Tron’s Takeover of Steemit Is Internet History Repeating Itself

Tron’s Takeover of Steemit Is Internet History Repeating Itself

Valerian Bennett is Managing Director of the Pop Network Foundation, which is dedicated to helping creators and communities find their freedom by decentralizing the streaming economy. He is a graduate of the BoostVC accelerator (Tribe 8) and limited partner at Amentum Capital.

On December 23, 2019 as many around the world were settling into the Christmas holiday, a crypto disaster struck. Google-owned YouTube, the largest streaming media site on the web, started banning scores of content creators related to blockchain and cryptocurrency.

The outrage was swift and justified.

Many on Crypto YouTube, like Chris Dunn and IvanOnTech, have spent years developing their brand and building massive content libraries while attracting a large number of followers…all to have the result of their own labor arbitrarily taken from them. For some, like Alex Saunders, the purge had the effect of shutting down his primary business and financially threatening his family.

Even ethereum creator Vitalik Buterin had some of his cryptocurrency research videos removed under the bizarre label of “Harmful or dangerous content.”

Then, just as quickly as the purge happened, it stopped. After days of unrest, YouTube announced the whole thing was a mistake and that everything would go back to normal.

Q: So, why did the ban happen in the first place?

A: No one knows, except Google and YouTube.

Q: And, why don’t they tell us?

A: Because they don’t have to. It’s their platform, their rules, and if you don’t like it you can leave.

Q: But, the value of YouTube is built upon the videos that users submit. Surely YouTube must be accountable to its users, right?

A: Wrong.

This is the nature of centralization. When sufficient power aggregates to a central authority, that authority inevitably drifts away from representing the source of its power and ends up existing solely to preserve and expand power for itself. In the Crypto YouTube case, it means arbitrarily hurting creators and their communities without providing any recourse for grievance.

The key attraction of a decentralized economy is that it takes power and profits away from large institutions and corporations, and puts them into the rightful hands of the people.

As Charles Hoskinson, creator of Cardano, summarized the episode, “Absolute power and centralization ALWAYS turns into this.”

So, if absolute power is destined to corrupt absolutely then how do we get from under the thumb of concentrated authority and, instead, create a system that is built for, by, and accountable to its users above all else?

The Freedom Protocol

Bitcoin provided one answer for this with its introduction of peer-to-peer electronic cash. As a measure of resistance to the unchecked power of banks and governments over the financial system which we all use, bitcoin created a decentralized system of money. In this blockchain-based system, governments and banks are not only unnecessary to move money, they are irrelevant.

This transformative power applied to a myriad of industries is one of the reasons there is so much genuine energy around blockchain.

Could blockchain technology make central authorities of social media, like YouTube, unnecessary and irrelevant while creating a system that is built for, by, and accountable to its users above all else? Yes!

We strongly believe in this future. Because we are building it.

Our mission at POP Network, a blockchain media platform, is to help creators & communities find their freedom by decentralizing the streaming economy.

Unlike YouTube, POP Network works peer-to-peer with blockchain crypto-economic incentives. Nodes share media independently rather than relying on a central server. The benefit of decentralization is that creators and their communities can no longer be “de-platformed” because, in essence, they are the platform.

As bitcoin is to money, POP Network is to media. Both feature the principle of decentralization combined with blockchain technology to create a system meant to reward the participants for the value they create while retaining self-sovereignty.

In this vision of the future, it is critical to note both networks make one big assumption: that “blockchain” and “decentralization” continue to evolve together.

But, what if an alternate future unfolds?

If bitcoin is described as open, decentralized, permissionless, and censorship-resistant and is the prime example of blockchain and decentralization evolving together in the financial sector, then its inverse example is now coming to life. We have the first vision of what a closed, centralized, censorable state-sponsored digital currency would look like.

Say hello to the “Digital Yuan.

Last fall The People’s Bank of China (PBOC), the nation’s central bank, said the goal of their project is to replace all physical money with a new digital currency. Although the stated purpose is to give the government real-time influence on the economy, the functional result is improved state surveillance, advanced social engineering, and absolute central control.

This is Jeremy Bentham’s Panopticon brought to life.

Now imagine this alternate ending applied to our YouTube censorship example.

Not only would creators have their videos removed, they would have their bank accounts closed and their savings confiscated. And, anyone that watched or shared those videos could also have their accounts closed and money seized. Object to this policy and guess what happens to you?

Given that potential outcome, would anyone watch a blockchain or cryptocurrency video again?

This type of economic censorship and social engineering is the nightmare scenario in the burgeoning decentralized streaming economy.

Unfortunately, this scenario is not so far-fetched.

The Rebirth or Death of Steem?

Tron’s recent acquisition of Steemit, a blockchain-based blogging and social media website built on top of the public Steem blockchain, once again raises the question of whether decentralized media can remain that way. Tron also bought BitTorrent, a company built on top of the open bittorrent peer-to-peer file sharing protocol.

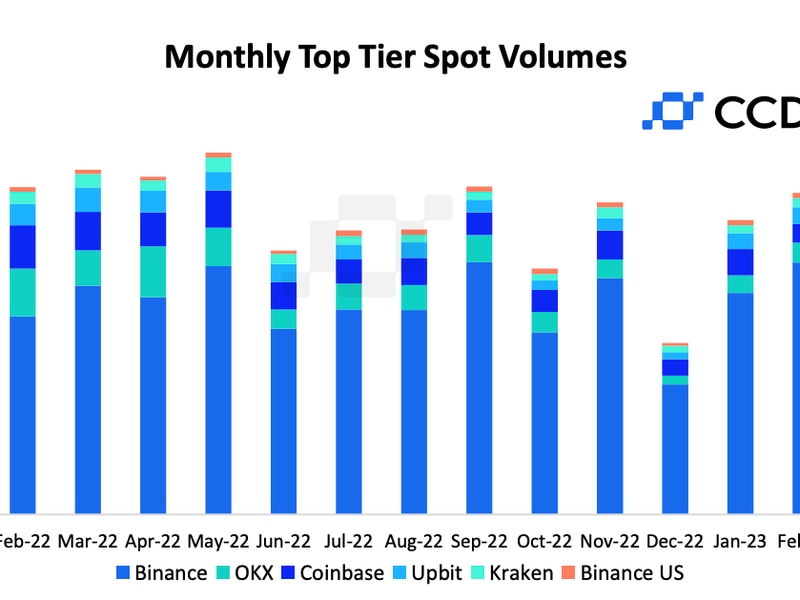

Tron bills itself as “an ambitious project dedicated to building the infrastructure for a truly decentralized Internet.” But it seems Tron colluded with top exchanges Binance, Huobi, and Poloniex to stake custodial Steem (i.e. users’ funds) and replace elected DPoS witnesses on the Steem blockchain with their own. Effectively, they are mounting a hostile takeover of a public blockchain, making it subservient to a private corporation.

Even before this, Tron had an unspoken history of removing competitors to its native applications at the project level. POP Network has first-hand experience as it was originally developed on Tron before being excluded for competing too strongly with Tron’s native BitTorrent Token.

This iron-fisted control goes all the way down to individual content creators as Tron’s two flagship streaming products BitTorrent Live and newly acquired DLive. greet visitors with an ominous warning: No Political Speech.

Formerly decentralized media projects BitTorrent, DLive, and now Steemit, are controlled by corporations that has demonstrated both an ability and willingness to govern based on the same standards as old-line centralized projects. They govern in their own interests above user interests and without accountability.

Although we can’t be sure of the future, consolidation of the biggest pieces in a decentralized movement should be cause for deep contemplation.

History repeats

Maybe we shouldn’t be surprised by the promise of freedom, openness, and neutrality of public blockchains being co-opted. We saw this story play out in the 1990s as the ideals of the original internet were overrun by moneyed interests.

It is clear that institutions seeking to utilize blockchain technology for their own benefit, while holding values in opposition to the intended push toward decentralization, will continue to grow in number. But will those institutions grow in value?

The key attraction of a decentralized economy is that it takes power and profits away from large institutions and corporations, and puts them into the rightful hands of the people. This measure is typically reflected in the value of the native cryptocurrency of the network. If public blockchains are used just to reaggregate power and profits to private corporations or central governments, then what is their value to the users of those systems?

“Ultimately, I think the ongoing trend toward increasing centralization inevitably leads to a situation where a blockchain loses its entire raison d’etre as a permissionless platform with strong assurances and what we’re left with is a permissioned network that resembles today’s centralized networks but built on less efficient infrastructure. That doesn’t sound very interesting or exciting to me,” says Spencer Bogart, partner at Blockchain Capital, of this inherent conflict.

Blockchain without decentralization doesn’t sound very interesting to me either.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.