“Trying to Predict the Price of Bitcoin is a Loser’s Game,” Renowned Finance Expert Says

What’s going on with Bitcoin? After triggering everyone’s bullish mood, Satoshi Nakamoto’s creation experienced one of the worst crashes of the year, as if some divine providence was telling traders to take it easy.

Analyses are contradictory, but some experts claim that this contradiction happens because there is no real substance to study, and investing in crypto could be dangerously close to gambling territory.

BTC Trader = Loser

Mark Mobius is one of the experts who support this thesis. The founder of Mobius Capital Partners LLP and acclaimed authority on emerging markets told the Financial News that there was no point in trying to analyze bitcoin’s prices because, in the end, it doesn’t follow any pattern. His words are clear:

“Trying to predict the price of Bitcoin is a loser’s game.”

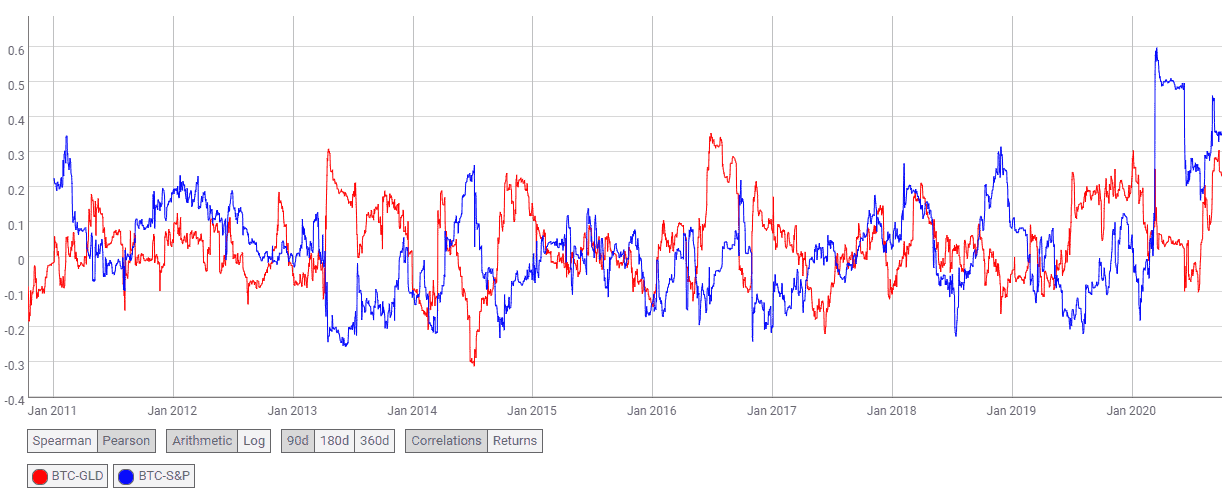

It’s undoubtedly challenging to attempt to make comparisons. Throughout the year, bitcoin has been highly correlated with gold and the SP500, which tends to be somewhat counterintuitive. A recent report from Fidelity Digital Assets said that Bitcoin was “unique” among all investment assets —which in a nutshell means that its price does whatever it wants.

This could strengthen the theory that there’s a lot of randomness in Bitcoin’s performance. For example, at the start of the pandemic, it lost 50% of its value, then —at the peak of the pandemic— it began a sustained bull run. Shortly after the U.S. presidential election, the token accelerated its rise almost into bubble-land.

Mobius bluntly explains that speculating with bitcoin is very similar to winning a lottery —or playing poker, to bring some human skill into the equation:

“[Bitcoin’s price is] based on no reliable information … [It’s rise is a] casino operation based on all sorts of rumours and speculation.”

Bitcoin Critics Delighted After The Correction

Of course, when the price drops, the voices of the Bitcoin critics resonate even louder. It’s not only Mobius who has issued some warnings; the most well-known anti-bitcoin guys of the crypto-verse also had a word or two.

Famous BTC hater Nouriel Roubini said that investing in BTC was worse than betting in a casino because the market could be even less transparent than a regulated gamble.

Investing in BTC is equivalent to take your portfolio to a rigged illegal casino & gamble; at least in legit Las Vegas casinos odds aren’t stacked against you as those gambling markets aren’t manipulated the way BTC is. Instead BTC is manipulated heavily by Tether & whales. 8/n

— Nouriel Roubini (@Nouriel) November 26, 2020

Also, Peter Schiff commented that MicroStrategy’s move to acquire bitcoin was hazardous. The famous gold bug also called it a gamble.

I think its improper for @michael_saylor to gamble shareholder funds on #Bitcoin. If MicroStrategy does not have a productive use for its excess cash, it should start paying dividends. Then shareholders who want to roll the dice on Bitcoin can do so with their own money.

— Peter Schiff (@PeterSchiff) November 25, 2020

Two days later, in a podcast, he criticized Bitcoin for being a highly manipulated market with a lot of potentials to crash

“Regardless of whether or not it makes a new high, I still expect the price to crash … We’re in a very, very vulnerable position right now for a much more substantial pullback … Clearly, there’s a lot of insiders that don’t want that to happen. [It’s a] highly manipulated market to the extent that, if they can drive Bitcoin to a new high, they’re gonna try their best to do it. The question is: Can they succeed?”

It is still too early to talk about a bear market. The correction was expected and some could even say the markets needed it. However, it might not be a bad idea for traders on the bullish court to calm down.

And next time, expect the unexpected… You decide if it’s gambling or theory.