TrueUSD’s Borrowing Rates Jumped to 100% as TUSD Soared to $1.20: Kaiko

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Traders quickly jumped in to take advantage of TrueUSD’s (TUSD) depegging event earlier to capture a potential 20% gain – paying an outrageously large amount in fees to be able to do so.

Crypto analytics firm Kaiko said in a Wednesday newsletter that onchain traders utilized Aave and Compound, two popular lending protocols, to borrow large amounts of TUSD and quickly swapped these holdings for USD Coin (USDC), another dollar-pegged token.

Such a move was to effectively short, or bet against, TUSD from its elevated price. However, neither Aave nor Compound had a large supply of TUSD, which caused borrowing rates to hit over 100% annualized on both protocols.

Kaiko said these token conversions appeared to be organic instead of driven by automated bots. The firm added TUSD’s depegging likely occurred due to the lack of liquidity backing its intended $1 peg.

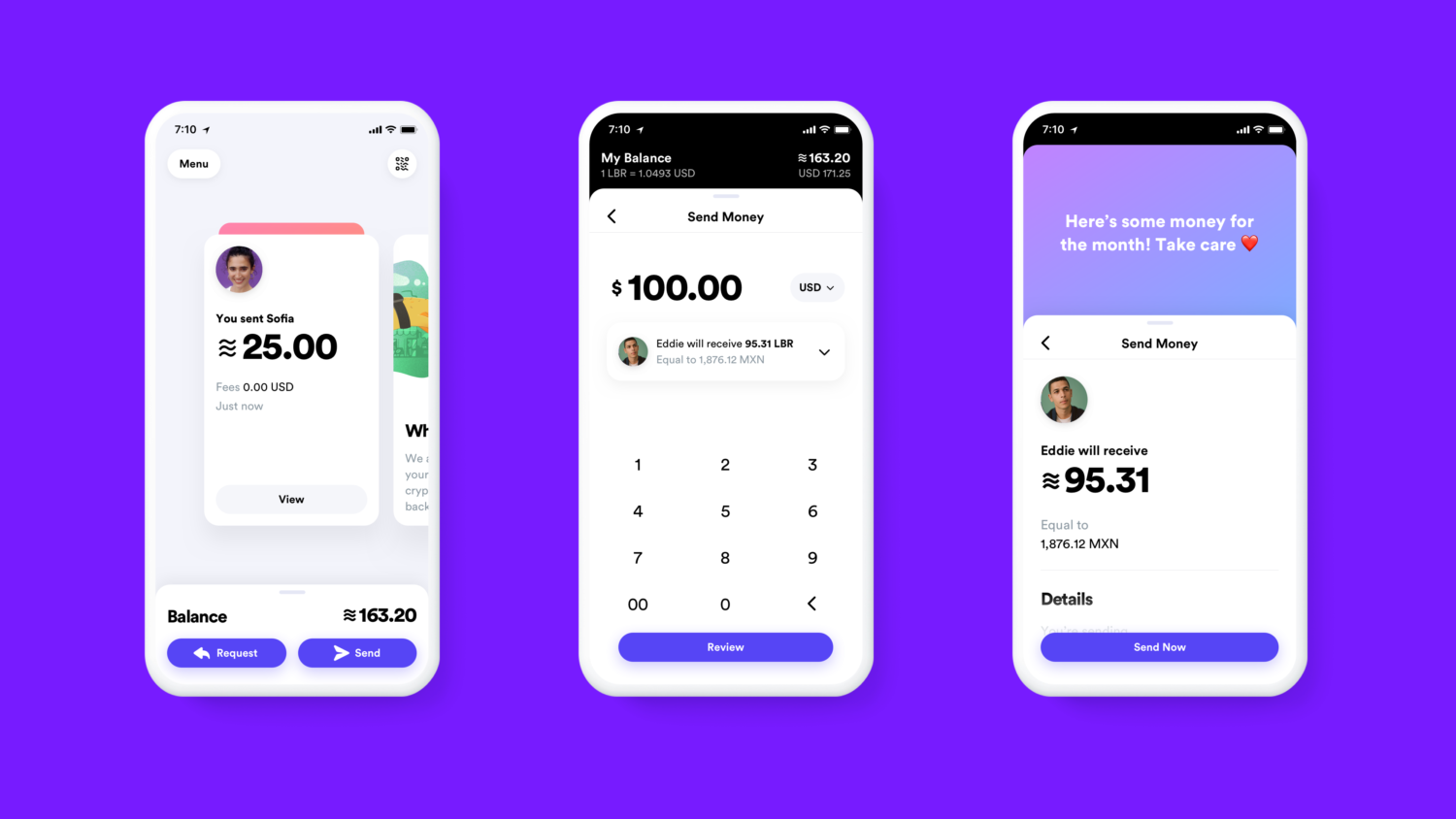

“Binance has recently been promoting TUSD, making BTC-TUSD the only zero-fee pair on the exchange,” Kaiko wrote. “This quickly made Binance BTC-TUSD one of the highest-volume pairs in all of crypto despite TUSD being relatively unknown amongst stablecoins.”

“Additionally, TUSD liquidity has not kept pace with its volumes, making a depegging like this more likely,” it added.

Binance has shied away from binance USD (BUSD), which it offered in association with crypto firm Paxos since regulatory troubles earlier this year. Paxos said at the time it would stop minting new BUSD tokens at the direction of the New York Department of Financial Services (NYDFS).

Traders have quickly adopted TUSD on Binance. Bitcoin trading volumes paired with the token clocked over $1 billion over the past 24 hours, second only to tether-denominated trading at $1.5 billion.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.