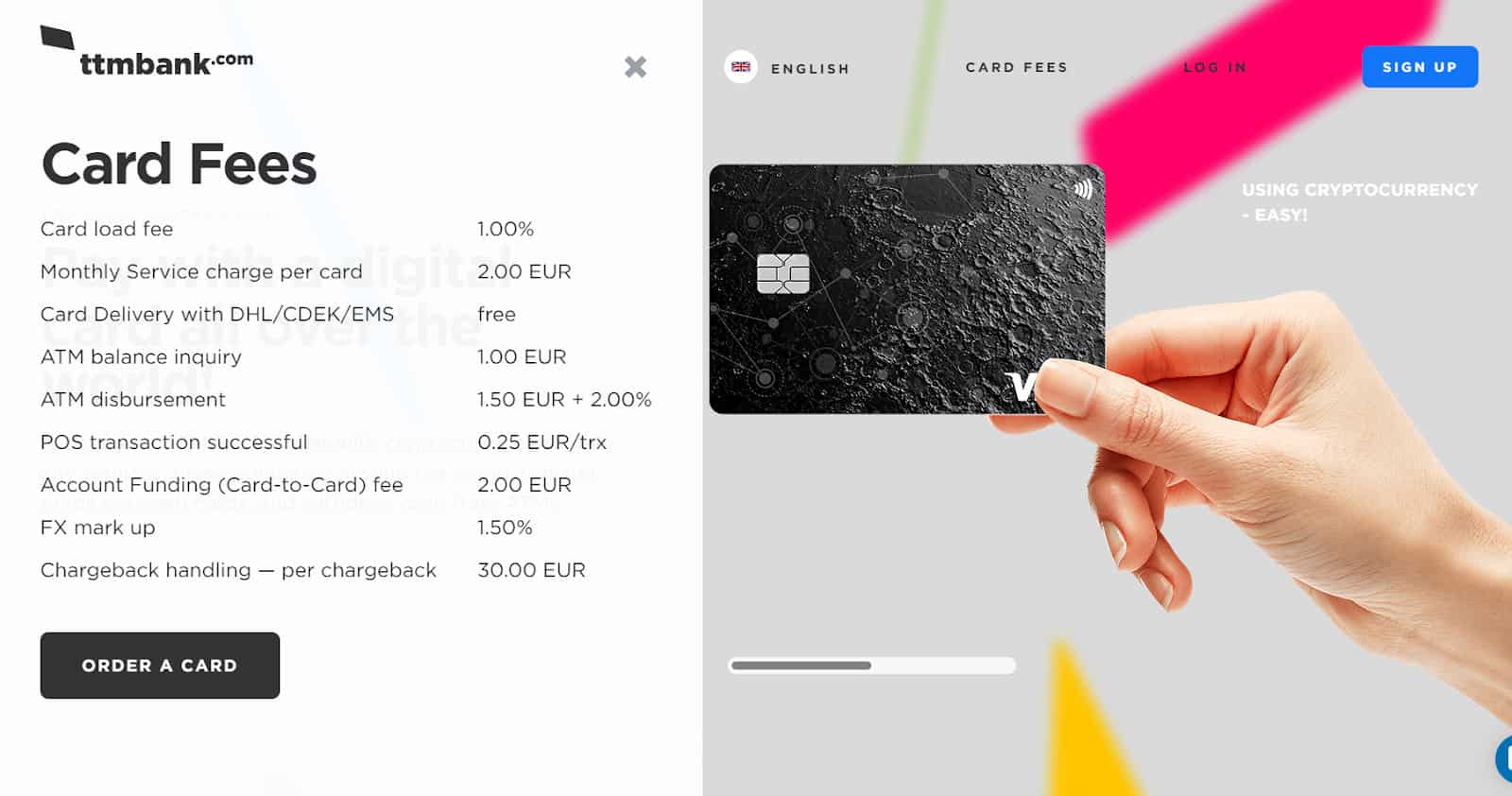

Fees and Limits

The TTM Bank crypto card supports the following cryptocurrencies: BTC, ETH, USDT, BNB, and TRX. Similar to any crypto card, the TTM card has its fees for transactions. For depositing, it charges 1% of the deposited sum. The monthly service charge per card is €2. The ATM balance inquiry costs €1. Withdrawing cash at ATMs costs €1.5 plus 2% of the sum. Cross-conversion between two currencies that are both valued against a third currency costs 1.5% of the sum.

Holders can store up to €5000 per card. The maximum deposit in one transaction is €5000. The daily limit for purchases via POS-terminals is €2500. The monthly limit is €5000.

In comparison with fees and limits of other crypto cards, the TTM bank offer seems adequate.

The TTM Bank Card Advantages

Privacy

The user name is hidden in shopping transactions. Also, there is no need to worry that the bank will block the card at the worst possible time due to transactions worldwide. If the card is stolen or lost, it is possible to block it in the personal account on the TTM bank webpage.

Convenience

There is no need to spend time looking for an exchange to convert crypto to fiat. The card is charged up directly via a wallet, and upon depositing, funds are automatically converted to euro. The transaction swiftness cancels the need to deposit big sums on the card account. For example, the recently added cryptocurrency BNB is converted to euro and deposited to the card account within 3-4 minutes. Therefore, it is possible to charge up the card just before purchases.

Favorable Terms

Besides the euro, it is possible to convert into and withdraw other currencies. In this case, the exchange rate will depend on the bank that owns the ATM.

Support and Accessibility

The support team is available 24/7 via chat on the official web page or personal account. Unlike its competitors, TTM Bank issues cards to residents of almost all countries, excluding a few countries in Africa or the Middle East, Island, North Korea, and the Virgin Islands.

What Are the Disadvantages?

Verification

After registration and filling the user profile, the user will be followed by the message

“It seems that you have not passed the KYC procedure. Please proceed to KYC and start the process in the personal account”.

The know-your-customer (KYC) procedure is needed for the issuance and delivery of the card to the client. It is also not possible to use a virtual card without verification. Some users find the process unclear, but the TTM Bank support team provides detailed instructions upon request.

The Need to Have a Document in English

It is not possible to get a card without a document in English. The information will be needed for card issuance and verification. The system needs the user’s face and the first page of the document to be brought to the webcam. Not all cryptocurrency holders have a document in English. Therefore, it could be a deal-breaker for some users.

Conclusion

Only a small percentage of the total number of cryptocurrency holders have crypto cards. Such a low adoption of crypto cards is caused by several factors. The main cause is the need for a third-party for crypto processing.

But the TTM bank cardholders get full control over their funds and use cryptocurrencies for daily purchases without additional limits and fees. It is proven by more than 40 000 users that have already recognized the TTM Bankcard benefits.