Trump Polymarket Odds Briefly Dip After His No. 2 Bull Adds Bet on Harris

Donald Trump’s odds on Polymarket of winning the U.S. presidential election temporarily dipped Wednesday after the prediction market’s second largest holder of “yes” shares in a victory for the Republican nominee placed bets on his opponent.

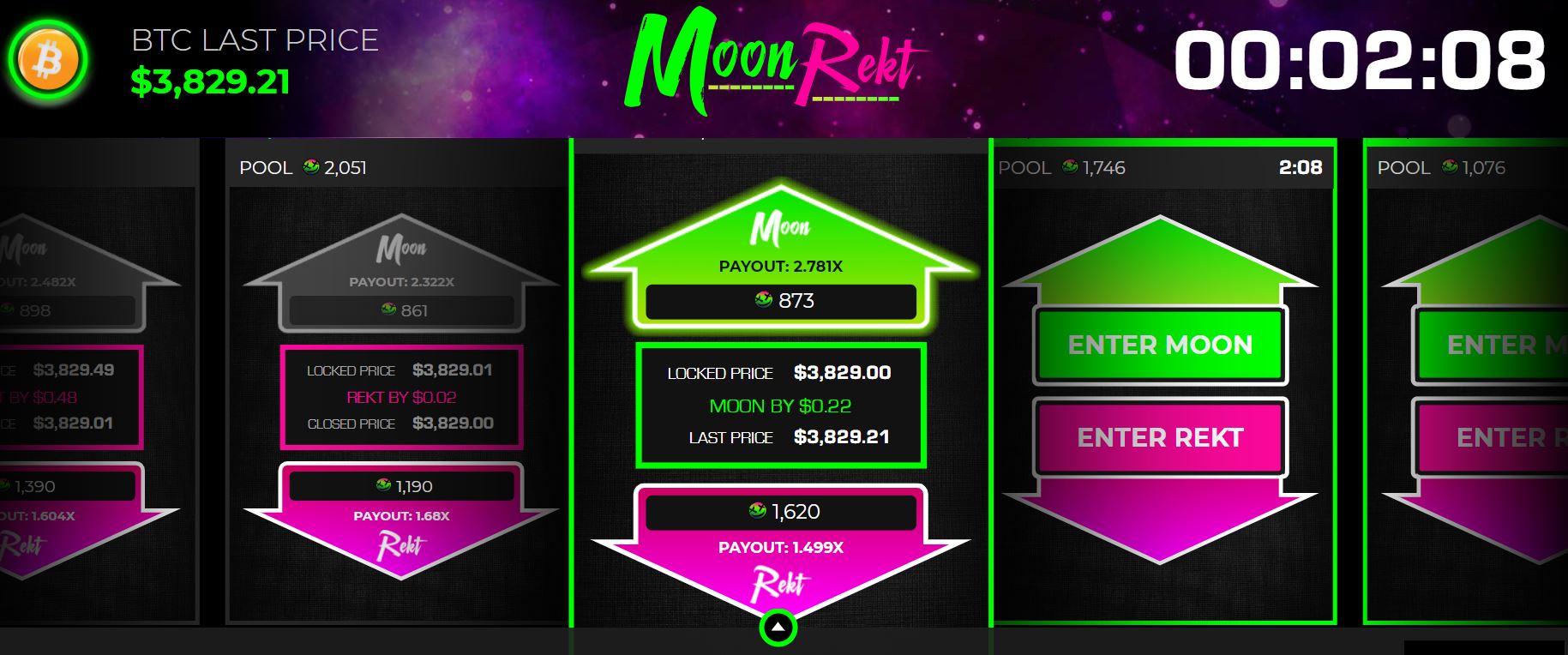

Theo4 has amassed 12 million “yes” shares in a Trump victory, second only to Fredi9999. These whales’ trades have come under scrutiny from market watchers and media outlets in the last week or so (Some observers have speculated that these two, and three other Polymarket accounts, are controlled by the same individual or group, outside the U.S.). Wednesday afternoon in New York, however, Theo4 appeared to hedge his (or her or their) bets, buying blocks of “no” shares for Trump and “yes” shares for Kamala Harris, before resuming Trump “yes” share purchases.

01:48

Bitcoin Nears ‘Golden Cross’ Amid Rising U.S. Treasury Yields Concerns

02:02

Nigeria Frees Binance’s Gambaryan; Peter Todd Goes Into Hiding After HBO Doc Names Him Satoshi

13:23

Navigating the Crypto Waters With Nick van Eck

01:44

Bitcoin’s $4.2B October Options Expiry May Bring Short-Term Volatility

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SGFNR4ASXNHPFCHT6UUX6LS5DQ.png)

Each share pays out $1 (in the USDC stablecoin) if the prediction comes true and zero if not, so the price, expressed in cents on the dollar, reflects the market’s assessment of a candidate’s probability of winning (in the case of “yes” shares) or losing (for “no” shares).

Trump’s odds slipped from 65% before Theo4’s uncharacteristic trades to as low as 59%, before rebounding to as high as 64%. At press time they were at 63%.

Flip Pidot, a veteran prediction market trader who has been closely tracking Polymarket whale trades, attributed the short-lived dip to Theo4 in a post on X (formerly Twitter).

In recent days, a flurry of mainstream media outlets and (often pro-Harris) social media posters have suggested, with varying degrees of certainty, that pro-Trump forces are manipulating Polymarket to make his chances look higher than they are. These claims cite heavy buying by Fredi9999, Theo4, and other Trump whales.

Betting market proponents counter that anyone who tried to distort these markets would create opportunities for traders with solid information to eat their lunch.

Polymarket bars U.S. traders under a settlement with the Commodity Futures Trading Commission, although clever Americans have circumvented the geofencing using VPNs. Bloomberg reported this week, citing unnamed sources, that Polymarket is taking fresh steps to make sure U.S. users are not trading on its platform, though the article did not spell out those measures.

The CFTC has been trying to stop election betting at exchanges it regulates, proposing a rule against such activity and unsuccessfully fighting the Kalshi prediction market in court.

Nevertheless, political betting is one of the 2024’s big trends, with Polymarket logging $2.3 billion in volume on its main U.S. presidential contact.

Edited by Stephen Alpher.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/d1d917b0-ea51-4a6f-9c33-dec206570812.png)

Marc Hochstein is CoinDesk’s Deputy Editor-in-Chief for Features, Opinion, Ethics and Standards. He holds BTC above CoinDesk’s disclosure threshold of $1K and de minimis amounts of other digital assets (details in bio).

Follow @MarcHochstein on Twitter