Trading Cryptocurrencies on BITmarkets: The Complete Guide

Cryptocurrency trading has become particularly popular throughout the past couple of years as the asset class forayed into the mainstream.

With that, many cryptocurrency exchanges compete to provide the best user experience and harbor as many traders as they can.

BITmarkets adopts a different approach towards exchanging crypto for both retail and corporate clients. The platform has opened up the existing cryptocurrency markets for everyone, regardless of their location.

The company is on a mission and strives for mass adoption of crypto by making it easy to understand, secure, simple, and trustworthy – all at the same time.

The following is a comprehensive guide and a walkthrough of the BITmarkets platform that encompasses everything you need to know to start trading crypto today.

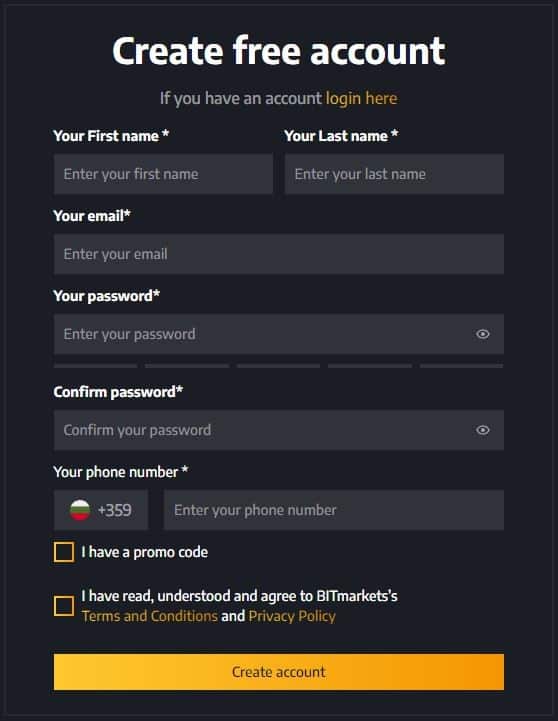

How to Register on BITmarkets?

First things first, you will need to create an account. The procedure is very straightforward, and you will only need to provide:

- First and last names

- Password

- Phone number

Make sure that the phone number you input is one that you have access to because you will need to verify your account through it. The same goes for your email. This is the first sign that the exchange is taking appropriate measures to prevent spam accounts.

Once you have your account registered, it’s time to complete the verification process. You will need to do this to start trading and to use your account to its fullest capacity. This also represents another sign that the platform is taking the necessary steps in abiding to laws & regulations. Ultimately, that’s good for the user.

You will need to upload one of the following documents:

- ID Card

- Passport

- Valid driving license

Apart from that, you will also have to provide proof of residence. BITmarkets will accept:

- Recent utility or gas bill

- Bank statement / credit card bill

- An official letter that must include: the issuer, date, full name, and address

Once you’ve done this, you will also have to take a selfie with your ID and upload the picture.

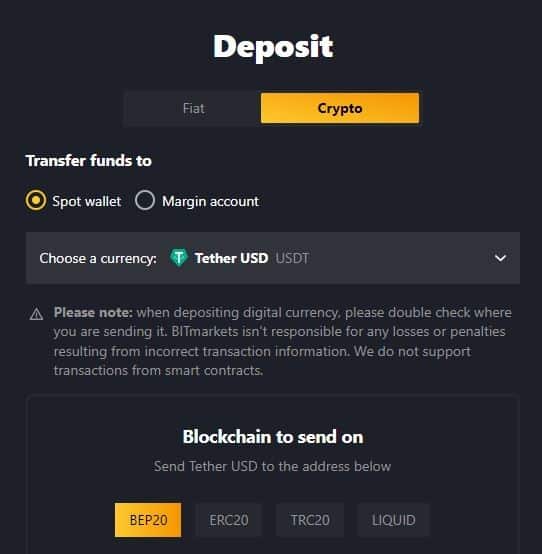

How to Deposit or Withdraw Funds?

As soon as you have your account verified and fully functional, it’s time to learn how to deposit some funds. Staying true to its promise of making crypto trading accessible, the platform supports both fiat and crypto deposits. Keep in mind that if you want to deposit fiat currencies, you must complete the verification process.

For the sake of this guide, we’ve decided to deposit some USDT – hence crypto and the process is incredibly straightforward.

Hit the deposit button on the top navigation menu, and select the crypto option and the cryptocurrency that you wish to deposit from the drop-down menu. The system will generate an address to which you can deposit the funds. Specifically for USDT deposits, you can also choose between different networks such as:

- BEP20 (BNB Chain)

- ERC20 (Ethereum)

- TRC20 (Tron)

- Liquid

This is quite convenient. Sometimes, when network usage is high, blockchains such as Ethereum can see their transaction fees grow exponentially higher, making it economically unviable to send funds, especially in smaller amounts. That’s when you can choose another network, such as the BNB Chain or Tron, which are known for their substantially lower fees and transaction speed.

Withdrawing is also incredibly straightforward. All you have to do is go to your wallet and click on the “Withdraw” button for the respective cryptocurrency.

How to Trade Cryptocurrencies on BITmarkets Spot?

Trading on BITmarket’s spot exchange has been made very straightforward. The platform itself seems suitable for both beginners and expert traders as it boasts all the necessary tools for successful trading.

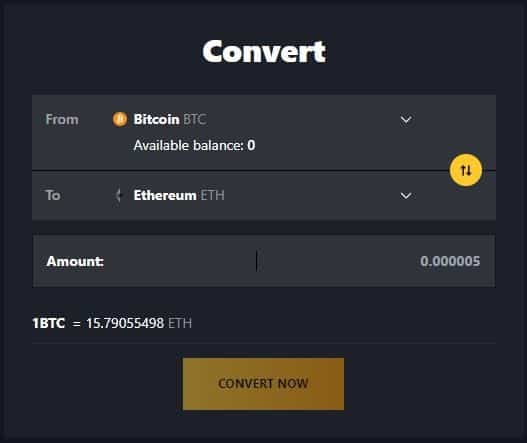

One of the tools is the function to convert different currencies. It makes swapping between different cryptocurrencies particularly easy and is suitable for beginners. This is what it looks like:

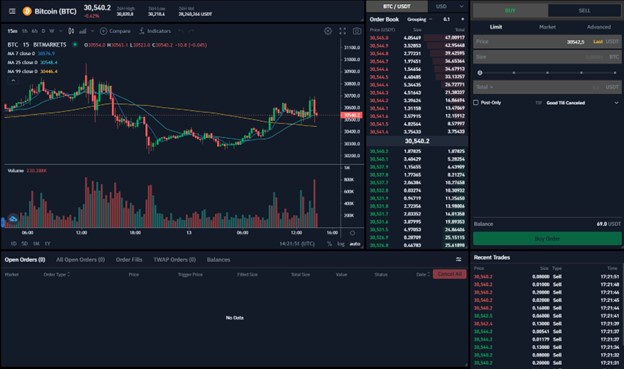

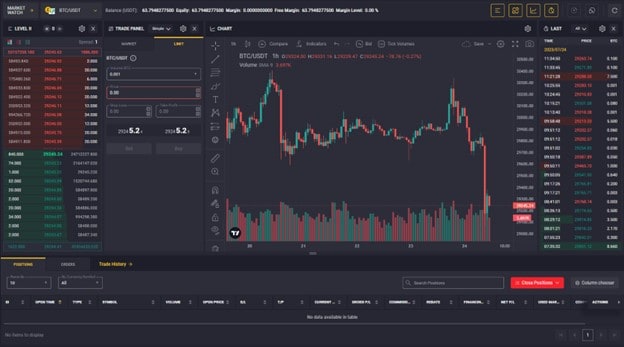

For those interested in more complex trading, this is what the interface looks like:

You can see the chart (which can be customized with a range of different indicators) on the top left, the order book on its right, as well as the different order types on the right side of the interface.

Right below the chart is where your positions will be visible, as well as where you can find other important information such as the order quantity, entry price and time, and so forth.

As we mentioned, BITmarkets has equipped traders with a number of order types so that they can execute trades precisely as per their trading strategy. These include:

- Limit order

- Market order

- Stop limit

- Stop market

- Take profit limit

- Take profit market

- Trailing stop market

More advanced traders can also take advantage of TWAP orders, especially when they want to execute larger order quantities without impacting the market.

In terms of supported cryptocurrencies, the spot exchange, as well as the futures exchange, offer a tremendous variety. These include, but are in no way limited to:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Polkadot (DOT)

- Cardano (ADA) and many others.

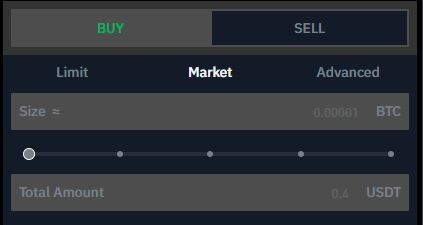

In essence, trading on the spot exchange is very easy, and all you have to do is select the order type. The easiest way to go about it is by initiating a market order, which will execute your trade immediately at the best available price from the order book. All you have to do is input the quantity and hit the buy button – it’s that easy.

How to Trade Cryptocurrencies on BITmarkets Futures?

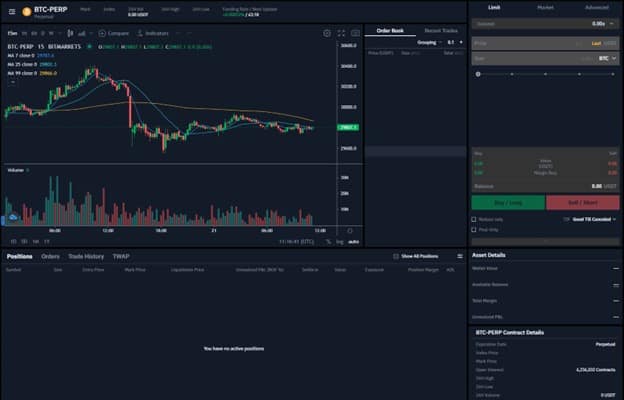

You will notice that the futures trading interface looks very similar to that of the spot one. There are, however, a few differences.

Right off the bat, users are able to set the leverage up to 100x on specific cryptocurrencies, such as Bitcoin. This essentially allows them to open a position worth 100 times the margin they decide to post.

So, for instance, you can use $10 and open a position worth $1000. What’s the catch? Well, there’s something known as a liquidation threshold or liquidation price. This is the price that, if reached, will automatically close your position, and you will then lose your collateral. In the case of using 100x leverage, that’s a deviation of just 1% in the opposite direction of your trade.

That’s why leveraged trading is risky and should only be carried out by experienced users. In any case, it’s not advisable that you use anything above 5x.

With that being said, the interface is incredibly easy to navigate – all you have to do is once again choose the order type and set the leverage. You also have to set the margin mode. There are two:

- Cross margin – all the assets in your futures account, as well as the margin used for other positions, are used for collateral to the position you open.

- Isolated margin -– you specify the quantity of collateral that you want to use, and it’s limited only to this specific position.

BITmarkets Margin Trading

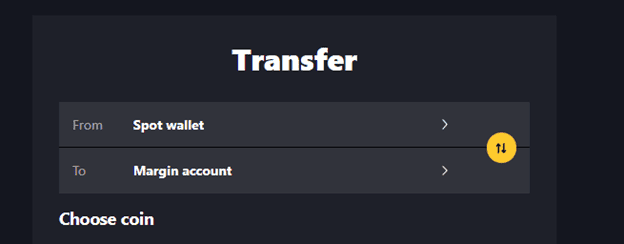

Beyond futures and spot trading, BITmarkets also has a margin trading platform with a unique deposit-to-margin feature. The major benefit behind this particular feature is that it streamlines the process and eliminates the need for separate transfers between wallets, meaning you can directly deposit funds into your margin account.

However, if you have already deposited your funds in one of your other wallets, the transfer process is very easy.

If you want to trade, you will notice that the interface is slightly different:

Nonetheless, it’s also relatively straightforward. Users can choose between market and limit orders, as well as a number of cryptocurrencies to trade with.

Open positions are displayed right below the chart, where you can also track their performance. You can also monitor your orders there, as well as the overall trade history.

Security and Customer Support: Is BITmarkets Safe?

There’s no record of BITmarkets being exploited, and the exchange does boast a very serious customer support service.

In fact, it is one of the very few that even have live customer support reachable through a telephone number.

According to the official website, 99% of the funds are held in cold storage to keep the assets safe.

The exchange also offers video calls, as well as support through both phone and email, which are available 24/7 in over 15 different languages.

The BITmarkets Token (BTMT)

BITmarkets also has its own token that’s native to the platform. It provides a range of benefits to those who hold it, including governance powers.

Traders who hold BTMT can benefit from discounted trading fees, as well as exclusive access to some features on the platform through personalized VIP support.

The token’s private sale ended on June 18th, 2023, and is now in the stage of presale for VIP registered users of the exchange while getting ready to proceed with its public sale. The COO at BITmarkets, Peter Sumer, introduced the token in an interview for Forbes and said that the public sale phase is expected to take place toward the end of the third quarter.

Some of the benefits include, but are not limited to:

- Reduced trading fees

- Early access to special features and projects

- Access to exclusive content

- Participation in reward programs, offerings, and airdrops

- Access to personalized VIP support

Is BITmarkets licensed?

BITmarkets is open about its whereabouts, as well as legal status. The website has a full page dedicated to its license.

There, we can find out that the company behind the BITmarkets trademark is called Unicorn Technologies LTD, which is a company incorporated under the laws of the Marshall Islands. The page also contains full information regarding its registered office. This is the company that’s providing futures trading services..

The trading services on the spot exchange are provided by a company called UAB BITmarkets. The website states that it’s an authorized virtual currency exchange and depository virtual currency wallet operator in Lithuania and operates under license 306062346. The company is fully supervised by the Financial Crime Investigation Service of the country.

Providing this information for anyone to verify is vital in the path to complete transparency and trust.

What Are the Fees on BITMarkets?

Trading fees are essential to serious users who exchange cryptocurrencies on a regular basis. This is why it’s very important to make sure that you do your proper research when selecting a platform.

BITmarkets approaches fees differently for their spot and futures platforms.

More information can be found here.

The essence, however, is that there’s a tiered approach to determining the fees, and it would depend on the 30-day spot trading volume in USD. Basically, the more you trade, the less fees you will pay.

Conclusion

BITmarkets seems like a very well-rounded cryptocurrency exchange that provides pretty much everything that a trader may need.

From sufficient trading tools to first-class customer support available live on the phone and in over 15 languages, the platform does have a lot to offer.

It offers a range of different trading pairs, adding to the abundance that the platform delivers.

The post Trading Cryptocurrencies on BITmarkets: The Complete Guide appeared first on CryptoPotato.