TRX Trades at Premium on Poloniex as Arbitrage Lures Risk Takers

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

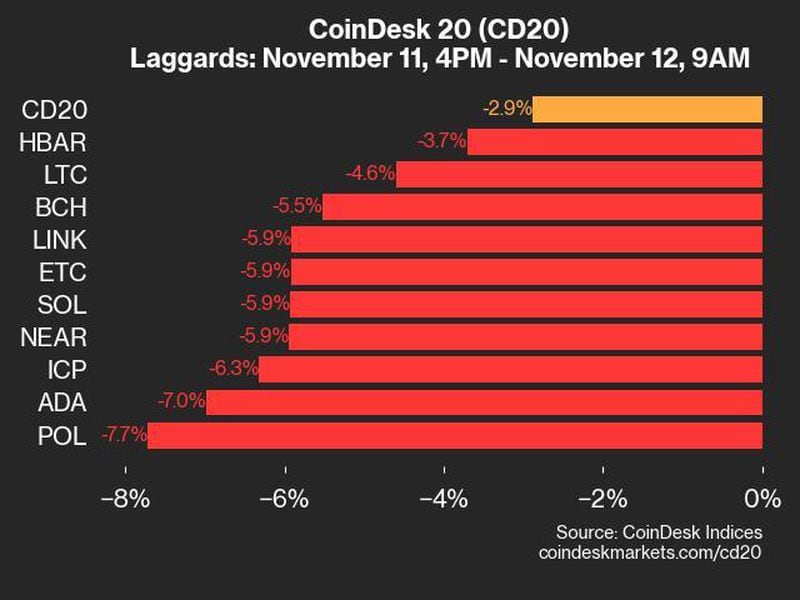

Tron’s native token (TRX) traded at a premium of up to 17% over the weekend on the recently hacked exchange Poloniex, creating a potentially lucrative arbitrage trade.

The premium has since shrunk to around 7%, with TRX trading at $0.10561 on Binance and $0.11005 on Poloniex, according to exchange data.

An arbitrage trade involves buying an asset on one venue and simultaneously selling it for a higher price on another. Traders take on an element of counterparty risk as they need to ensure capital can eventually flow between both venues.

Poloniex was hacked for more than $114 million last month, an event that prompted the exchange to temporarily freeze deposits and withdrawals.

Tron founder Justin Sun told CoinDesk on Monday that “TRX withdrawals are open,” despite the asset trading at a premium on Poloniex.

The trade-off with scooping up cheap TRX on Binance and selling it at a higher price on Poloniex is that certain assets are still locked from being withdrawn. Poloniex said that it has deployed “a phased approach” to withdrawals starting with TRX, which will be followed by bitcoin (BTC), ether (ETH) and tether (USDT) over the coming weeks.

As a result, traders would have to hold assets on Poloniex they are available to withdraw.

Edited by Sheldon Reback.