Trump Derides Bitcoin and Nothing Happens (Except a Price Increase)

President Donald Trump finally broke his silence on Bitcoin, and the result was disappointingly predictable — and bland, compared to the usual flare that lights up his Twitter rants.

Giving him the rare opportunity to talk about something more orange than his spray tan, Trump announced on Twitter, his favored forum, that he is “not a fan of Bitcoin and other Cryptocurrencies, which are not money and whose value is highly volatile and based on thin air.”

He then went on to cite Washington, D.C.’s most referenced use case for cryptocurrency (drugs and “other illegal activities”), to which we responded by reminding him that cash is overwhelmingly used to conduct illicit purchases.

Incidentally, bitcoin has rallied 3 percent following Trump’s comments, everyone (on Bitcoin Twitter, at least) had a good laugh about it and the topic was beaten to death by the mainstream press within an hour of the comments.

Trump also took the opportunity to take a swipe at Facebook’s not-actually-a-cryptocurrency, Libra, which he said “will have little standing or dependability” and whose association will have to “seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks, both National and International.”

Reactions

The comment section of Trump’s tweet thread became a playground for rebuttal as all walks of Bitcoin Twitter descended on the tweet faster than Trump cycles through staffers.

“Mr. President, one could say the same of unregulated fiat currencies, like the privately operated U.S. dollar. The advantage of cryptocurrencies is that they are predictable and transparent. Regulated or not, useful tools can be used for good and evil. Don’t let the U.S. fall behind,” Kraken CEO Jesse Powell warned.

Others were more flippant with their clapbacks. CryptoCobain, for instance, wrote, “I agree Donald. Bitcoin is a criminal tool. Bitcoin was made by Craig Wright maybe you should put him in jail,” while another commenter wryly observed that, once upon a time, you could actually buy a condo in Trump’s New York City hotel for bitcoin.

Justin Sun used it as an opportunity to invite Trump to his million-dollar lunch with Warren Buffet, another famed bitcoin bear. And Saifedean Ammous used it as an opportunity to promote his book, “The Bitcoin Standard” (which, in fairness, could actually teach the sitting president a thing or two).

‘What You Call Thin Air, We Call Math’

Conservative journalist Kassy Dillon chimed in with: “Well, that’s how you lose the libertarians … If you still had any.”

A few scrolls down, and you’ll see Bitrefill COO John Carvalho’s impassioned and pointedly Libertarian take:

“What you call money, we call slavery. What you call thin air, we call math. What you call unlawful behavior, we call freedom.”

Echoing the ethos behind Carvalho’s words, Blockstream CEO Adam Back said, “Bitcoin is the free market pulling society back from the cliff of dystopian geopolitical failure, by separating money from State. Via dilluting [sic] the dystopian economic influence of State power. It’s a free market decentralised counter-veiling opt-out force.”

When I opened my inbox this morning, I was greeted by a particularly riled and caustic reaction, whose author, at one point, compares Trump’s ranting to a deflating balloon “[farting] its way around the room in all directions.”

“Imagine giving Donald Trump a money printing machine and then asking him kindly not to use it. My thoughts exactly … This is why the U.S. economy is $22 trillion in debt and why the average lifespan of a government backed fiat currency is 27 years,” George McDonaugh, the CEO of the London-based KR1 blockchain investment firm, wrote in the email. “[Bitcoin] belongs to everyone, always. Think software for money with a free licence to use it how you wish in perpetuity. It’s not possible to win a fight against this kind of utility, and just like all the other software we’ve invented, in time it will eat the world. No wonder old men in suits are shaking their fists at it.”

Bitcoin vs. Trump’s Status Quo

Trump, entrenched as he is in the status quo, obviously has his reasons to defy Bitcoin. As the president of the world’s economic and political leviathan, it’s no surprise he preached in his tweet thread that the “only one real currency in the USA … is stronger than ever, both dependable and reliable. It is by far the most dominant currency anywhere in the World, and it will always stay that way. It is called the United States Dollar!”

Bitcoin, as a global and decentralized monetary system, stands in opposition to the dollar as the world’s reserve currency.

“Here’s what you’re up against. Who has a vested interest in things staying the way they are? The government. This should not be a surprise,” said Joe Kernen of CNBC’s Squawkbox, who has become a fan favorite of Bitcoiners for his bitcoin-aligned stances as of late.

Meanwhile, the Federal Reserve is debating cutting interest rates as global economic instability looms. President Trump, for his part, pressured the apolitical body earlier this summer to cut rates, ostensibly to keep the market afloat as he vies for re-election come 2020.

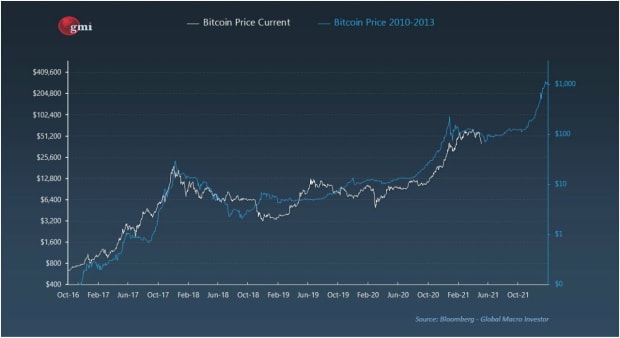

Also meanwhile, Bitcoin, which is up 300 percent over the year, doesn’t have an interest rate and it doesn’t give a lick about Trump’s approval, or lack thereof.

The post Trump Derides Bitcoin and Nothing Happens (Except a Price Increase) appeared first on Bitcoin Magazine.